Former FTX CEO Sam Bankman-Fried (SBF) claims in his planned testimony before the U.S. House of Representatives Committee on Financial Services that he was pressured into filing for bankruptcy for the FTX companies by the law firm Sullivan & Cromwell, asserting that their motivation for doing so was the potential legal and consultancy fees.

SBF was set to testify before the U.S. House of Representatives Committee on Financial Services on Dec. 13. However, he was arrested in the Bahamas on Dec. 12, at the request of the U.S. government.

Forbes obtained a draft of Bankman-Fried’s planned testimony and has published it verbatim.

In the testimony, SBF makes a claim under ‘Chapter 11’ that he had received an “offer for billions of dollars to help make customers whole,” shortly after signing a nomination for John Ray to take over FTX as CEO.

SBF states that he instructed his counsel to rescind the document only moments later to find this it was not possible to do so. The testimony also reports that “Sullivan & Cromwell lawyers were submitting it on [SBF’s] behalf despite [SBF’s] instructions not to.”

SBF claimed that the Ray nomination document was filed by Sullivan & Cromwell against his wishes “roughly 6 hours later.”

SBF then claimed that Ray filed for Chapter 11 afterward for all FTX entities “-including a fully solvent US entity, FTX US, in which they shut down customer access and withdrawals.”

According to the testimony, The Bahamas Attorney General, Ryan Pinder, released an official statement:

“It is possible that the prospect of multimillion-dollar legal and consultancy fees is driving both [the Chapter 11 team’s] legal strategy and their intemperate statements.”

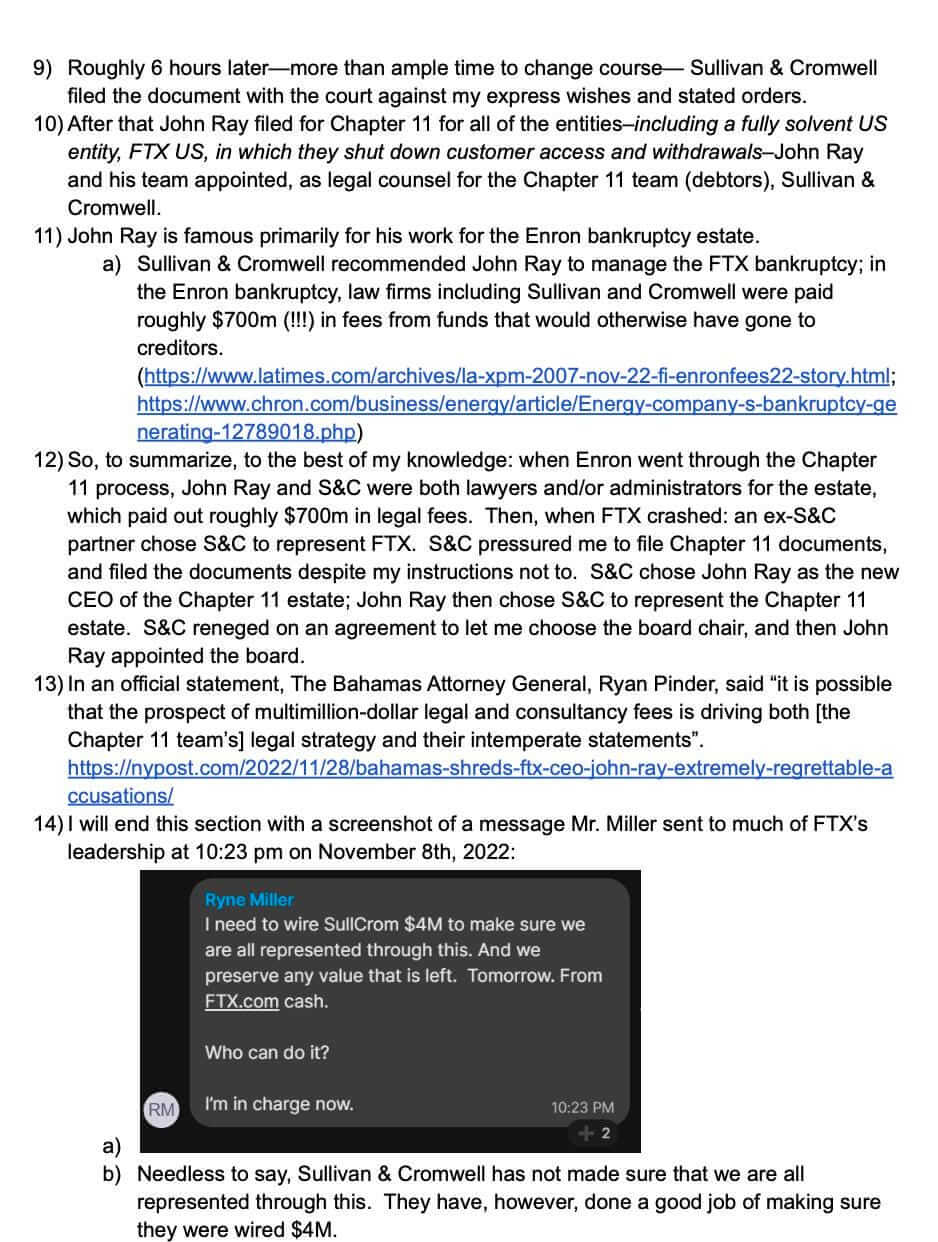

SBF concluded page nine of his testimony with a screenshot revealing a message from General Counsel at FTX, Ryne Miller, requesting consent to send “SullCrom” $4 million to ensure representation “from FTX.com cash.”

The post SBF claims law firm Sullivan & Cromwell pressured him into bankruptcy filing for legal, consultancy fees appeared first on CryptoSlate.