Bitcoin miners are facing a challenging time due to ongoing price uncertainty and global energy shortages.

In addition, macro factors have conspired to raise the cost of borrowing, while access to capital is also drying up as risk appetite dwindles in the face of recessionary pressures. This situation is particularly bad for publically traded miners, who typically borrow to fund the purchase of mining equipment.

What’s more, with the price of Bitcoin floating in and around two-year lows, profitability remains tight for all but the most efficient miners.

On-chain Glassnode data analyzed by CryptoSlate reveals, since August, the BTC held by miners has dropped significantly. However, it is unclear whether this was driven by the need to offload at exchanges.

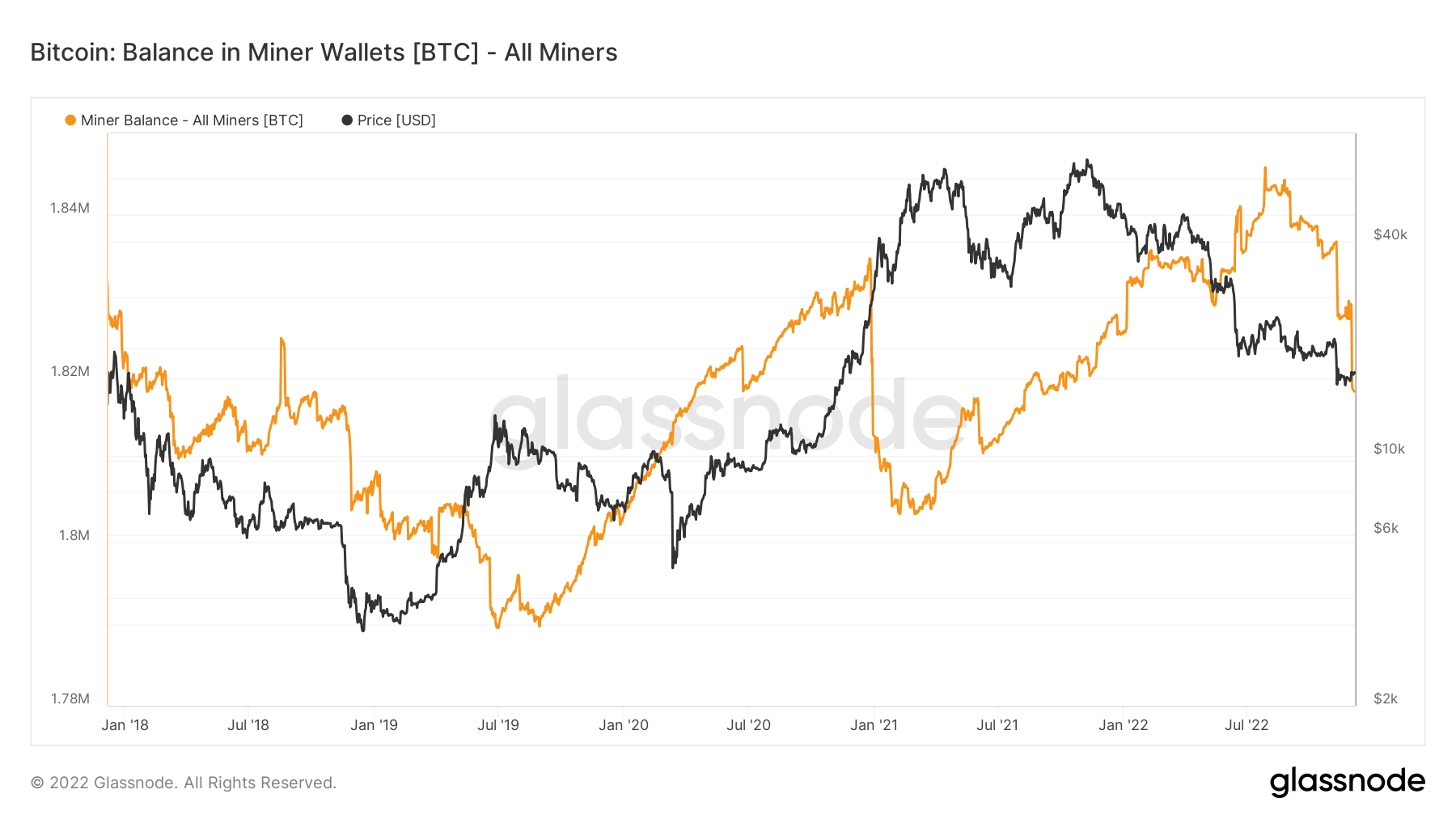

Bitcoin held by miners

Glassnode’s Bitcoin: Balance in Miner Wallets metric identifies miners’ wallets and tracks the total BTC supply held in these addresses.

