Globalization has occurred to people, products and corporations — but what about our money?

Globalization + What Is Money = Bitcoin

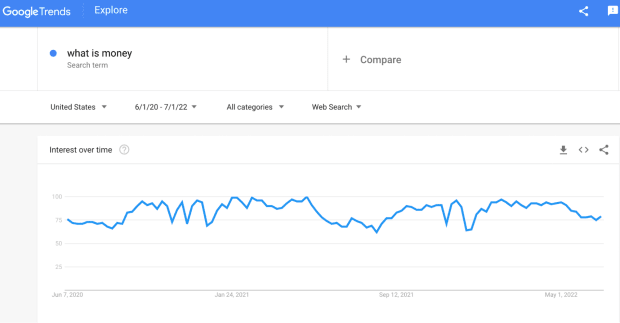

What is money? It’s one of the more popular questions of the last few years. Especially in 2020 and 2021, when the grand, new U.S. administration decided to act as if a drunken sailor had taken over the keys to the printing press.

“You get money, you get money, and you get …” CTRL+P … CTRL+P … CTRL+P …

So — what is money?

It’s a question I asked early in my journey that started in the depths of the Great Financial Crisis (GFC). I asked this question for years before and after the infamous month of September 2008, when the global financial system ground to a halt.

Bank Runs And Liquidity Crises

A historic day, September 16, 2008, the day of the breaking of the buck … The day when global money market funds were no longer worth a dollar due to a liquidity crunch manufactured by the world’s most prominent banks, corporations, hedge funds, elites and global financiers — a crunch precipitated by professionals, not retail.

The systemic plumbing was frozen. Since May, the cryptocurrency ecosystem has been facing its own liquidity crisis.

This new digital asset class consists of many new and naive players, many who’ve never seen what happens when financial plumbing freezes. Pain has been felt and narratives have been shattered as the meltdown and deleveraging moved across the intertwined system. The market is taking no prisoners, much the same way it always does in the traditional financial system. Leverage and greed are a double-edged sword. The two have no mercy on anyone in their path. No player goes unscathed. Neither did bitcoin or traditional markets as the spillover from leverage and degen trading made its way across the globe, one financial participant and asset at a time.

So, we sit here, facing our first real and broad liquidity crisis in Bitcoin.

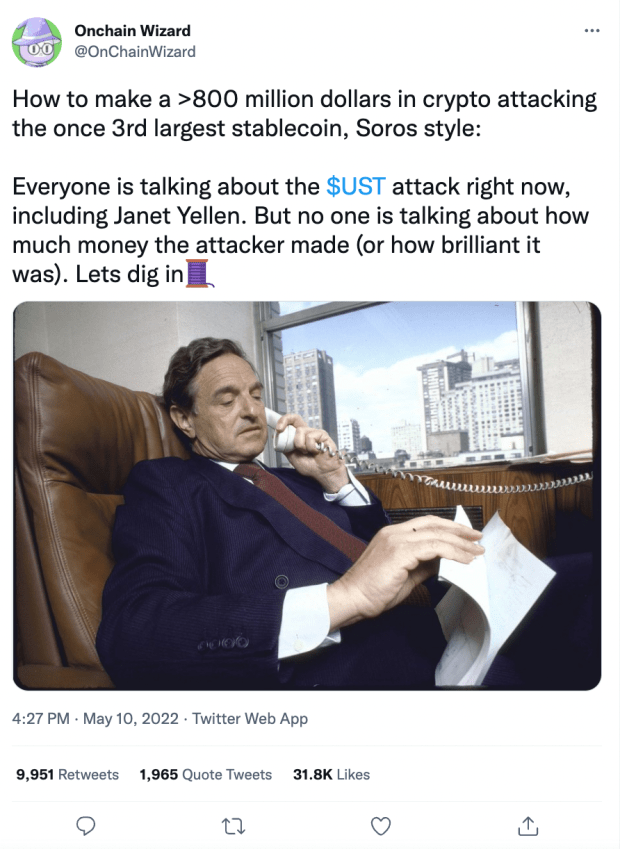

This is a crisis precipitated by greed, exposed by Terra/LUNA’s algorithm which attempted to codify the behaviors and role of the Federal Reserve Board. Through these mechanisms we learned they provided a facility for ex-Wall Street sharks to target as they swam amongst cryptocurrency liquidity pools, exchanges, and newly-formed cryptocurrency hedge funds.

