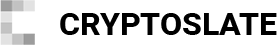

The total cryptocurrency market cap saw net outflows totaling $15.5 billion. As of press time, it stood at $920.11 billion, down 1.7% over the last 24 hours.

Bitcoin’s market cap fell 1.5% over the reporting period to $365.11 billion from $370.69 billion. Meanwhile, Ethereum’s market cap was also down 1.5% to $164.03 billion from $166.48 billion over the last 24 hours.

After yesterday’s gains, the top 10 cryptocurrencies are trading mostly flat with a sell-side bias today. The notable exception was XRP, which posted 8% gains over the last 24 hours. Shiba Inu was the biggest loser, down 3% in price.

The market cap of the top three stablecoins — Tether (USDT), USD Coin (USDC), and BinanceUSD (BUSD) — saw slight gains over the period, standing at $67.97 billion, $50.16 billion and $20.51 billion, respectively.

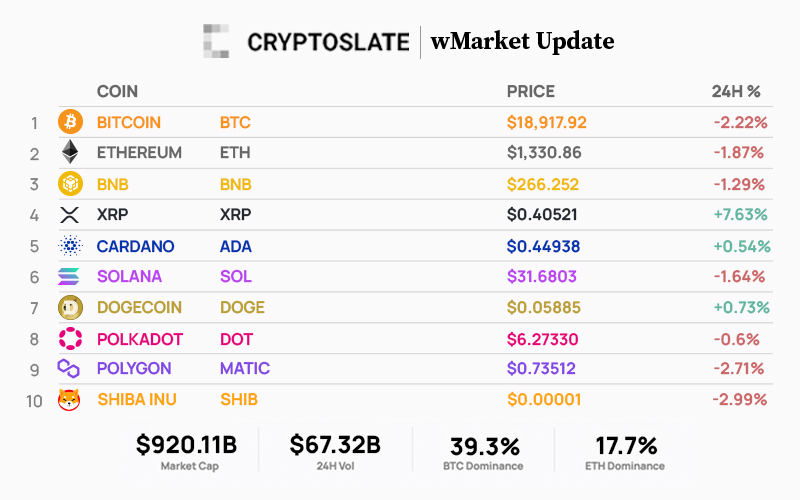

Bitcoin

Over the last 24 hours, Bitcoin was down 2% to trade at $18,900 as of press time. Market dominance rose slightly from 39.3% to 39.4% over the period.

Following a weekend sell-off, late Monday evening (UTC) saw BTC peak at $19,700. Since then, the leading cryptocurrency has been trending downwards, with the zone around $18,700 providing support.

Going into Wednesday, BTC is trading within a narrow band between $18,800 and $19,100, with a retest of local support looking imminent.

The FOMC meeting concludes today, with markets poised on the interest rate decision.

