Quick Take

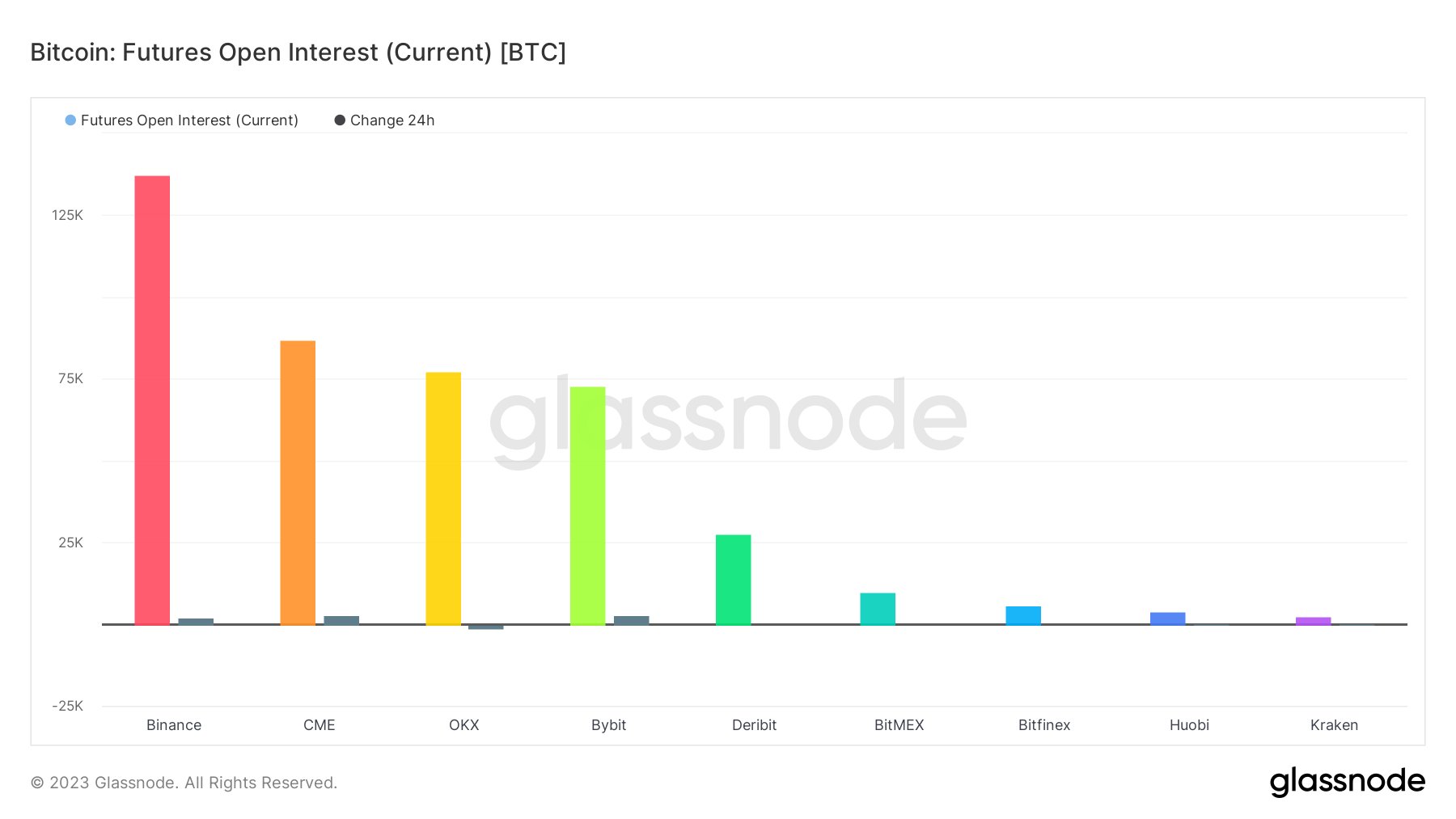

- Cryptoslate reported on Jan. 24 that the CME exchange saw 84,000 Bitcoin, or $2 billion, allocated in futures contracts in the last 24 hours.

- A further 2,715 BTC were allocated into futures open interest (OI) in the past 24 hours, now totaling 86,950 BTC.