Some things never change … even if money tries to.

Greed is hard to avoid and hides in plain sight under the names of yield, credit, lending and arbitrage.

We watch headlines one after another as they announce the failure or merger of major “decentralized” cryptocurrency institutions. As they crumble we realize many of these “over-collateralized” lenders and loans may have just been another alias for greed — the very thing Bitcoin and its 21 million impenetrable units are supposed to help fix, but in the end did not.

What we found is that the money might be different, but individuals and institutions are the same.

I guess there really are wolves in sheep’s clothes?

What we found is that education matters. An education on money is still sorely needed before Bitcoin and money are ready for globalization!

Monetary Crises Are Not New

The psychology and behavior of these events are typically the same. Whether it’s 1873, 1893, 1907, 1929-1933, 2000, 2007, or 2020. It always feels much like it does now — the hype, the hysteria, then the disbelief as the dominoes fall.

Some have seen it before and some are finding out for the first time what it really means to be leveraged, experiencing the pain of receiving a margin call.

We are finding that contagion can reach Bitcoin even if it stems from the broader “cryptocurrency” ecosystem, as many believe. We’re finding out that boomers and their rocks may be jaded, but may also not be totally wrong. Every narrative is part truth and part marketing. In challenging times, you find out which is which.

Through pain is learning. Through pain there is education. It comes with a degree from the school of hard knocks.

Money made easily, goes easily.

Yield that sounds unreal, is unreal. It’s just a matter of time.

That’s the first grade lesson the community learned. One collateral asset plus a borrowed collateral asset is not equal to to 20% risk-free yield. Some, unfortunately, will repeat first grade. Others will move on.

Preparing To Be Globalized Money

The entire digital asset class is facing its first real test as it prepares to become global money. We globalized people in the early 1900s, we globalized corporations and products in the 1980s and 90s, but we’ve still yet to globalize money. Until the globalization of money happens we can’t efficiently move people, products and money throughout the system.

What we learn from this event, from this bear market in bitcoin, will help lead towards the globalization of money, completing the triangle of people, products and money.

The same tests were taken by corporations, manufacturers and the travel industry as they prepared to move people, products and corporations around the world. So, now it’s time for money to stand up and take these tests as well.

Bitcoin needs to prove it’s ready to be a global money; to prove it’s ready for mass adoption.

This test proved you can’t lose sight of the meaning of having a low time-preference. This test proved you can’t have 100:1 leverage, why rehypothecation is bad and why even getting involved in an innocent attraction to yield can get messy, really quick.

Not your keys, not your coins just became, “Hand over your keys, hand over your coins.”

Given the amount of leverage wiped out, we know there were more wearing the not-your-keys t-shirts than there were practicing what they preached. Today, and for the past month or two, individuals are no longer asking, “What is money?” They are asking:

- Where is my money?

- What about that yield you promised?

- What is rehypothecation?

- Why, why why?

The short answer is greed.

As the 21st century nears being already a quarter behind us, it feels like a good time to reflect on where we are, where we’ve been, and where we’re headed. To do so, it requires reflecting on globalization: what that means, what its impact has been, and what it hasn’t achieved.

The Global Economy Is Integrated, But Money Is Not

This is the opportunity.

When referring to globalization, there’s no time like the present to quote our friends (below) at the World Economic Forum (WEF) on the definition of globalization.

Why? Shouldn’t we be running to the hills away from this group?

Didn’t they cause the destruction?

