Doorstead, a property management startup which offers “guaranteed” rental payments to homeowners, has raised $21.5 million in a Series B round of funding.

Ryan Waliany and Jennifer Bronzo started Doorstead in 2019, initially testing out its model for setting prices for rental properties on Craigslist. Over time, the company built out a pricing model through data science and machine learning that the pair says gives it the ability to better predict how much rent a given property can command.

That’s not to say that it operates without risk. The duo acknowledge that it is indeed a risky endeavor to guarantee rent to landlords considering Doorstead has to cough up the difference if it can’t get the amount it promised.

However, they claim their prediction model works so well, that it still comes out ahead. Doorstead makes its money strictly by charging an 8% management fee, so it is not incentivized to list properties at rents that might be higher than is realistic or fair. So, if the company is able to get a higher rent than guaranteed, it doesn’t pocket the difference. Instead, that extra cash goes to the property owner.

“Other companies might take that upside but we believe then that incentives are misaligned,” CEO Waliany told TechCrunch. “What we offer is a risk-adjusted guarantee based on the market.”

To request a guaranteed offer, property owners enter basic information about their property on Doorstead’s website. If the property is eligible, the company tells the owner the minimum amount they will receive each month and when they will start receiving their payments.

Says COO Bronzo: “We cover the difference if we rent out the property for less [than the minimum] or if it takes longer to find a tenant. So, the owner still gets the rent, and we pay the difference out of pocket, or it cuts into our 8%.”

Doorstead targets “getting above the baseline listing price 75% of the time,” according to Waliany.

“…It works out financially very well for us, and we’re helping eliminate unnecessary vacancies. Without a guarantee, sometimes property managers drag their feet,” he said.

The model does seem to be working considering the startup says it saw 270% property growth in 2022 and that its revenue “outpaced” property growth with “healthy unit economics.” Doorstead says it has served “thousands” of owners over the years, generated over 30,000 guaranteed rental offers and currently has north of $1 billion worth of properties under management. The startup operates in seven markets in California, Washington and Massachusetts with plans to “double or triple” its footprint this year.

Doorstead only works with individual landlords of single-family homes, condos or townhomes, not institutional landlords.

Waliany formerly worked in product at Uber and Bronzo has experience in property management. The pair believes their combined backgrounds have given them a good perspective on how to run a tech-enabled, “full-service” property management business, and then some.