The chart below shows an uptrend in Bitcoin held by miners since the start of the year. This peaked at 1.86 million BTC around August, leading to a sharp drop-off, accelerating into a near-vertical drop since November.

Market dynamics have sunk the number of tokens held to approximately 1.81 million BTC at present, which equates to the same level seen around November 2021.

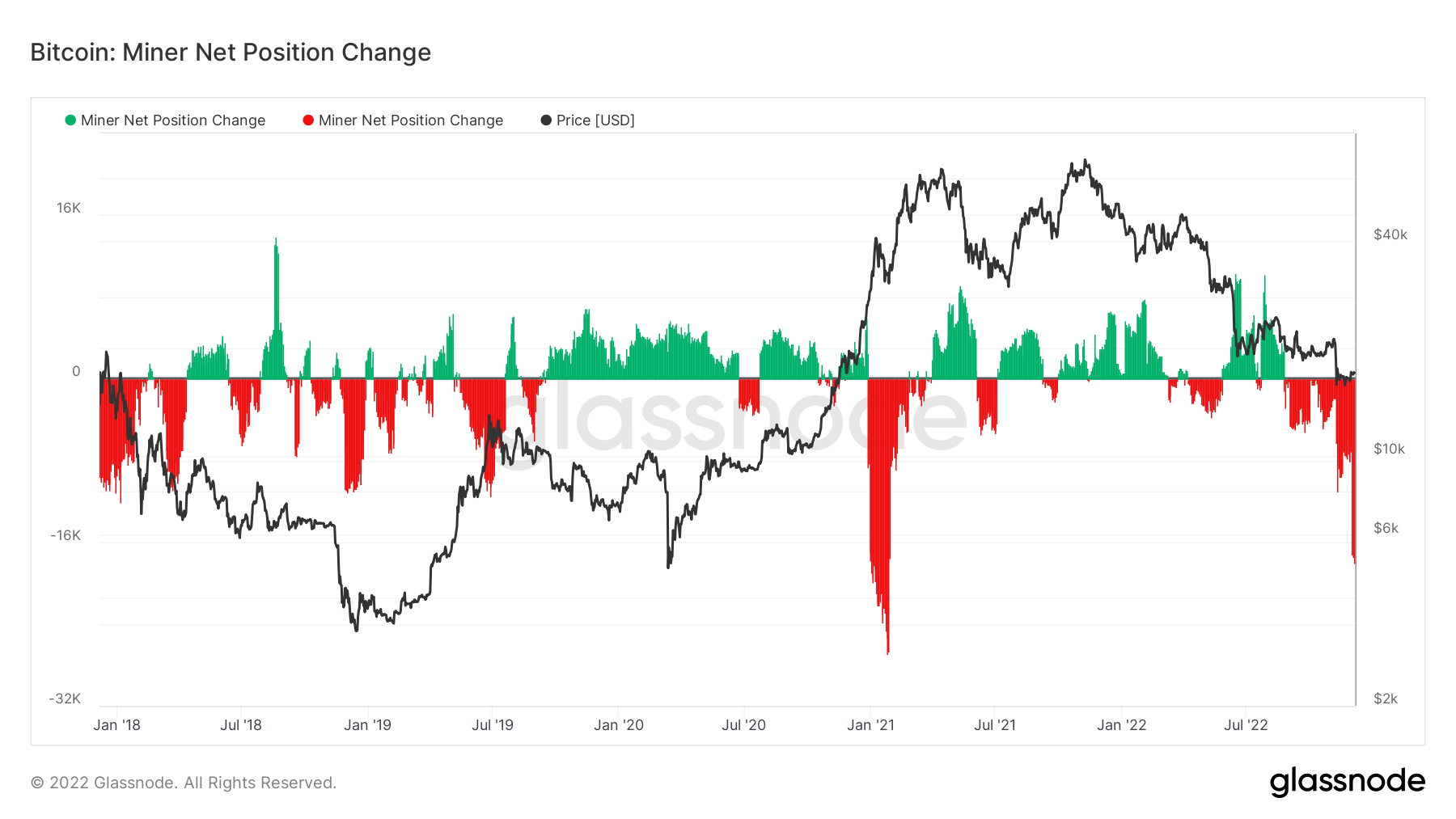

Miner Net Position Change

Miner Net Position Change looks at the flow of Bitcoin into and out of miners’ addresses. During times of stress, including depressed price action, in aggregate, miners tend to distribute their mining rewards, represented by outflows from the Net Position Change metric.