Didn’t they contribute to the mass psychosis of the last few years?

Aren’t they part of the conspiracy the anons are against?

Frankly … who knows? I’ll let you decide. They know. We don’t.

They’ll have to answer to the man upstairs at the pearly gates. Believers won’t have to answer for them.

All we can do is gather information that matters — to us, our families, our neighbors, our communities and the things that happen within the four walls of our own households. What matters is that money is being globalized as we speak. What matters is that the opportunity at hand is to be part of the globalization of money, to bring it inline with the movement of people and corporate products.

On the other side of this liquidity crisis will be a world that operates for the first time in a truly global nature. One where people, corporations, products and money flow seamlessly across the rails of the internet as needed and when needed.

So, according to the WEF, globalization is

“In simple terms, globalization is the process by which people and goods move easily across borders. Principally, it’s an economic concept – the integration of markets, trade and investments with few barriers to slow the flow of products and services between nations. There is also a cultural element, as ideas and traditions are traded and assimilated.

Globalization has brought many benefits to many people. But not to everyone.”

Let’s rewrite this a little. In simple terms, the opportunity is to globalize money so that it can move as easily across borders as people and goods, so that few barriers slow the flow of money between nations, people, products and services. The opportunity is to connect ideas and integrate traditions so that money can be traded and assimilated in manners that match and are globalized in a way that brings benefit to many, but more importantly, to everyone.

This is what the WEF, Bank of International Settlements (BIS), International Monetary Fund (IMF), World Bank and central banks preach but DO NOT practice with their siloed, self-serving non-globalized money. The opportunity is to introduce change.

My thoughts were stirred by Lawrence Lepard’s (@LawrencLepard) comment on a Twitter post by Otavio Costa (@TaviCosta).

The point conveyed is how the global economy is interconnected. An interconnected economic system is a good thing.

However, given the structure of how money flows through the system it doesn’t support the global nature of our people, products and corporations.

After the “COVID-19” meltdown of 2020 and the supply chain disruptions of 2021/22, it’s become apparent as to what the real problem is:

Yes, the global economy is interconnected BUT global money is NOT.

This presents a challenge for the way people want to move about the globe and how they need to pay for things. In the 20th century, we experienced globalization of people, products and corporations. The Bretton Woods (BW) agreement of 1944 initiated this movement, but was not successful in the globalization of money. Bretton Woods was an attempt to move from a fixed-rate gold system to a dollar-pegged fiat system, though it began to falter only a couple of decades after.

Living Out Triffin’s Dilemma

The benefit of Bretton Woods was that it paved the way for globalizing corporate products and business in a manner that matched the flow of people moving around the globe. The downside was that the system didn’t really solve the main problem of providing money that was truly global in nature. Though a new system, it still suffered the same problem of not being global. As such, it succumbed to Triffin’s dilemma.

“… the Bretton Woods system contained an inherent and potentially fatal flaw in its dependence on the dollar. … the volume of trade expanded over time, any fixed exchange rate system would need an increase in usable reserves, in other words, an increase in acceptable international money to finance increased trade and investment.* Future gold production at the established price could not be enough to meet the need, so the source of the international liquidity necessary to lubricate growth within the Bretton Woods system would have to be dollars …

“If the U.S. deficits continued, confidence in the dollar and eventually the system would be undermined, and the result would be instability. But if the U.S. deficits were eliminated, the rest of the world would be deprived of the dollars it needed to build up its reserves and finance economic growth. For countries other than the United States, the question later became stark: hold more dollars in their reserves or turn them in for more gold from the United States. The latter course, probably sooner rather than later, would force the United States to stop selling gold, one of the foundations of the system. The former course of holding an increasing amount of dollars would inexorably undermine confidence as the potential demands on our gold stock came to far exceed the amount available to meet them. Either course contained the seeds of its own disaster.”

Source: Changing Fortunes by Paul Volcker and Toyoo Gyohten

*Personal note: we tried to solve this with eurodollars.

