Quick Take

- Many investors try to pinpoint the exact times we are in previous cycles or decades.

- Every cycle and decade is slightly different in some way, but we have similar narratives to the 1970s of high inflation and elevated interest rates.

- Similar to the 1940s of financial repression, i.e., inflation is a lot higher than interest rates hence negative real rates.

- A comparison to the 1970s saw colossal inflation, rising interest rates, and an economy in stagflation. However, unemployment is still at record-low levels.

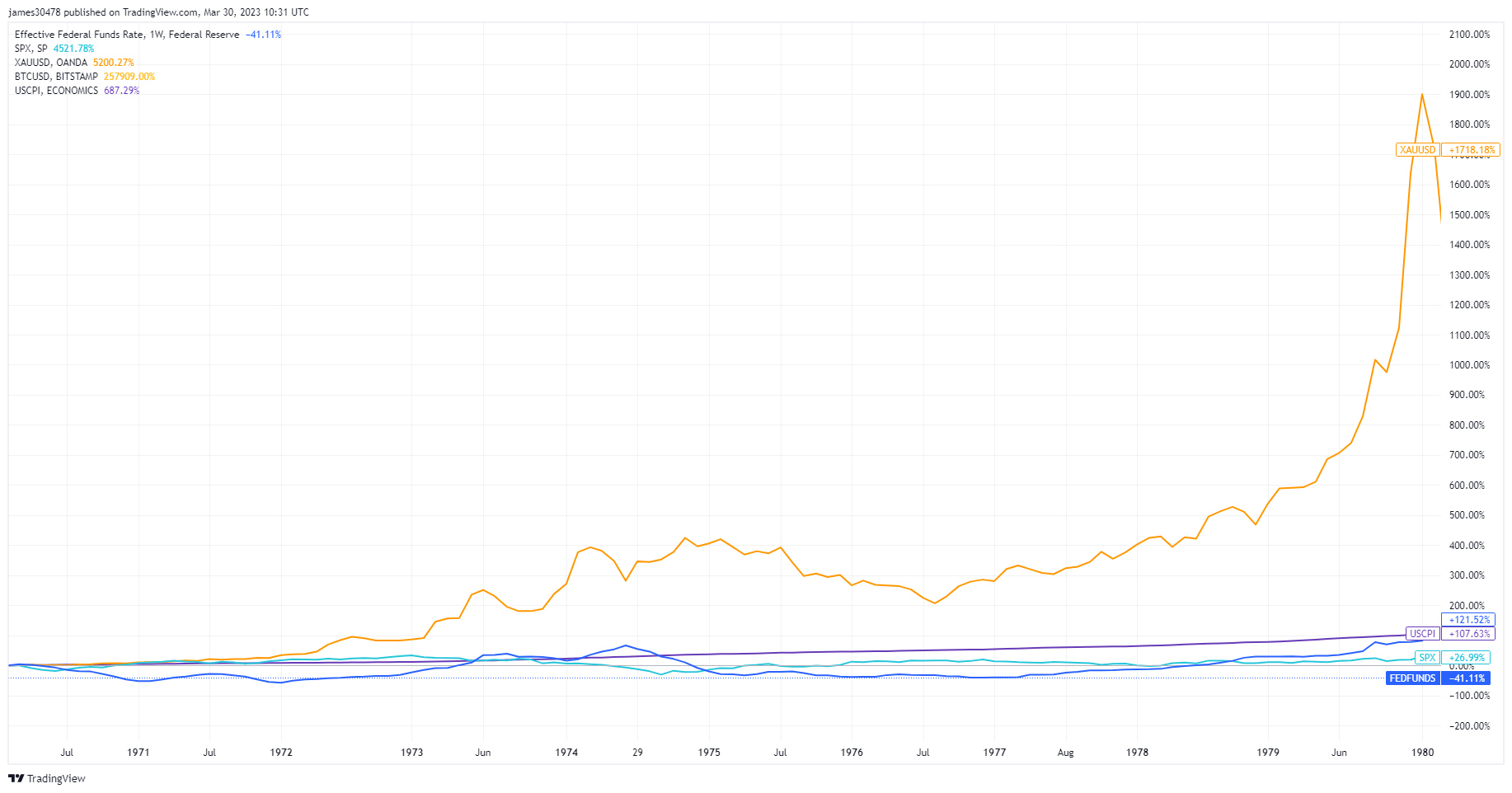

In the 1970s, this is how some assets performed;

- Gold appreciated: 1718%.

