In contrast to Sam Bankman Fried’s recent claims that he wasn’t aware of Alameda’s position, Forbes recently released its communication with SBF when drafting their billionaires’ list, indicating that he was well versed in Alameda’s finances.

During his recent interview with the New York Times, the ex-CEO said Alameda made risky investments on the FTX platform because it had too much leverage and that he did not understand what the company was doing.

“It’s not a company I run. It’s not a company I have run for the last couple of years. And Alameda’s finances I was not deeply aware of. I was only surface-level aware of Alameda’s finances,” SBF stated during the interview.

Amid these developments, interestingly, a few billionaires came to Bankman-Fried’s defense.

Call me crazy, but I think @sbf is telling the truth.

— Bill Ackman (@BillAckman) November 30, 2022

Along with Bill Ackman, FTX investor O’Leary, also a spokesperson for the exchange, expressed his support for Bankman-Fried.

I lost millions as an investor in @FTX and got sandblasted as a paid spokesperson for the firm but after listening to that interview I’m in the @billAckman camp about the kid! https://t.co/5lWzTT7JEv

— Kevin O'Leary aka Mr. Wonderful (@kevinolearytv) December 1, 2022

Forbes’ recent revelations about SBF tell a different story

Bankman-Fried sent Forbes documents showing his ownership stakes in Alameda (90%) and FTX (about 50%) and screenshots of wallets holding cryptocurrencies in January 2021.

SBF says he was "not deeply aware of" Alameda's finances

Forbes says he sent them details of Alameda's holdings as recently as Augusthttps://t.co/SVR3XJuvc5 pic.twitter.com/PHek7Tx7qv

— db (@tier10k) December 2, 2022

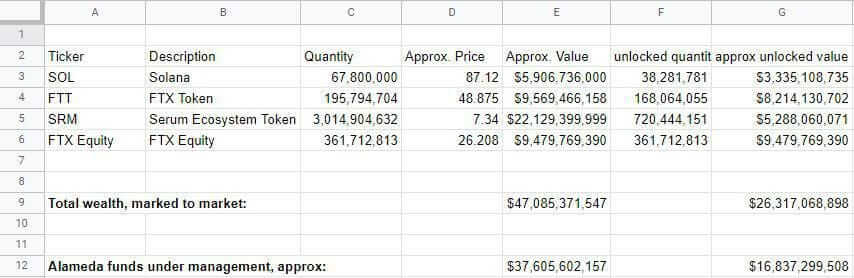

According to the revelations, he sent a Google Sheet listing his assets, including FTX equity, 67.8 million Solana tokens, 193.2 million FTT tokens, and 3 billion Serum tokens.

Following that, Forbes also caught periodic modifications to the Google sheet when calculating the annual World’s Billionaires list.

As crypto prices rose, Alameda increased its share of FTT tokens to 195.8 million. As a result, the “Alameda funds under management, approx.” row read $37,605,602,157.

“A separate column, listing only tokens that were unlocked–meaning able to be transacted–pegs Alameda’s total funds at a more modest $14.7 billion. Updates like this arrived periodically–practically whenever Forbes asked for them,” Forbes stated

The Google Sheet was then modified in September 2021 to include an updated tab, “Alameda’s funds under management,” which had grown to $37.6 billion, $16.8 billion, counting only unlocked tokens.

It was in March 2022 that Bankman-Fried updated the spreadsheet again with additional details about Alameda’s ownership share. FTT holdings were down to 176 million tokens; Solana was down to 53 million.

SBF again guided Forbes through his net worth two months before FTX collapsed, providing a table of FTX and FTX U.S.’ largest shareholders. On a new tab in the spreadsheet, Alameda’s holdings were also shown, with 53 million, 3 billion, and 176 million shares of Solana, Serum, and FTT, respectively.

At the time, Bankman-Fried’s management share of Alameda’s funds totaled $8.6 billion, or $6.4 billion, counting only unlocked tokens.

Some Twitter users have taken shots at the former CEO of FTX following the recent revelations:

Helping Forbes develop picture of net worth is a huge red flag. Most billionaires want to keep their wealth as stealthy as possible.

— Ben Davenport (@bendavenport) December 2, 2022

Forbes stated.

“The level of detail Bankman-Fried provided to Forbes over the years shows that he had detailed knowledge of some of Alameda’s holdings and at least some knowledge of the transactions it was making, especially in 2021, despite stepping back from running the hedge fund after cofounding FTX in 2019.”

The post SBF had detailed info on Alameda’s finances as recently as March, Forbes reveals appeared first on CryptoSlate.