In an attempt to combat this, during the 1960s and 70s, the Group of Five (G5) was created out of meetings by a select few that ultimately built international relationships to determine the pecking order underneath the U.S. hedgemon. They decided who would devalue, who would inflate and who would seek help through loans from the IMF and World Bank. These self-defined committees weren’t originally official in capacity, but are today what we refer to as the Group of Seven (G7), G8 and G10 — the groups that meet but appear to have increasinglyly taken direction from the Bank For International Settlements (BIS), International Monetary Fund (IMF) and World Bank as to how the global financial system should and will operate.*

*Interpretation source: Changing Fortunes by Paul Volcker and Toyoo Gyohten

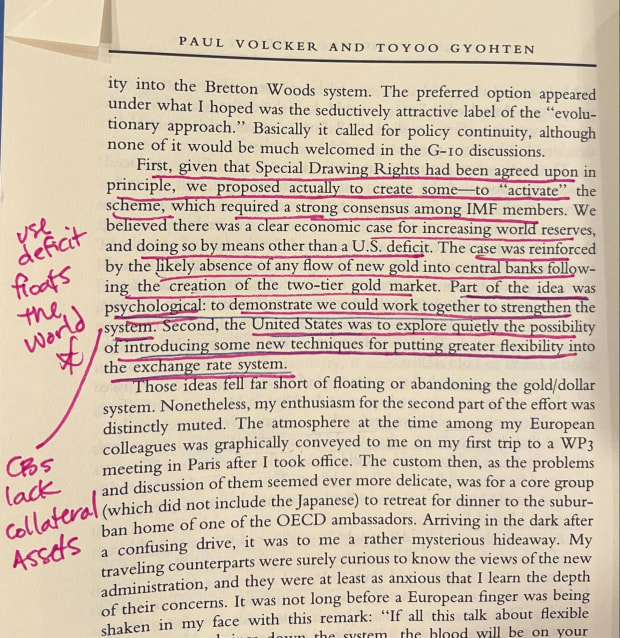

As signs of trouble arose under Bretton Woods, it was determined that lack of reserves was the issue more than lack of money, as reserves would allow an extension of more money than just money itself. So, in 1969 the Special Drawing Rights (SDR) were set up as an international reserve asset. SDRs, in theory, would broaden the burden of one country being the global reserve, removing the nth currency problem. It was considered a digital asset that was a basket of the major global currencies of that time (USD, euro, yen, British pound, and the yuan as of October 2016). SDRs are held by countries and aren’t usable by individuals or private parties. Technically, SDRs were digital money, but they did not function as such because they lacked monetary and communication technology — two critical inputs that are now available in the 21st century.

“… he [secretary Henry Fowler] had succeeded in obtaining agreement on the creation of Special Drawing Rights, or SDRs, at the annual IMF meeting in Rio de Janeiro in September of 1967. Great hopes were placed on the imaginative new instrument, which promptly was labeled “paper gold” but was neither paper nor gold; as one wit at the IMF said, the SDR was “not minted, not printed.” Rather, the SDR could be found only in the blips on an IMF computer, and many restrictions were placed on activating the computer. … The financial markets viewed it as something of a synthetic creation that was not really as good as gold or the dollar.”

Source: “Changing Fortunes” by Paul Volcker and Toyoo Gyohten

In 2022, we are acutely aware and understand the ramifications of globalization without globalized money.

Now, we have the capability and monetary technologies in place. Now, we have true digital currencies. Digital currencies that are more than blips on an IMF computer. Now, we have the Bitcoin network. Now, we have the ability to globalize money.

But, do we have the global leaders to implement it? Are there leaders of countries who are more interested in producing sound money and less interested in battling for power and control during a time when our world order is seemingly up for grabs? Will the New World Order redefine money on a sound basis?