- Fed Funds % change went up 121%.

- US CPI grew by 108%.

- S&P appreciated 27%.

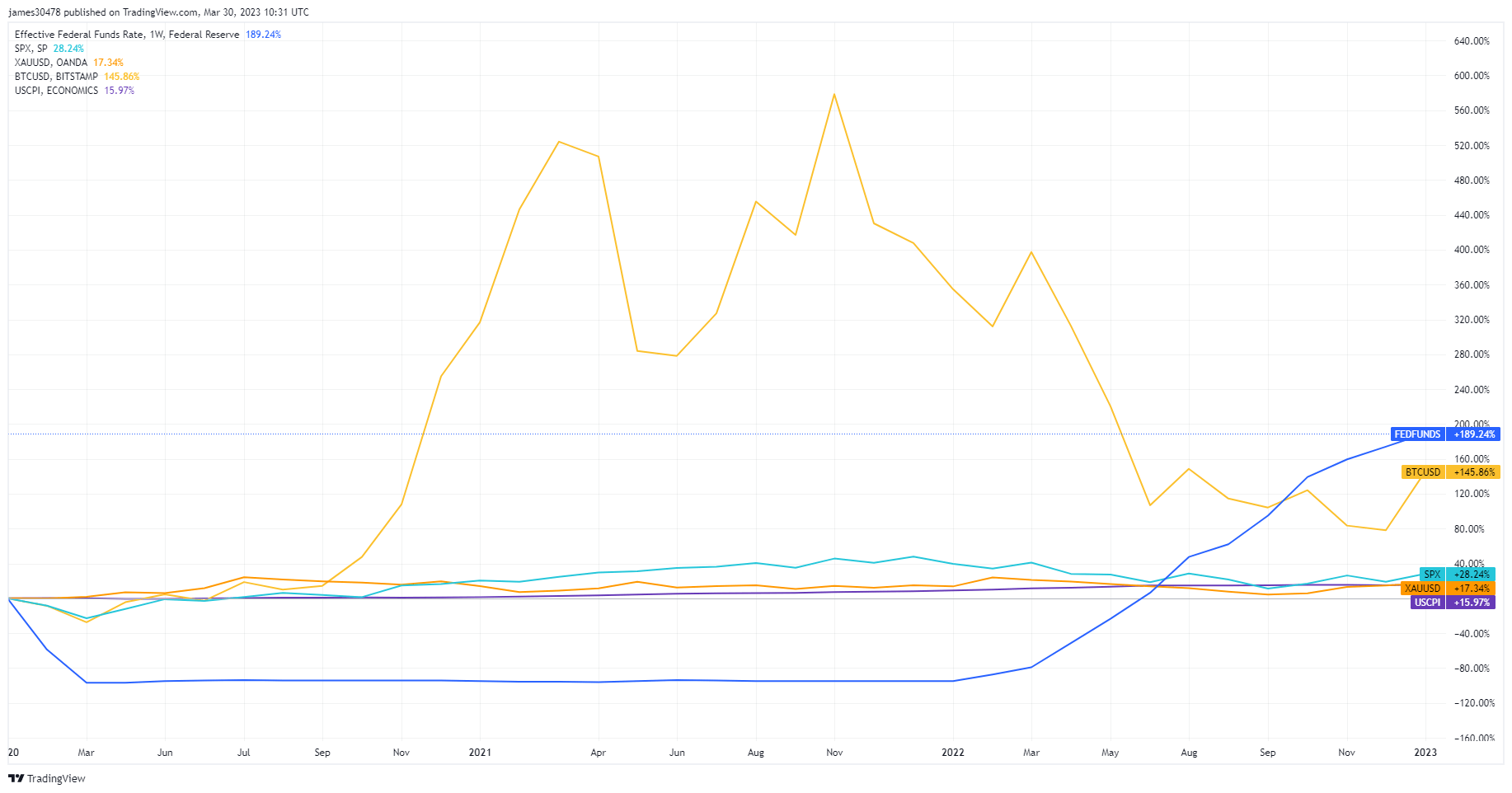

In the 2020s, this is how some assets have performed;

- Fed funds have appreciated by 189%.

- Bitcoin has appreciated 146%.

- S&P: 28%.

- Gold: 17%.

- US CPI: 16%.

The post How gold and Bitcoin are responding to inflationary pressures – comparing the 1970s and the 2020s appeared first on CryptoSlate.