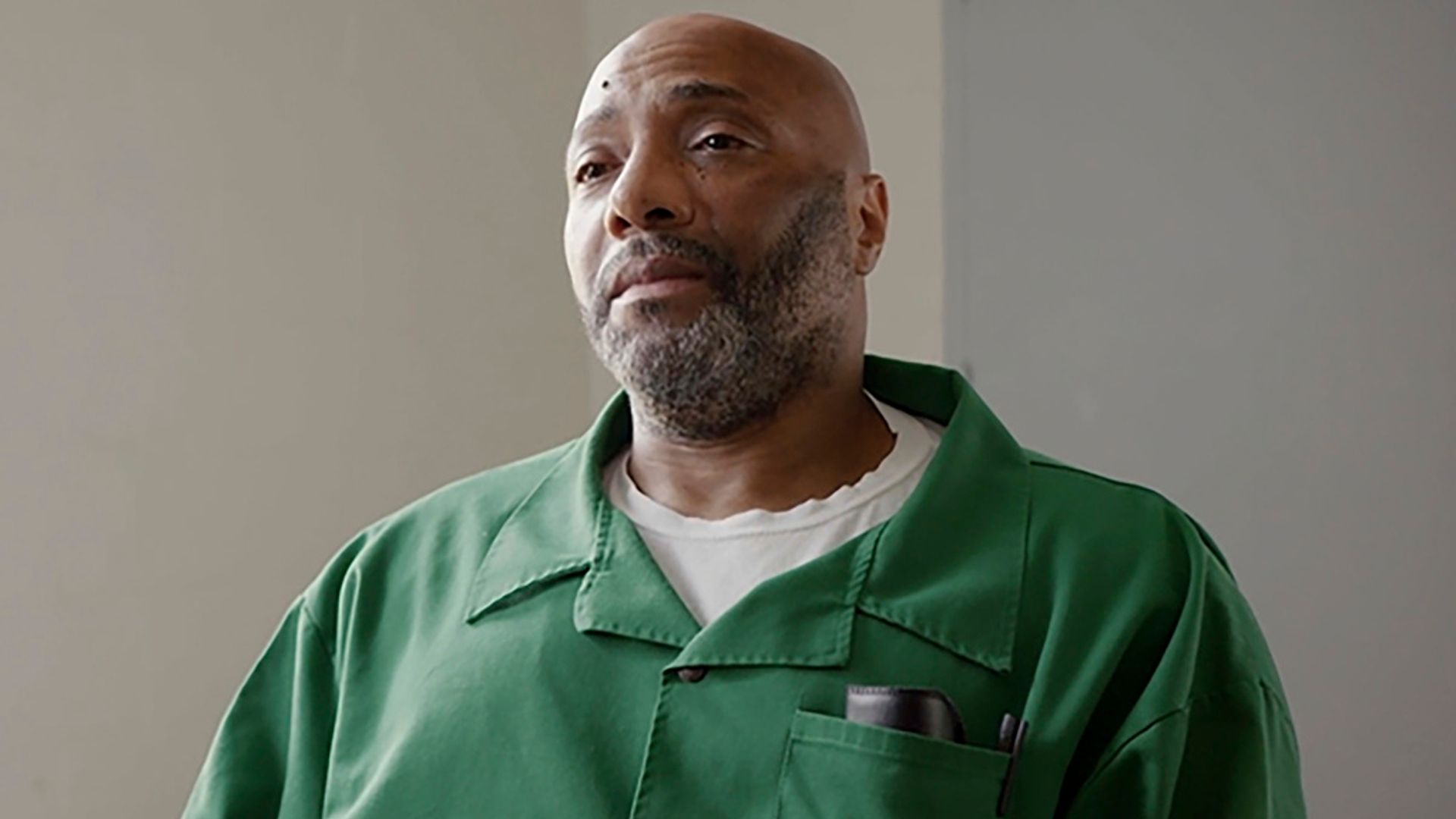

Image Credits: Co-founders Ryan Waliany (CEO) and Jennifer Bronzo (COO) / Doorstead

“When we started, we thought that, ‘we’re just going to make a tech enabled property management company. We’re going to build like Uber Eats for property management.’ But when we started talking to customers, we realized that we were wrong,” Waliany told TechCrunch. “We realized that there was a bigger problem that was unaddressed in the market, and that was that property owners were getting overpromised rents. Their properties could sit vacant for three or six months and in some cases, it cost them their home. So we thought, ‘what if we can give them a guarantee upfront before we find a tenant?’ ”’

Avanta Ventures led the round, which included participation from MetaProp, M13 and Madrona. Avanta is the venture arm of CSAA Insurance Group, an AAA insurer (AAA is also known as Triple A, or the American Automobile Association). Eric Wu and Tom Willerer (former CEO/CPO of Opendoor, respectively) are also backers. Doorstead has raised $37 million since inception.

Presently, the San Francisco-based startup has about 150 full-time distributed employees, with about 80 in the United States. Besides a geographical expansion, Doorstead wants to focus on capital efficiency and “improving unit economics” with an eye towards profitability.

“We’re shooting for growth, but profitable growth,” Waliany said.

Steve Bernardez, partner at Avanta Ventures, told TechCrunch via email that he was drawn to back Doorstead in part because he believes that “the rental property management space is a large and growing market historically underserved by legacy providers.”

“Despite a huge market opportunity, the rental property management space suffers from poor solutions that misalign incentives, fail to address financial risks, and can be painfully inefficient for all parties involved,” he continued. “…Using data-driven analytics trained on constantly refreshed local real estate data, Doorstead’s guarantee offers property owners confidence that they will get a minimum rental income stream at a guaranteed start date despite any volatile market conditions. Doorstead then helps the property owner prep the property for listing, secures a tenant, and manages ongoing repairs and maintenance, all within an efficient user interface that today’s property owners expect.”

In conjunction with the raise, Doorstead also announced it has acquired the Boston assets of another venture-backed investment property-focused startup, Knox Financial, which wound down operations at the end of last year.

TechCrunch’s weekly fintech newsletter, The Interchange, launched on May 1! Sign up here to get it in your inbox.

Got a news tip or inside information about a topic we covered? We’d love to hear from you. You can reach me at [email protected]. Or you can drop us a note at [email protected]. If you prefer to remain anonymous, click here to contact us, which includes SecureDrop (instructions here) and various encrypted messaging apps.)

Doorstead closes on $21.5M to make sure you always have a tenant for your rental property by Mary Ann Azevedo originally published on TechCrunch