“At one point, my French colleague [Claude Brossolette] drew a little triangle on a piece of paper to illustrate what he considered the three ways of designing a monetary system. One one side of the triangle he wrote ‘Dominant Country’ or ‘Hedgemonic Power’ – I don’t remember the precise phrase. Underneath it he wrote ‘tyrant’. He said, ‘We don’t want that.’ On another side of the triangle he wrote ‘Dispersed Power,’ and underneath that he wrote ‘chaos.’ ‘We don’t want that.’ And that left only the base of the triangle, where he also wrote ‘Dominant Power.” But underneath that he wrote ‘benign.’

“I think he meant the United States had been relatively benign, and the system had worked.”

Source: “Changing Fortunes” by Paul Volcker and Toyoo Gyohten

Through decades of financial trial and error, banking panics, liquidity crises and geopolitical feuds we’ve come to understand that centralized money is a neverending financial war: a war precipitated by a few men and women and a handful of committees and central banks around the world — all centralized and all with their own self-serving interests.

In the United States, these financial battles began in the mid-1800s with wildcat banking and led to the Panic of 1907. This last event gave rise to the creation of the Federal Reserve in 1913, which was ultimately the outcome of similar but competing plans from Democrats (the Federal Reserve Act) and Republicans (the Aldrich Plan).

“The presidential campaign of 1912 records one of the more interesting political upsets in American history. The incumbent, Willam Howard Taft, was a popular president, and the Republicans, in a period of general prosperity, were firmly in control of the government through a Republican majority in both houses. The Democratic challenger Woodrow Wilson, Governor of New Jersey, had no national recognition, and was a stiff, austere man who excited little public support. Both parties included a monetary reform bill in their platforms: The Republicans were committed to the Aldrich Plan, which had been denounced as a Wall Street plan, and the Democrats the Federal Reserve Act. Neither party bothered to inform the public that the bills were almost identical except for the names. … since the bankers were financing all three candidates, they would win regardless of the outcome.”

Source: “The Secrets Of The Federal Reserve” by Eustace Mullins

After decades of Federal Reserve rule and improvements under the Bretton Woods system, we did have a broader and more diverse economic system, but also one that isn’t lasting. In short order, the new system (BW) began to falter in the 1960s and 70s and these uncorrected errors defined by the IMF and BIS still plague us today, after five decades of kicking the can down the road.

It is now clear that the lack of technology was the cause of the demise that led to the introduction of the petrodollar and the removal of the gold standard in 1971.

Global finance ministers were well aware because the system was breaking in the 1960s and 70s. They were bound by long plane flights and months of committee meetings — bound in a period when time was of utmost importance as it related to currency market turbulence; a time when the gold standard was removed, because no party was willing to relinquish monetary power at the expense of their country’s currency over another. In those days, the solutions were there but they required more technology than financial markets had access to.

“Organizational and institutional development is not, of course, a substitute for action, and the early Kennedy years saw a lot of technical innovation. For one thing, the United States began intervening in the foreign exchange markets, ending the taboo on such operations that had prevailed for many years. Partly as a means of acquiring resources for intervention, a “swap network” was established. That was a technique for prearranging short-term lines of credit among the major central banks and treasuries, enabling them to borrow each other’s currency almost instantaneously in the time of need.”

Source: “Changing Fortunes” by Paul Volcker and Toyoo Gyohten

Today, both on the monetary and communications front we have solutions for these problems.

They are driven by the power of the internet and new telecommunications towers.

In the past, the creation and maintenance of international relationships required days of travel or months of tireless committee meetings all over the world. The findings had to be brought back to each country and rehashed again. Now, much of that leg work can be replaced by instant global communication via mobile phone, text, email, chat and platforms like Zoom that offer video for more formal meeting purposes. Today’s technology immensely increases the ability to solve monetary problems and create policies quickly with real-time information and data access. Today, we can move in the direction of monetary communication and money that benefits all in a better means than in the past.

On the money front, we now have the Bitcoin network to act as a digital collateral asset, much like SDRs were intended.

