On-chain data shows exchanges have observed a vast Bitcoin outflow recently, a sign that whales may be going on a buying spree of the asset.

Bitcoin Exchange Netflows Have Been Negative In Recent Days

An analyst in a CryptoQuant post pointed out that around 10,000 BTC flowed out of exchanges yesterday. The relevant indicator here is the “all exchanges netflow,” which measures the net amount of Bitcoin entering or exiting the wallets of all centralized exchanges. The metric’s value is calculated by dividing the inflows and outflows.

When the indicator records a positive value, the inflows are more significant than the outflows, and a net amount of BTC is moving into exchanges. If these deposits are heading towards spot exchanges, BTC could feel a bearish impact as investors usually use these platforms for selling purposes.

On the other hand, the netflow having a negative value suggests the holders are withdrawing a net number of coins right now. Such a trend can be a sign that investors are currently accumulating the cryptocurrency and are bullish on the asset’s value.

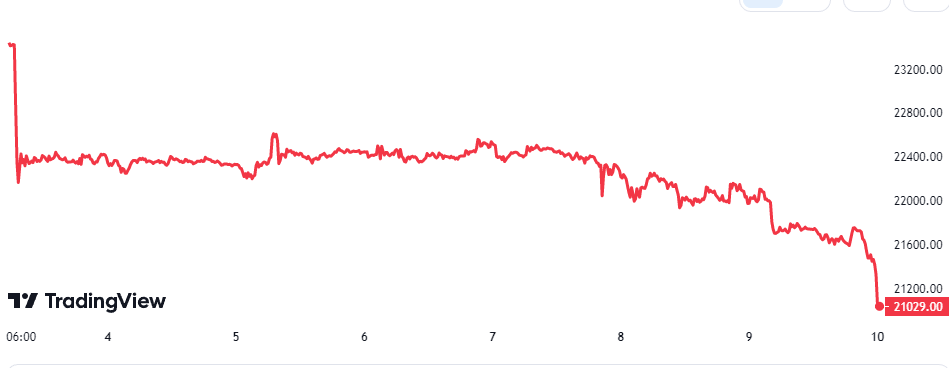

Now, here is a chart that shows the trend in the Bitcoin all exchange’s netflow over the last couple of months:

The above graph shows that the Bitcoin exchange netflow registered a huge negative spike just yesterday. Investors have withdrawn a net amount of 10,000 BTC corresponding to this spike.

However, whether these withdrawals were a sign of some fresh buying from the whales is unclear. It’s because investors use spot exchanges for buying-related activities. Still, the netflow indicator used here includes data for both spot and derivative exchanges; outflows from the latter wouldn’t necessarily imply accumulation.

A metric that can provide hints about the source of these outflows is the “open interest,” which measures the total amount of futures contracts currently open on derivative exchanges. The below chart shows how the Bitcoin open interest’s value has changed recently.

The graph shows that the Bitcoin open interest registered no decline over the past day, while all exchanges netflow observed a huge negative spike simultaneously. Rather, the open interest even slightly rose during this period.

If the outflows from yesterday were coming from derivative exchanges, the open interest would have gone down as investors would have closed some contracts to withdraw the coins. Since that hasn’t been the case, it seems reasonable to assume that the withdrawals were from spot platforms.

If the large negative netflow spike was a sign that some whales were buying up the cryptocurrency, the price of BTC could feel a bullish impact.

BTC Price

At the time of writing, Bitcoin is trading around $21,000, down 10% in the last week.