The U.S. Treasury sanctioned the Tornado Cash mixing tool, setting a precedent for blocking financial privacy and censoring open-source code.

The below is an excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

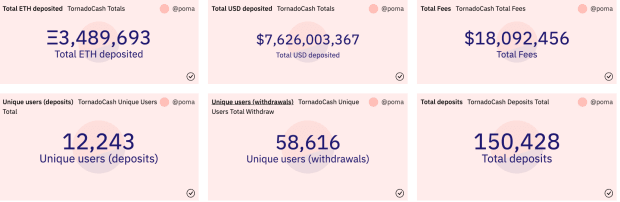

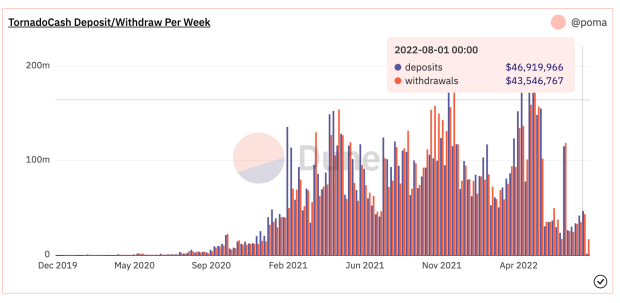

Early on August 8, 2022, it was announced by the U.S. Treasury that Tornado Cash was added to the U.S. OFAC (Office of Foreign Assets Control) SDN list (the list of specially designated nationals with whom Americans and American businesses are not allowed to transact). Tornado Cash, a non-custodial open source software project built on Ethereum, allowed users to mix their coins through the use of the Tornado Cash smart contract, obfuscating the previous trail of the coins (which are of course being transacted across a transparent ledger).

The sanctions placed were particularly notable because they were placed not on an individual person or particular digital wallet address, but rather the use of a smart contract protocol, which in the most basic form is just information. The precedent set by these actions are not ideal for open source software development.

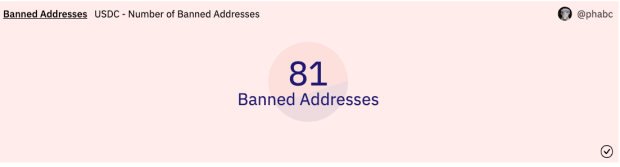

Following the announcement, it could be seen that Circle, the centralized issuer of stablecoin USDC, blacklisted every sanctioned address from using USDC.

These actions have led many to question the safety of holding centralized digital assets, even for non-criminals who just prefer to use privacy-enhancing tools.

The total number of USDC addresses that are blacklisted now stands at a current total of 81. Readers can track the banned address list here.

On a similarly scary note for active bitcoin/crypto developers, the co-creator of Tornado Cash Roman Semenov had his GitHub (open source development repository) account suspended. This should worry freedom-loving bitcoin/crypto enthusiasts, given the nature of the sanctions placed on Tornado Cash — which, as stated earlier in the piece, is simply non-custodial software.

These actions also beg the question as to what is the future of many tools in the so-called DeFi space, that depend on centralized stablecoins and that may have centralized development choke points.

As brutal as it may be, the organic and decentralized nature of bitcoin’s rise is the only reason it is still standing today. Open-source software will continue to operate as designed, but given the increasing pressure that will likely be placed on software/wallet/protocol developers, only the strongest and most truly decentralized networks will not be co-opted.

Lastly, it should be reiterated that stablecoins themselves, while useful to escape the short-term volatility of bitcoin/other crypto assets and help many around the world access U.S. dollars, are centralized.

Zooming out further, when looking at the long-term case for bitcoin, among its strongest value propositions is the fact that it’s an asset that has no counterparty risk nor dilution (devaluation) risk. Yet, more importantly in light of many government regulations that are taking shape and are likely to come, Bitcoin’s true decentralized properties and censorship resistance will be just as important.