African credit-led neobank Finclusion Group has raised an additional $2 million in equity financing as it officially rebrands to Fin, the company said in a statement shared with TechCrunch.

The news follows a January announcement that the fintech, which uses AI algorithms to provide financial services to African customers via an array of credit-centric products, raised $20 million in debt and equity pre-Series A financing. Fin also raised a $20 million debt facility from emerging markets debt provider Lendable in September 2021, bringing its total capital secured in equity and debt to $42 million.

Per the statement, the new equity financing — led by existing investors Leonard Stiegeler, who is also joining the board of the company along with Sudeep Ramnani and Jai Mahtani — will be used to add new, fully integrated territories to its business, as well as develop new offerings, specifically in third-party support of microfinance banks wanting to offer more financial services.

African customers are in dire need of credit. But from a long-term perspective of a company offering just loans, it can be hard to compete with other lenders that provide deposits and investments, financial services that any lender, backed with years of customers’ credit history, can efficiently cross-sell.

Since 2018, Fin, taking a cue from other credit-first neobanks, has built consumer-facing credit products to close the credit gap in the countries where it operates, including Tanzania, Namibia, South Africa, Eswatini and Kenya. Its offerings are also diversified. There’s SmartAdvance, where Fin, via employer partnerships, offers solutions for employees’ financial well-being. Its wage streaming product provides payroll loans and future wage loans where employees can take loans off the back of their salary, deduct them from their payroll and lend through employer relationships. There’s an insurance product too, with savings products, cards and buy now, pay later offerings via a merchant network, still in the pipeline.

Fin

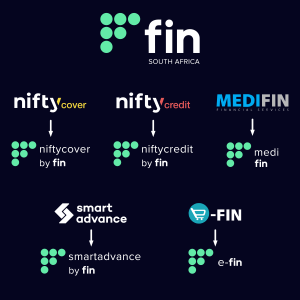

With this rebrand, subsidiaries across its core markets have also been renamed: Fin Kenya (formerly TrustGro), Fin Tanzania (formerly Fikia Finance) and Fin South Africa (with its products now being SmartAdvance by Fin, NiftyCredit by Fin, NiftyCover by Fin, MediFin and e-Fin). Fin’s plan is that the consolidation of its footprint across Africa under this identity will accentuate its ambition to dominate the neobank space across Eastern and Southern Africa, which has seen players such as TymeBank, Kwara, Koa and Fingo emerge in recent years.

“Our cross-selling experience was limited when we first launched,” co-founder and co-CEO Timothy Nuy told TechCrunch over a call. “So effectively through this integration, everything becomes Fin. Someone will log into his Fin South Africa platform, and effectively get access to all the financial services we offer in that country that they need, which makes it easier to drive repeat engagement and to ensure that customers have full visibility of our offering, but also the financial products they have outstanding.”

In the last couple of months, Fin has improved its numbers. For instance, its loan book has increased by 30% from last year, with over 40,000 unique customers, said Tonderai Mutesva, the startup’s other founder and chief executive. They pay interest of 24-42% APR depending on the product type and market. Default rates of its loans still fall between 7-8%, but Mutesva said the fintech is working to get that down to about 3%.

What’s next for the brand? A planned expansion into new markets next year, then offering services to microfinance banks that will enhance their value proposition to customers; for instance, better credit or saving tools. The technology behind this offering will be known as Fin Connect and is supported by Fin’s earlier acquisition of the microfinance technology services provider Awamo. Finally, Fin says it will continue supporting adjacent businesses in the space through its venture portfolio, one of which is Kenyan insurtech platform m-Tek.

“The real goal is to rethink what we need to do in 2023, integrate all the brands, and continue just scaling up our loan portfolio as well as bring more of these businesses to break even on an operating profit basis,” said Nuy. “When it comes to capital raising, we’ll conduct a bigger capital raise probably towards the end of 2023.”

African credit-led fintech Finclusion raises additional capital amidst rebrand by Tage Kene-Okafor originally published on TechCrunch