The collapse of the crypto exchange FTX is causing a historic event in the Bitcoin market. Yesterday, on-chain data signaled the second wave of a Bitcoin miner capitulation in one cycle.

Historically, miners have had a massive impact on the BTC price. The now heralded miner capitulation will put further selling pressure on the Bitcoin price, which is experiencing a historically bad November, down 21%.

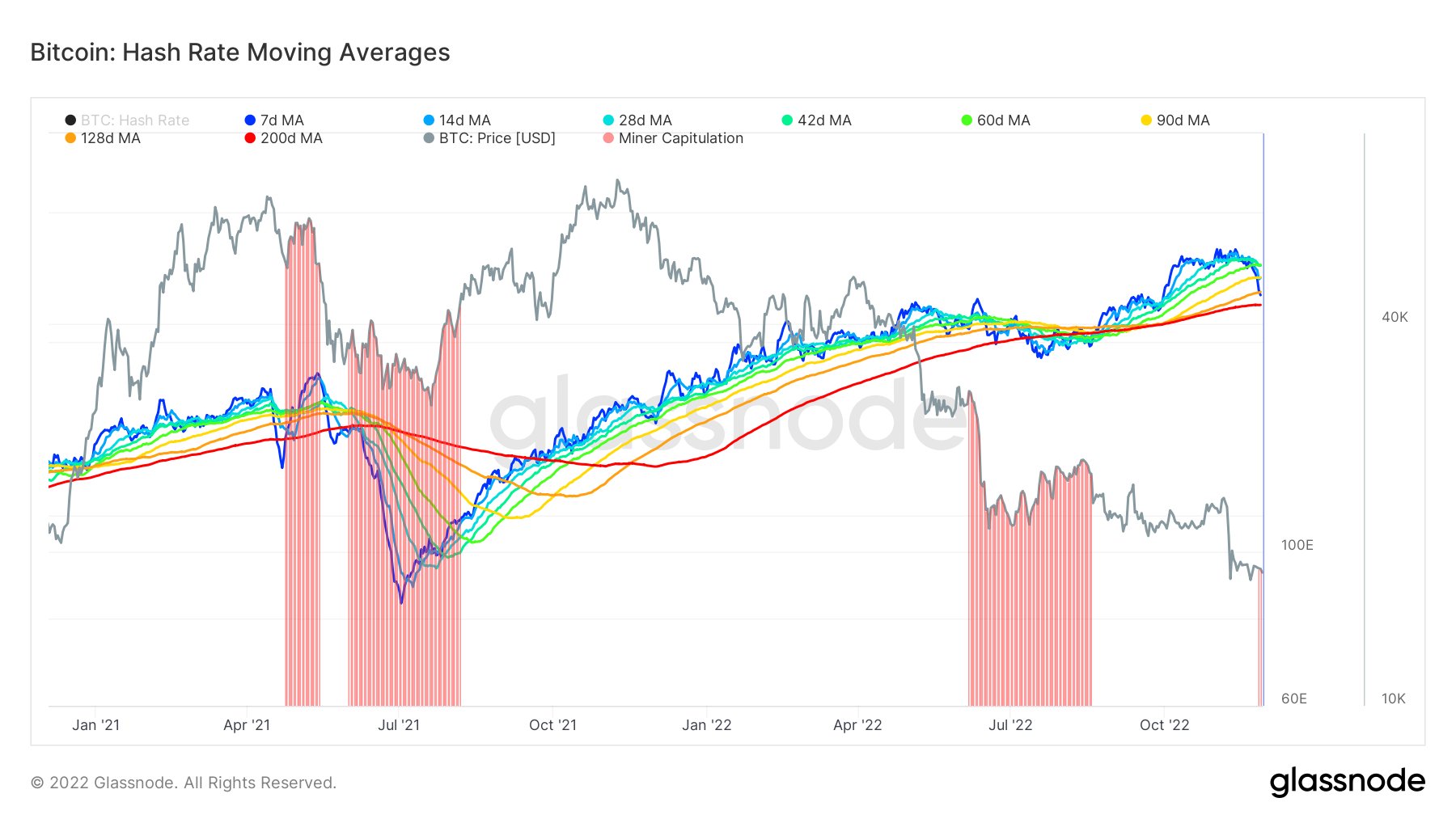

On-chain data shows that the second wave of miner capitulation has now begun, suggesting further pain for the BTC price. As analyst Dylan LeClair wrote, the Bitcoin hash rate is starting to tilt here.

Bitcoin Miners Under Water

The 7-day moving average hash rate is now 13.7% away from its all-time high. Mining difficulty is expected to adjust by about -9% in a week, which will take some pressure off miners, at least in the short term.

Nevertheless, miner margins have been and continue to be massively squeezed since June, the first capitulation event in this cycle. Despite this, the hash rate still rose to an all-time high until recently.

This, the increased mining difficulty, and the FTX-related price crash have pushed the hash price to its lowest level since late 2020.

As Capriole Investments’ Charles Edwards noted yesterday, hash ribbons have confirmed the start of capitulation. “Triggered by the $10 billion FTX scam and subsequent collapse, bitcoin miners are now going broke and the hash rate is trending down,” Edwards stated.