As serious troubles within the monetary system arose, in the 60s and 70s countries began playing economic games in currency markets. It was a race to devalue in order to compete, a race that only put more pressure on an illiquid, disjointed, and fragile system.

Focus On The Home Front Or The Frontier?

For the U.S., there was a growing economic struggle to maintain and balance the needs at home with the needs of the world. It was becoming too much for one country. It was proving what Triffin had warned of. Once again, countries were beginning to sour on the benefits to the United States on their behalf. At the time, many international players were more open to a floating rate system as it would allow each to take care of themselves at home, though it may cause issues to the growing globalized economy of products and people. Today’s technology is better suited for exactly these types of globalized floating-rate monetary systems, encompassing networks involving Bitcoin, stablecoins and a host of other monetary technologies that can allow for the globalization of money.

Looking back, the SDR (sometimes called XDR) probably was the best solution conceivable at the time, but it was stymied by the fact that we didn’t have the technology to make it work.

“One reason XDRs may not see much use as foreign exchange reserve assets is that they must be exchanged into a currency before use.[5] This is due in part to the fact private parties do not hold XDRs:[5] they are only used and held by IMF member countries, the IMF itself, and a select few organizations licensed to do so by the IMF … This fact has led the IMF to label the XDR as an “imperfect reserve asset”.[22]

“Another reason they may see little use is that the number of XDRs in existence is relatively few … To function well a foreign exchange reserve asset must have sufficient liquidity, but XDRs, because of their small number, may be perceived to be an illiquid asset. The IMF says, “expanding the volume of official XDRs is a prerequisite for them to play a more meaningful role as a substitute reserve asset.[23]”

Mid-to-late 20th century, countries were beginning to awaken to the benefit the United States gained from having the global reserve currency in U.S. dollars.

“On February 4, 1965, de Gaulle [President of France] took the opportunity of one of his staged press conferences to begin an open attack. His basic argument was that the ‘dollar system’ provided the United States with an ‘exorbitant privilege.’ It was able freely to finance itself around the world, because unlike other countries its balance of payments deficits did not lead to loss of reserves but could be settled in dollars without limit. The solution would be to go back to the gold standard, and the language was arresting. The time had come, de Gaulle said, to establish the international system ‘on an unquestionable basis that does not bear the stamp of any one country in particular.’ ”

Source: “Changing Fortunes” by Paul Volcker and Toyoo Gyohten

It was recognized that new agreements were required. In those days, as a means to compete, others began the process of devaluing their currency in an attempt to gain global market share of power. Ultimately, the U.S. was boxed in. The world couldn’t survive if the United States didn’t maintain deficits and the U.S. couldn’t survive if others came requesting gold for their dollar reserves.

“In early 1962, in response to a Treasury initiative, the ten most important financial powers joined together in agreeing to backstop the International Monetary Fund with a credit line of $6 billion … The mechanism was called the General Arrangements to Borrow. [GAB] …

“While there was no clear intention of American draw on the IMF, the new agreements demonstrated that substantial funds could be marshaled to meet a speculative attack on the dollar without forcing the United States to sell large amounts of gold. We also did not want other countries to find themselves suddenly short of liquidity and forced into devaluation, which would undercut our competitive position.”

Source: :Changing Fortunes” by Paul Volcker and Toyoo Gyohten

(Note: I’ve added bold to denote the real desires and competitive advantages that were overlooked by other countries.)

At the time, the internet was non-existent. Today, it connects the globe.

