Applications in the metaverse often feel like more of a marketing gimmick than something that a critical mass of consumers would use, let alone pay for. But turn to the enterprise, and there appears to be a very lucrative opportunity that’s well into finding traction. Today, one of the early movers in building solutions for that market is announcing a round of funding to double down on the opportunity.

Varjo, which builds hardware and integrated software for “professional grade” virtual and augmented reality for industrial and other enterprise applications, has raised $40 million, a Series D that it will be using both to continue R&D for its headsets, as well as to delve further into software applications and tools for the Varjo Reality Cloud, its own streaming platform that it launched earlier this year.

The company is headquartered in Helsinki, Finland — founded and run by longtime veterans from Nokia cast asunder when that company, once a leading smartphone and mobile maker, went into a tailspin last decade — and its backers in this round include a number of big investors out of the region.

They include EQT Ventures, Atomico, strategic backer Volvo Car Tech Fund, Lifeline Ventures, and Tesi, the Finnish government VC and PE fund; with new backers Mirabaud and Foxconn also participating. Varjo describes the latter two as strategic: it’s not clear how the Swiss finance and banking giant is working with Varjo, but Foxconn is being tapped to help manufacture its devices, CEO Timo Toikkanen said in an interview.

Varjo is not disclosing valuation, but data from PitchBook estimates that its last round in 2020 valued it at $146 million and Toikkanen (who used to lead all of Nokia mobile phones business before and after it was acquired by Microsoft) noted that the new valuation is “very positive.”

In a hardware landscape that is dominated by big tech companies — particularly in VR hardware — Varjo is notable for being an independent player, and not one that’s prone to gobbling lots of cash to stay that way: it’s only raised around $150 million since being founded in 2016. Toikkanen declined to say whether Varjo has been approached by others for acquisition, but given that Nokia background, I’d hazard to say that he and others on the team understand first-hand the value of remaining a smaller company when it comes to innovation.

“We are very fond of what we do at this size,” he said. “There are great benefits to independence. We are fast moving and we have the ability to respond to customer needs.”

Perhaps the independence has also lent the company a greater degree of focus. A number of players in the area of XR have been focusing on headsets and applications for consumers, and some would argue that the quality of those efforts has been variable: Meta was roundly ridiculed when Mark Zuckerberg provided a preview its Horizon Worlds expansion; but others are making efforts to improve the experience.

And there are also a number of companies that have also put their money on the B2B opportunity (they include Meta building enterprise applications, HP, and ByteDance-owned Pico), although even in that area, some like Spatial have pivoted away to other aspects of the “metaverse.”

Within that spectrum, Varjo is among those that took a position early on that the first adopters (and perhaps the main ones?) of XR products would be enterprise customers, and it has stuck to it.

”Consumer and corporation expectations towards metaverse are globally high. To meet these expectations, both technology that is easy to use and accurate as well as high-quality software and content are needed. Varjo’s tech – namely, the new XR streaming platform ’Varjo Reality Cloud’ in combination with the company’s XR-3, VR-3 and Aero products – enables professional, fully virtual work in various sectors, anytime and anywhere,” said Keith Bonnici, investment director at Tesi, in a statement. “This then promotes global remote work, boosting efficiency and decreasing CO2 emissions from work travel.”

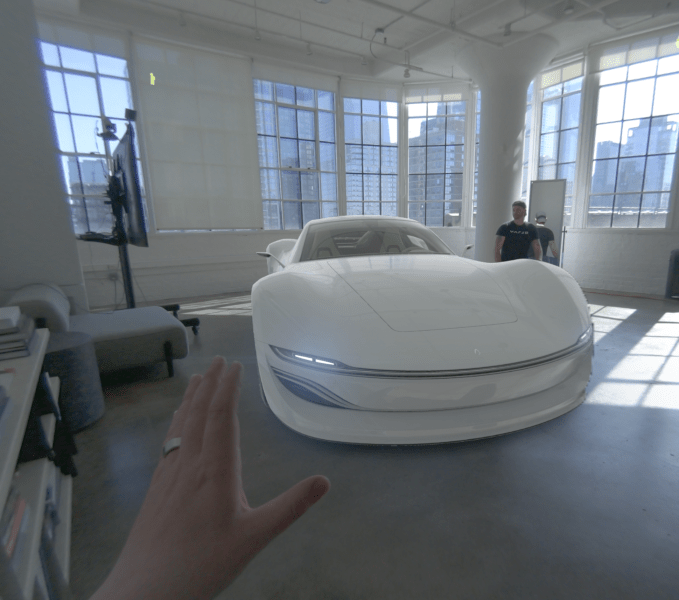

In terms of its products, Varjo’s focus is on producing premium, business-critical services and devices (read: expensive, but for a customer that is less sensitive on pricing), and to take an approach that virtual and augmented reality would go hand-in-hand as mixed reality. Toikkanen believes that prescience has been integral to its success.

“We have never been a ‘hype’ company,” he said in his understated, Finnish clip. “We have been very consistent in saying that the entry point from the beginning is mixed reality. Eventually everything has worked out to be built that way. We also said that the ultimate incarnation would need to be as good as real life. Pixelated holographic would never be good enough.”

The company currently makes three different headsets — the XR-3, the VR-3 and the Aero, ranging in prices respectively from about $6,500 to $1,500 with additional costs for software subscriptions to use with them (which appear to start at around $1,500 annually), as well as a separate development environments for its Reality Cloud and another next-generation product it calls Teleport that is still in alpha.

Its focus these days is on applications in areas like design and manufacturing, engineering, education, and healthcare, and in addition to Volvo, its customers include Lockheed Martin, Boeing, Aston Martin, Kia — in all, about 25% of the Fortune 100, the company said — as well as “various departments across the United States and European Governments.”

With found Urho Konttori, another Nokia alum, on board as Varjo’s CTO, the startup also owns seven patent families related to XR.

“Varjo is very intellectual property-protection oriented,” Toikkanen said, noting that the company has been approached by other tech companies to license that IP, but that it has yet to develop that business. “Today the focus is on building it into our own products and services. That is the way you can can get access.”