The chart below shows current ongoing uncertainty has resulted in significant outflows, from miners – dipping as low as around -20,000 BTC in recent weeks.

While the term “outflows” is sometimes associated with selling on exchanges, it should be noted that in the case of the Miner Net Position Change metric, tokens leaving miners’ wallets may also relate to moving to cold storage.

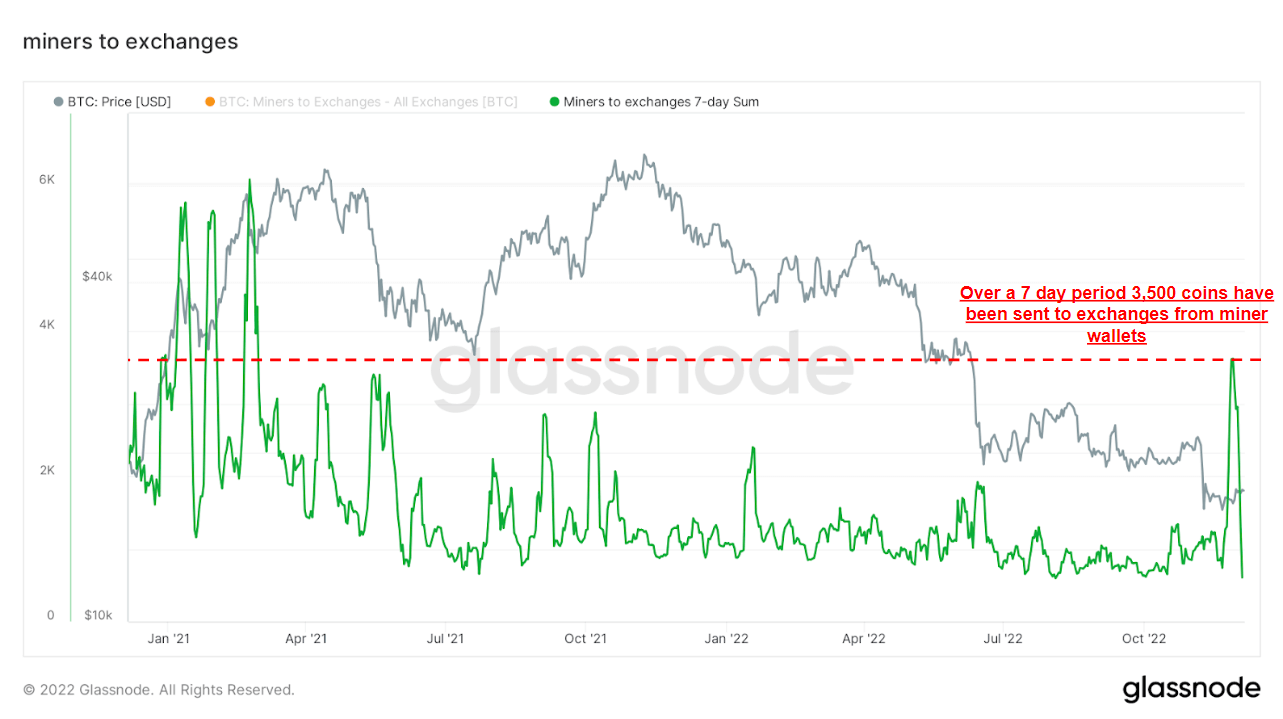

The chart below shows just 3,500 BTC were sent to exchanges from miners’ wallets over the past week. This would suggest the majority of the drop in Bitcoin held by miners was for reasons other than selling at an exchange.