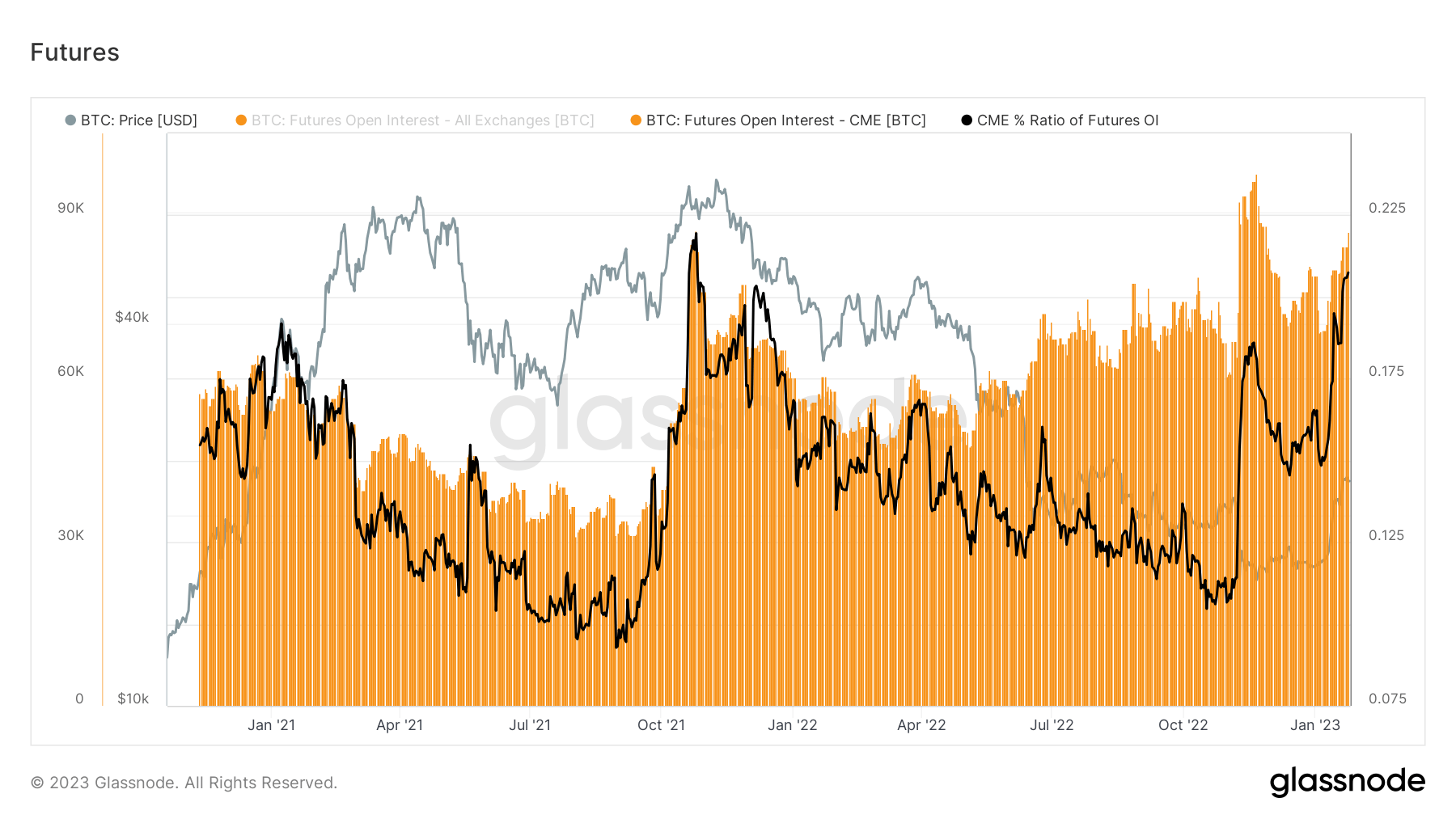

- The futures OI in CME accounts for 20% of the futures open interest in all exchanges, the highest since the November 2021 bull run.

- Total futures OI is 420,000 BTC, or about $9.5 billion.

Why is CME popular?

- CME is accessible for TradFi funds, as it’s regulated and uses a central counterparty clearing houses (CCPs) clearing model

- It’s easier for institutional speculators to trade BTC as it’s the same place they would trade commodity futures and, in general, relatively expensive for the average investor.

The post Bitcoin futures open interest at CME reaches 20% of overall BTC futures OI appeared first on CryptoSlate.