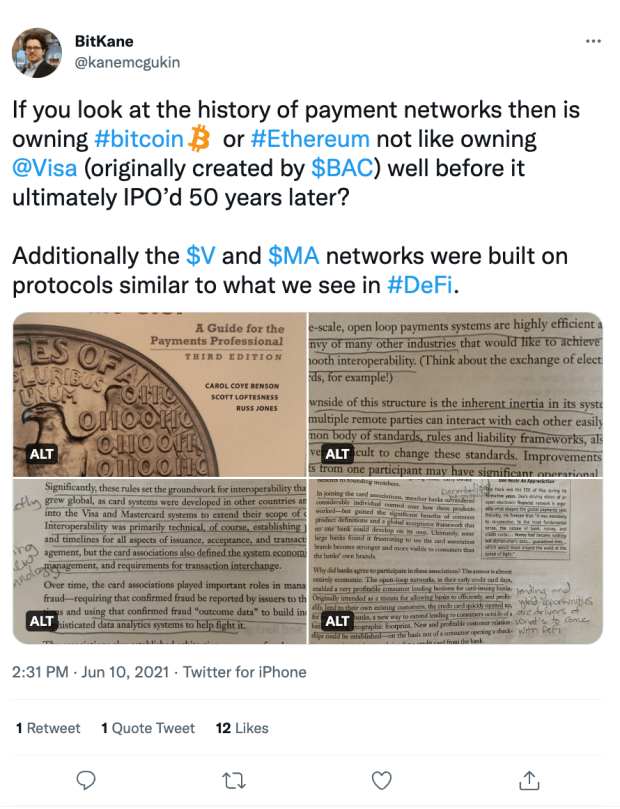

There wasn’t a means to move a digital asset like the SDR around the globe. Today, there is the Bitcoin network, and it offers many more decimals or fractions to help with the prior liquidity limitations of money. Additionally, a modern monetary network like Bitcoin offers the ability to integrate with existing, new and future monetary networks in ways that today’s networks and those of the past could not — all because it’s internet operated and money built for interoperability.

We have the tools and technology to solve the problems that plagued past financial systems. We have digital money and are building out more integrated monetary networks and monetary technologies that provide the seamless requirements so that the globalization of money can happen for the first time.

The Globalization Of Money

As money approaches its day in the spotlight of disruption, its day to become globalized, then we should be able to better achieve the ideals and benefits of floating rate exchange.

The globalization of money should allow each economy to have their own money — a form of money that fits their own needs, but is easily convertible at a cheap rate to a base-layer money a la bitcoin. Then, it can convert into whatever end currency is needed to complete the task at hand. All in a cheap, quick, and instantly settleable nature. These were the ideals of a base currency like SDRs and now we have a proven digital collateral asset like bitcoin that could make it work.

As we’re nearly a quarter of the way through the 21st century, we finally have the technology that allows for globalization of money. So now, we can have a truly global economy:

- Where people have the opportunity to move freely around the globe.

- Where corporations and products have the opportunity to move freely around the globe.

- Where MONEY has the freedom to move freely around the globe.

All in a way that works for all, not for one or a few.

As we move past this recent liquidity crisis caused by the cryptocurrency crash I think we’ll find that through experimentation and adoption the new global digital rails will be better suited to finalize the integration of people, business, and money.

It turns out that what we’ve called globalization, was not that at all.

Just as in the 1970s, if the United States decided not to play ball the economic system would have shut down, penalizing everyone. In 2020 we found that we have a one-way network of goods from primarily a single source, meaning that if China decides to shut down, then the world comes to a grinding halt and prices increase sharply as inflation takes hold. Much the same in 1912, if the Titanic or other ships crashed, the movement of people and goods around the globe was hindered.

Every few decades we’ve had advances in technology that brought forth another leg of support for globalization.

Now, we can finally have all three in place: people, business and money.

After this liquidity crisis, builders will finalize the new internet rails that will allow value to flow seamlessly around the globe, just as information, email, content, news, e-commerce and music currently do. That’s the power of internet money. That’s the power of programmable money.

When people are able to communicate money seamlessly the next wave of internet innovation will continue to drive the globe to new heights.

This is a guest post by Kane McGukin. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Opinions expressed in this article are not to be considered investment advice. Past performance is not indicative of future performance as all investments carry risk including potential loss of principle.