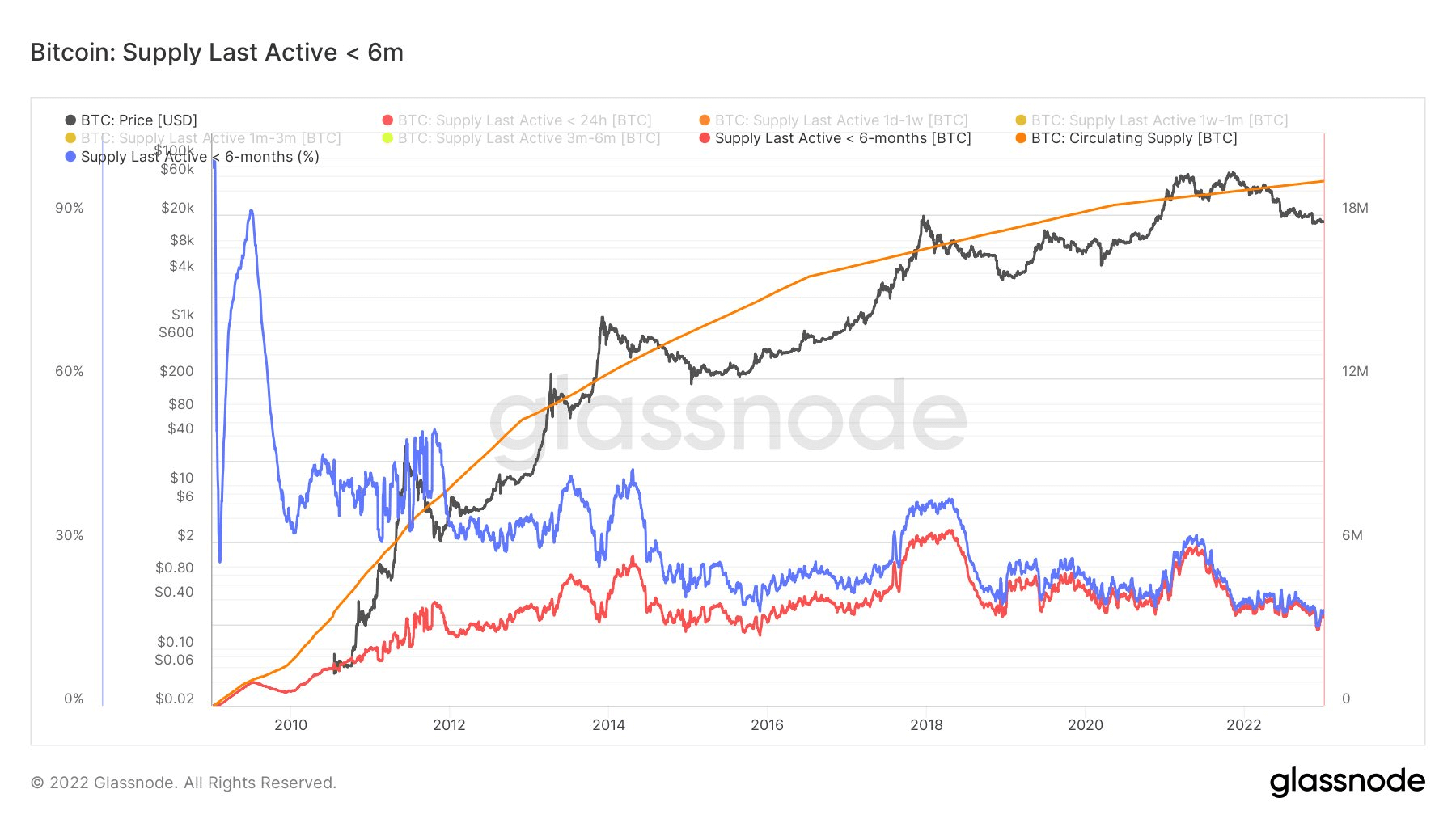

The Supply Last Active metric looks at the amount of inactive Bitcoin over a given time period. Analysts infer that the more inactivity exists, the more BTC is being hodled, thus reducing sell pressure and acting as a tailwind for bullish price action.

CryptoSlate’s analysis of Glassnode data showed the percentage of supply held for less than six months has fallen to its lowest level.

Bitcoin Supply Last Active falls to new lows

With the arrival of 2023, hopes are high that Bitcoin will reverse the negative price action that characterized the previous year.

The cohort of Bitcoiners who held for six months or less currently comes in at around three million BTC, which equates to 15% of the total circulating supply – the lowest-ever percentage.

The previous instance of the lowest Supply Last Active was during the bottom of the 2015 bear market, which occurred in Q4 of the year, as the metric touched 17%. From that point, over two years, the Bitcoin price grew from $200 to $20,000.

Analysis of past data showed younger coins typically come in volume during two key events:

- Bull markets as longer-term investors spend and divest into market strength.

- Capitulation sell-off events where widespread panic brings coins of all ages back into liquid circulation.

The post Research: Short-term Bitcoin holders fell to its lowest level at 15% of the supply appeared first on CryptoSlate.