On December 7, Jared Grey, the CEO and “Head Chef” of SushiSwap, suggested that the DEX is burning through cash like there is no tomorrow.

According to the forum post made by Grey, the DEX has, more or less, a year and a half in headroom which resulted in the exchange enacting a 100% allocation from fees on its staking token xSUSHI.

This 100% allocation, however, is temporary until the DEX’s situation improves or new tokenomics are enacted. Will this proposal be the answer to SushiSwap’s urgent situation?

New Year, New Tokenomics

Grey’s current proposal, if passed, is a technical undertaking for the DEX which could save it from its current state. According to the proposal, liquidity providers, or LPs, will receive a share of the 0.05 % swap fee on the ecosystem.

They can also lock their liquidity to earn emission-based rewards with a soft-lock system, meaning that they can pull their liquidity out before it reaches maturity but they lose their rewards.

xSUSHI rewards are also updated. The token would lose its previous cut on the fees and will be replaced with an emission-based rewards system. The soft-lock system will have differing rewards for different lock tiers.

The emission APY, according to the forum post, will be around 1-3% if instated. The new tokenomics would also introduce token burning in the form of buy backs of SUSHI and burning off the rewards if the locked liquidity or xSUSHI is pulled out.

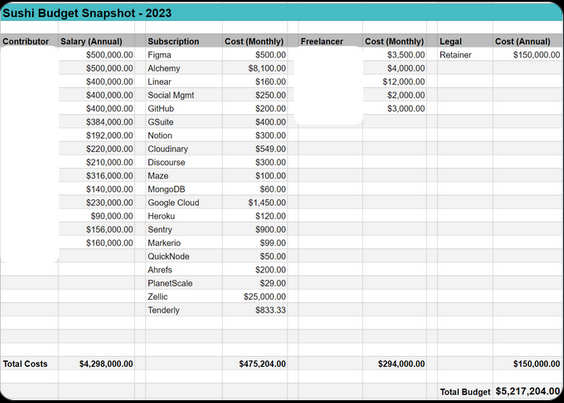

As I promised in Sunday’s tweet regarding Sushi’s Budget Snapshot for 2023, I am making the DAO operating costs public. Transparency is a critical component of a successful DAO. You can see most budget costs are salaries. 1/ pic.twitter.com/rVHXEJSfLR

— Jared Grey (@jaredgrey) December 13, 2022

Issues Wafting In The Air For SushiSwap

Although the new tokenomics look sound, a comment on the December 7 forum post shows something different. According to user GoldenNaim, the platform is currently using $4 million of the calculated $5 million operating budget for wages.

This is incredibly troubling as this only leaves the team a measly $1 million for making SushiSwap better through innovation. Jared Grey’s reply to this is just:

“Yes, we need to pay people competitive wages to work at Sushi.”

But it seems that the proposed tokenomics has an effect on SUSHI’s price. According to CoinGecko, SUSHI has jumped by 1.8% in the past 24 hours with the biggest rally in the weekly timeframe at 2.8%.

The DEX’s fundamentals are also looking bullish as Cryptolaxy, a crypto fundamental and technical analysis platform, show that SUSHI is undervalued to some degree. If SUSHI is to recover from 2022 market woes, the token must break through $0.9849 resistance.

As the year progresses forward, we’ll see if SushiSwap will implement its proposed tokenomics and save it from its current state.

-Restaurant Business Magazine