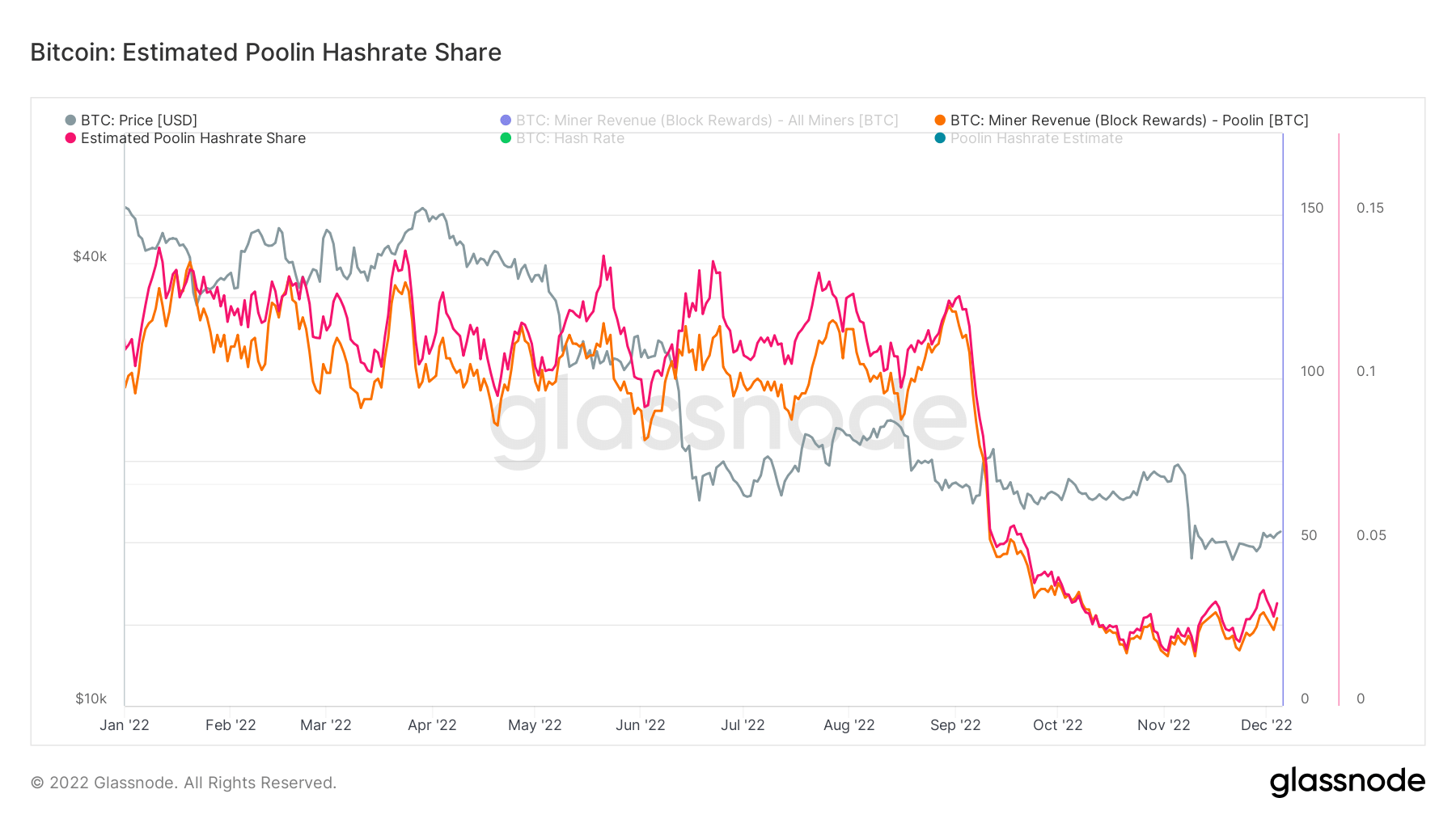

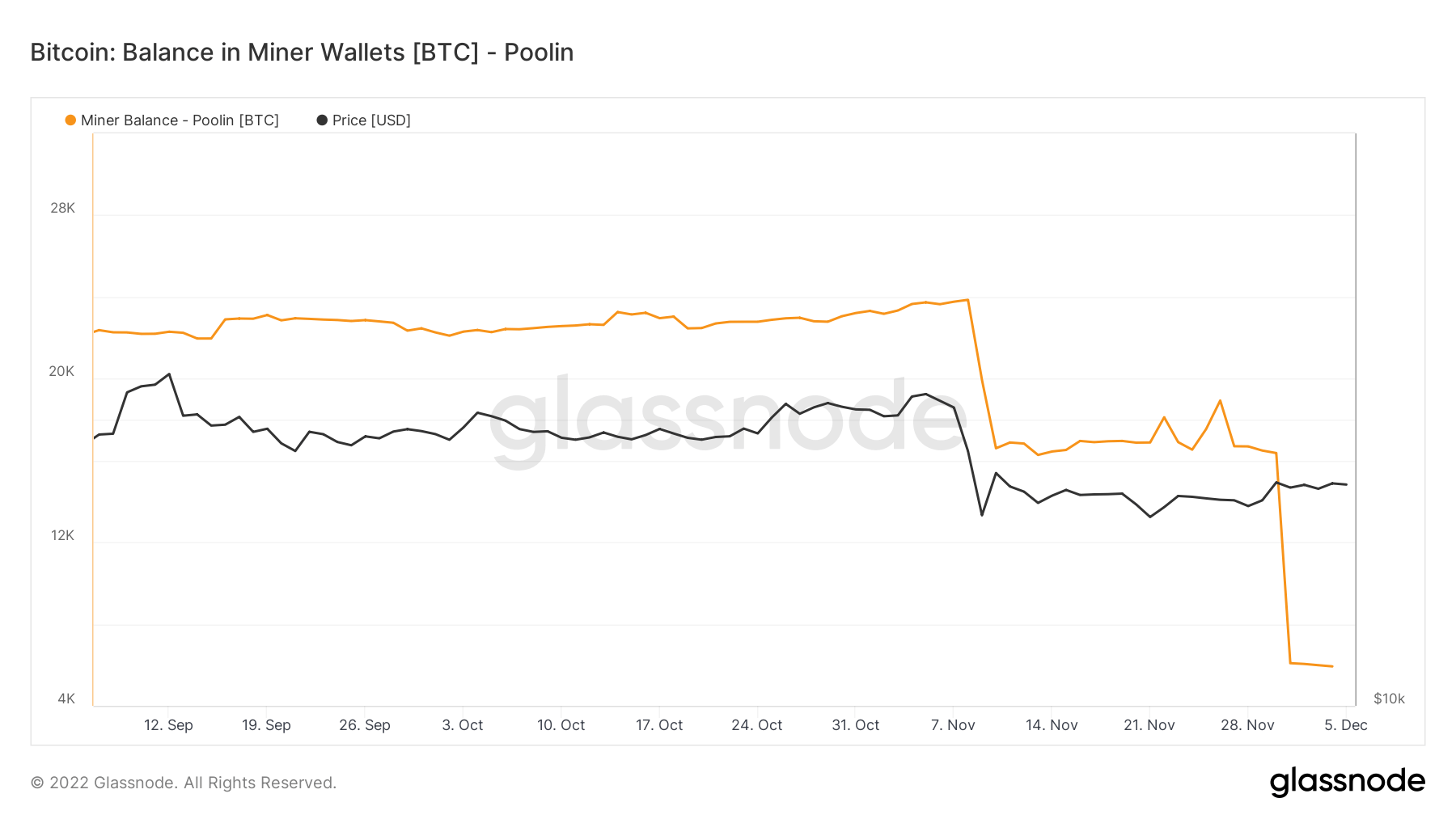

Poolin culpable

In early September, mining pool Poolin announced liquidity issues and a pause on the withdrawal of mining rewards.

Pre-announcement, Poolin was one of the top mining pools, accounting for 12% of the network’s overall hashrate, and as high as 15% when the company was at its peak in 2020.

However, the liquidity crisis triggered an exodus of participating miners, leading to Poolin’s share of the hashrate plummeting to 4% at the time.

Revisiting this, Poolin’s hashrate currently accounts for 3% of the network. What’s more, in November, this fell as low as 1%, suggesting the company’s woes have not improved.

Analysis of the Bitcoin held in Poolin wallets shows a sharp dip from early November when the balance was hovering around 22,000 BTC. Following a relatively stable balance over the next few weeks, another sharp drop occurred in late November, dropping the balance held to around 6,000 BTC.

The approximate 16,000 BTC drop off from Poolin addresses account for a significant chunk of the market’s overall decline in balances held by miners.

The post Research: Bitcoin held by miners sinks to 1 year lows; Poolin culpable appeared first on CryptoSlate.