The financial markets have responded positively to the government’s expected U-turn on parts of its massive mini-budget programme of unfunded tax cuts and energy price cap spending.

Markets have already priced in the government’s policy U-turn as the interest rate payments on long-dated government bonds, effectively state IOUs, sunk on Friday while the pound rose against the dollar and the euro.

As a result of the government’s anticipated rise in corporation tax, instead of the reduction it announced in the mini-budget, government bonds, known as gilts, fell.

These are the bonds that have had to be bought up as part of the Bank of England’s unprecedented intervention in the market to prevent a collapse in pensions as the market doubted the credibility of the UK’s economic plans.

The interest rate on long-dated gilts, which is the effective cost of government borrowing, fell steeply on Friday.

The interest rates had risen sharply following the mini-budget announcement, causing a massive sell-off, before the Bank announced its 13-day intervention on 28 September. That intervention is to end on Friday afternoon.

The 30-year gilts fell from near a high of 5% on Thursday following Sky News’s announcement of the U-turn, to 4.3% on Friday.

Tax U-turns will come at high political price for Liz Truss – but alternative might be more painful

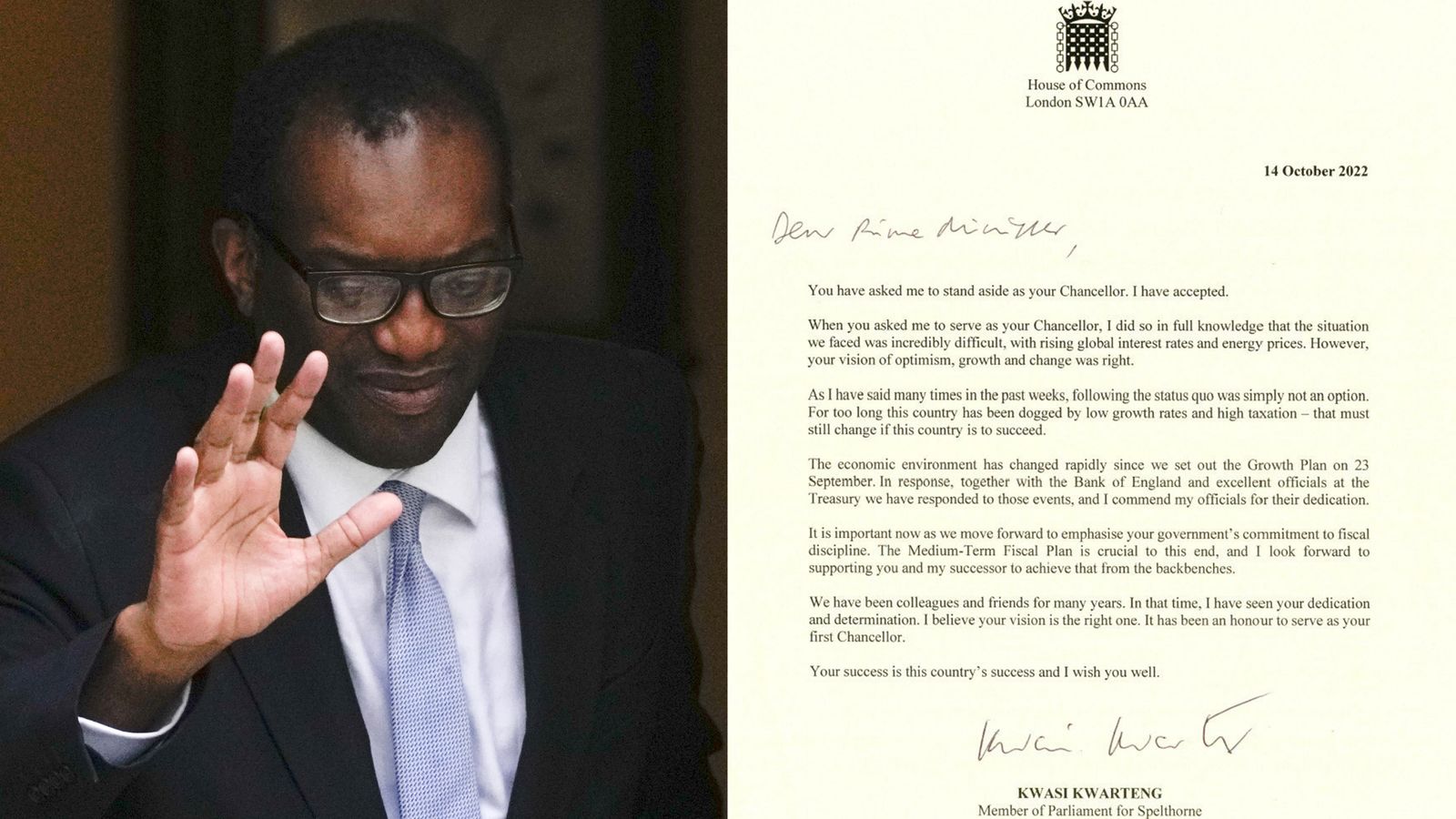

Chancellor Kwasi Kwarteng lands back in UK ahead of expected corporation tax U-turn

Priti Patel suggests ‘market forces’ could make government U-turn on tax cuts unavoidable

Similarly 20-year gilts fell from near a high of 5% to 4.42%.

The fall in the interest rate of the benchmark 10-year government gilt was also large, from 4.3% on Thursday to slightly above 4% on Friday.

The pound also saw a rise against the dollar, up from $1.11 on Thursday to $1.13 on Friday morning, before settling at around $1.12 on Friday afternoon.