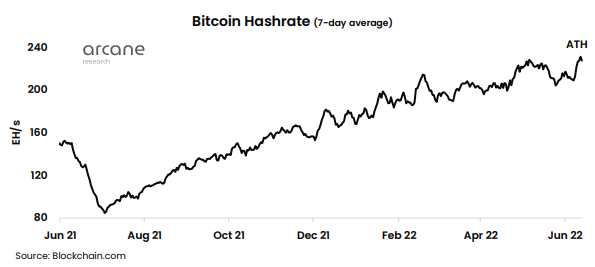

Data shows amid the panic of the crypto crash, the Bitcoin mining hashrate has gone flying to a new all-time high.

Bitcoin Mining Hashrate Surges To New All-Time High As Price Crashes

According to the latest weekly report from Arcane Research, the BTC miners’ revenues continue to suffer as price crashes and competition becomes all-time high.

The “hashrate” is an indicator that measures the total amount of computing power currently connected to the Bitcoin network.

When the value of this metric rises, it means more mining rigs are coming online, which leads to an increase in the competition among miners.

This results in smaller BTC revenues for everyone involved as the rewards are fixed and are shared between the active hashrate.

Related Reading | Bitcoin Faces a New Downtrend, Someone Still Makes More Than 1000% ROI

On the other hand, a decrease in the indicator’s value implies miners are shutting down some machines, possibly because of their mining revenues not being able to pay off electricity costs.

Now, here is a chart that shows the trend in the Bitcoin hashrate over the past year:

The value of the indicator seems to have observed an increase recently | Source: Arcane Research's The Weekly Update - Week 23, 2022

As you can see in the above graph, the Bitcoin mining hashrate has gone up over the last few days, and has now made a new all-time high.

Since miners usually pay their running costs in USD, the value of their BTC rewards in the dollar is what matters to them.

Related Reading | MicroStrategy Bitcoin Bet Backfires, Holding Losses Near $1 Billion – What Now?

Due to the crash, the price of the crypto has fallen down to around $21k, which would have delivered a blow to not just the hodlers, but also the miners.

Miner revenues had already been on a decline, but this crash combined with the hashrate reaching new highs mean further shrinkage in their profits.

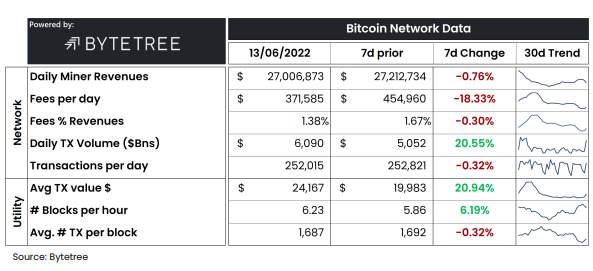

The below table highlights the various metrics related to miners and their revenues.

Looks like the fees per day has plummeted over 18% during the last seven days | Source: Arcane Research's The Weekly Update - Week 23, 2022

While the table shows the daily Bitcoin miner revenues as $27m, the report notes that this is a 7-day average, and the actual value for the day of the crash is closer to $23m.

BTC Price

At the time of writing, Bitcoin’s price floats around $21.5k, down 30% in the last seven days. Over the past month, the crypto has lost 28% in value.

Below is a chart that shows the trend in the price of the coin over the last five days.

BTC's price looks to have crashed down over the last few days | Source: BTCUSD on TradingView

Featured image from Unsplash.com, charts from TradingView.com, Arcane Research