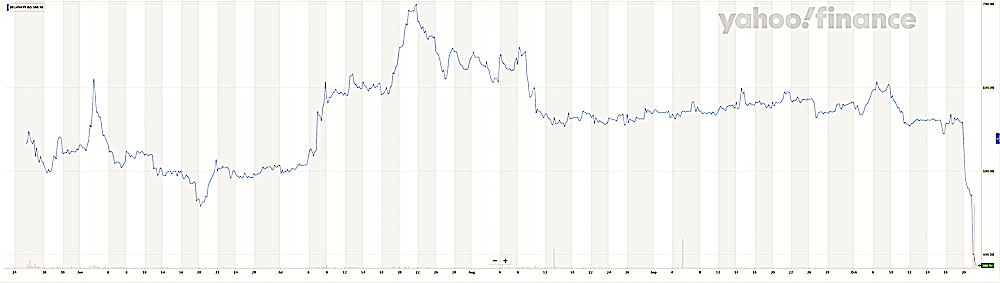

Shares of Delhivery have dropped by over 32% since Thursday, tumbling below its issue price from May, after the Indian logistics firm posted muted quarterly business growth this week.

Delhivery said this week that its supply chain service and truckload business volumes had shrunk in the quarter ending September. Shares of Delhivery plunged on the news, dropping from 562 Indian rupees ($6.8) apiece to as low as 382 Indian rupees ($4.62) before slight recovery. Delhivery’s issue price was 487 Indian rupees, whereas its shares rose to record high of 708.45 Indian rupees in July.

The tumble has pushed the market cap of Delhivery to below $3.4 billion, only slightly above the $3.2 billion valuation that it assumed in the pre-IPO financing round and below the $4.2 billion valuation in the secondary transaction among its investors a year ago.

The lock-in period for its pre-IPO shareholders lifts on November 10, which may see more voluminous selling. The company counts SoftBank, Tiger Global, Times Internet, The Carlyle Group, Steadview Capital and Addition among its backers.

Image Credits: Yahoo Finance

Delhivery has assured investors that it is on the path to recovery. The company said it has made “sufficient capacity investments in FY22 and early FY23 to sustain our current rate of growth and expect new mega-gateway and sorter decisions only by early FY24.”

“As inflationary pressures and service disruptions due to monsoon ease across the country we expect improvement in volumes, revenue and service margins going forward,” it said in its quarterly report published on the local stock exchanges.

Friday caps a rough week for Indian startups that have gone public in the past year and a half. Nykaa, a fashion e-commerce marketplace, which has so far performed the best among the tech startups, is trading only slightly above its issue price. Shares of online insurer Policybazaar, whose lock-in period for pre-IPO investors also lifts next month, have lost over 60% in value from the issue price.

Delhivery falls to all-time low after muted growth report by Manish Singh originally published on TechCrunch