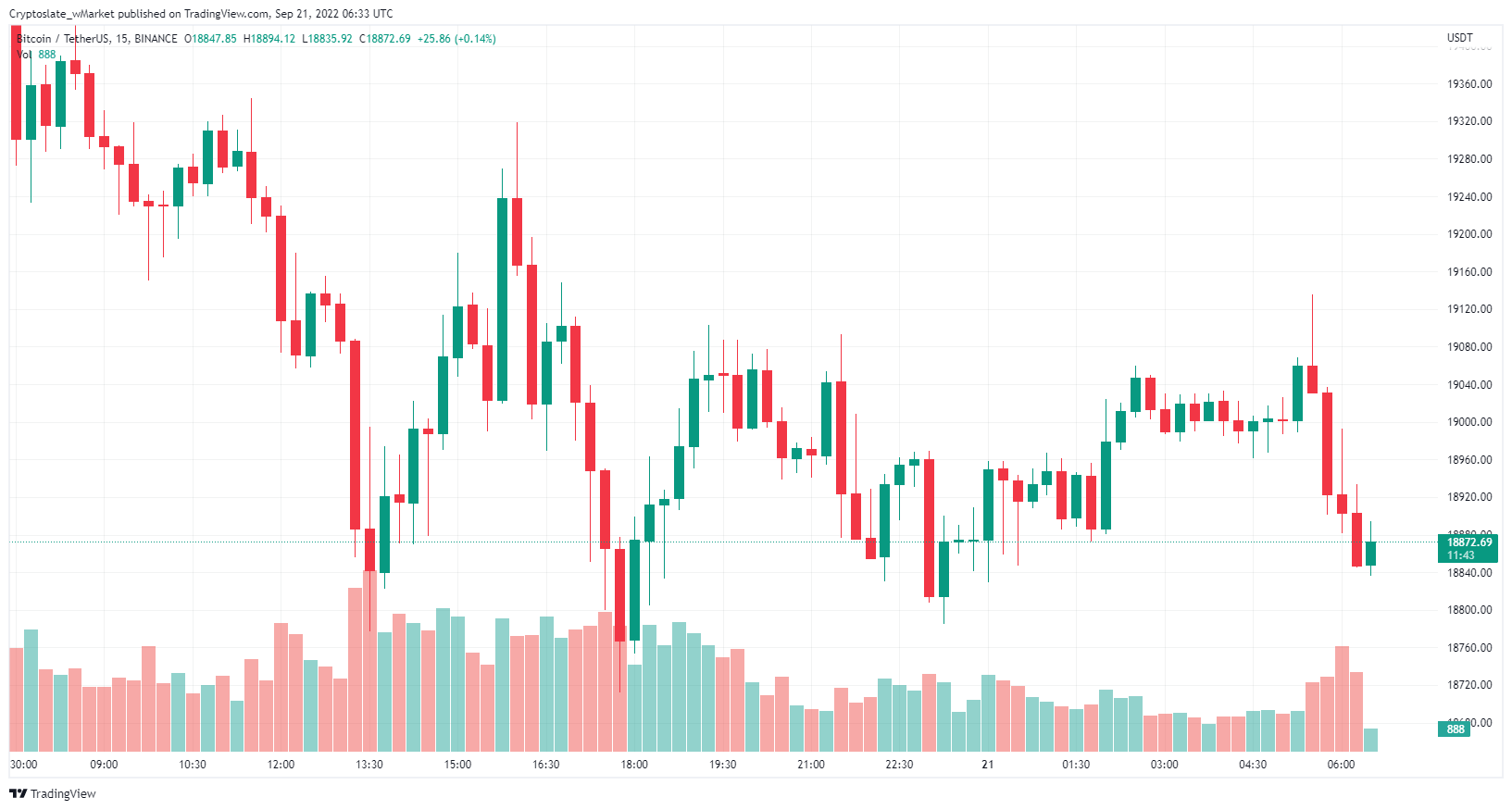

Ethereum

Ethereum fell 1.9% over the last 24 hours to trade at $1,331 as press time. Market dominance decreased slightly from 17.8% to 17.7%.

ETH bulls peaked the price at $1,385 early Tuesday evening (UTC). However, the price has since been on the slide, with the $1,315 level providing support. Like BTC, a retest of local support looks imminent.

Top 5 gainers

WINk

WIN leads the top gainers over the last 24 hours, trading around $0.00012 as of press time — up 18.5% over the period. The Tron-based betting dApp is down 96% from its April 2021 ATH. It’s unclear why the token pumped today. Its market cap stood at $111.74 million.

Braintrust

BTRST grew 9.3% over the past 24 hours and was trading at around $2.32794 at the time of publishing. It’s unclear why the decentralized “talent network” pumped today. Its market cap stood at $279.01 million.

XRP

XRP recorded 7.6% gains over the past 24 hours to trade at around $0.39280 at press time. The token is up 18% over the last month, and its market cap stood at $19.58 billion. With a “summary judgment” being filed recently, some expect the SEC vs. Ripple lawsuit to conclude soon.

Chain

XCN is up 5.4% over the last 24 hours to trade at $0.06527 at the time of publishing. This token was in yesterday’s top five losers list. Its market cap stood at $1.4 billion.

Status

SNT is up 4.3% since the last wMarket update to trade at $0.02902 at press time. Its market cap stood at $100.72 million at the time of writing.

Top 5 losers

Ellipsis

EPS is today’s biggest loser falling 18.9% over the past 24 hours to trade at around $0.15189 as of press time. The Binance Smart Chain-based stablecoin exchange is down 88% over a year. Its market cap stood at $253.89 million.

Pundi X

PUNDIX sunk 13.98% over the past 24 hours to $0.50212 at press time. The project is currently suffering high volatility to both upside and downside swings. It’s unclear what is behind this. Its market cap stood at $129.79 million.

Chiliz

CHZ plunged 11.6% in value over the reporting period to trade at $0.22408. Despite today’s sell-off, the token remains up 16% over the last seven days. Its market cap stood at $1.34 billion.

Cosmos

ATOM is down 11.4% over the past 24 hours to around $13.7778 as of press time. There have been no new significant developments recently. The token price is still up 21% over the last month. Its market cap stood at $3.95 billion.

Energy Web Token

EWT declined by 6.98% to trade at $3.90546. The Proof-of-Authority (PoA) Ethereum Virtual Machine blockchain supports enterprise-grade applications in the energy sector. Its market cap was $117.41 million at press time.

The post CryptoSlate Daily wMarket Update – Sept. 20: Markets on edge as Fed rate decision due today appeared first on CryptoSlate.