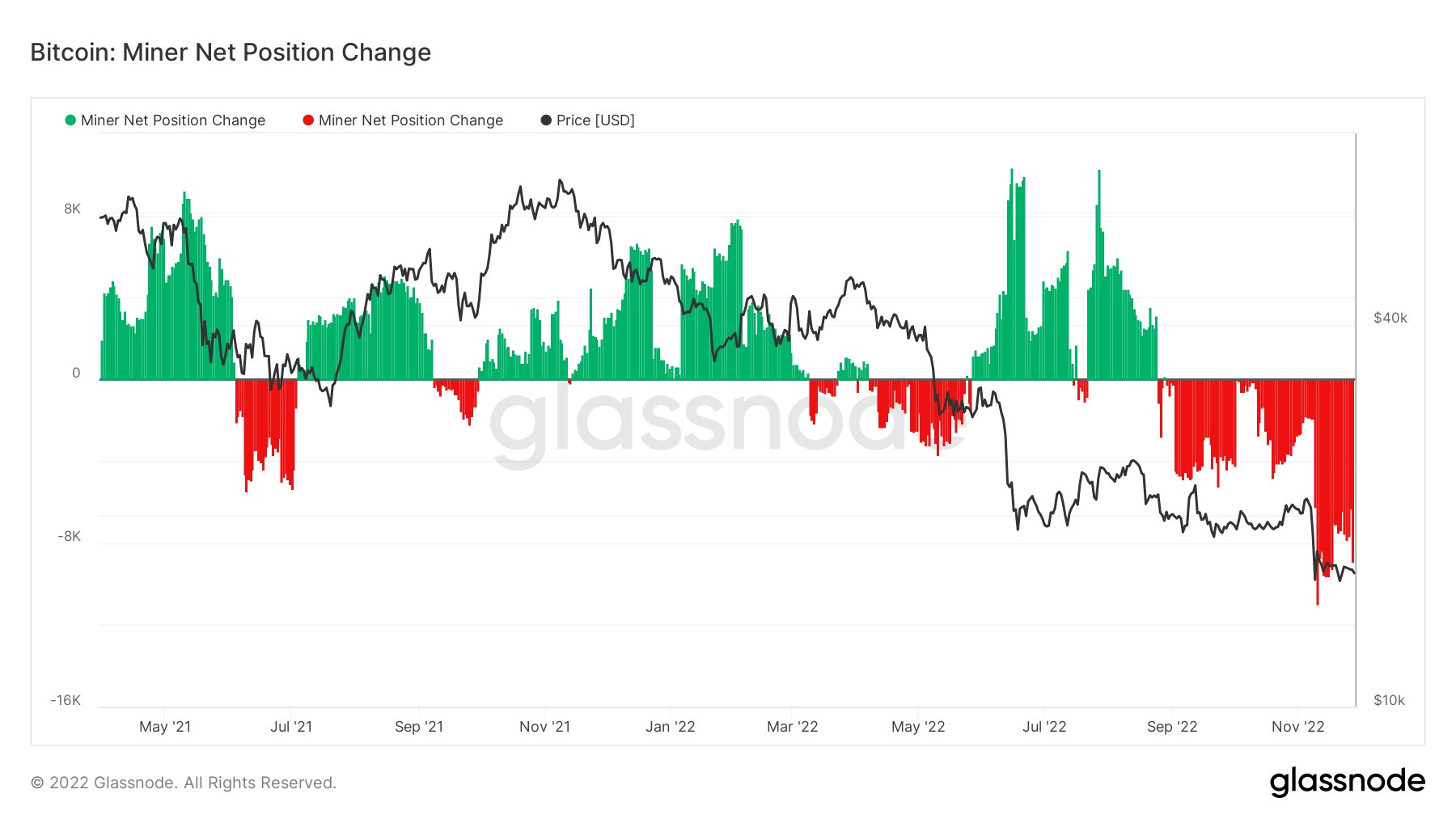

In the “Bitcoin miner net position change” chart, it can be seen that miners have been selling aggressively over the past month.

“Combined with the decline in the hash rate and today’s hash band bear cross, this suggests that we are indeed in a phase of miner capitulation,” said Will Clemente of Reflexivity Research.

How Long Will Miner Capitulation Last?

Something to keep in mind is that miner capitulation is usually the last stage of a Bitcoin bear market. In the 2018 cycle, the BTC hashrate continued to rise as the price reached the $6,000 mark until the final miner capitulation came at $3,000.

In the current cycle, miners have already undergone a capitulation in June. They reduced their holdings by 4,000 BTC, equivalent to about $68 million, in the last two weeks.

Prior to that, they had only begun a net accumulation trend in September 2022, betting that the bottom had been reached. However, they bet on the wrong horse and are now being severely punished.

Historically, miner capitulation has lasted an average of 48 days, which would put an end to miner selling pressure in sight by mid-January 2023.

However, the most recent capitulation ended only after two months, on August 18. The end marked the third longest capitulation in history. Bitcoin bulls should therefore be cautious in December and January, and watch the behavior of Bitcoin miners.

At press time, BTC saw a slight uptick and was trading at $16,481.