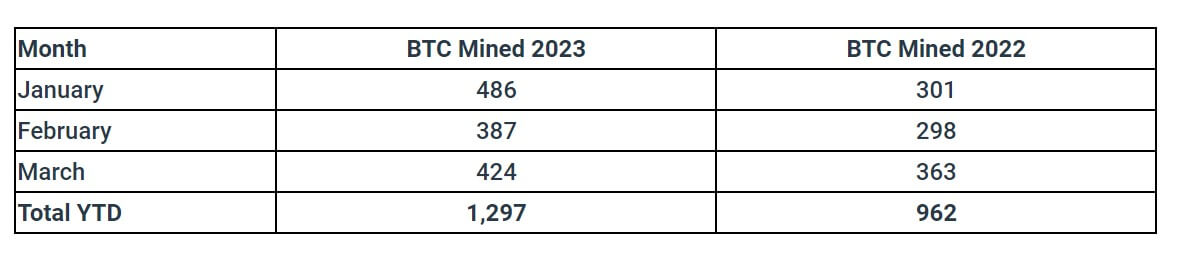

Bitcoin (BTC) mining firm Bitfarms said its BTC production increased 35% to 1,297 BTC in the first quarter of the year compared to what it produced during the same period last year.

In an April 3 statement, Bitfarms detailed how Bitcoin’s improved price performance helped it strengthen its balance sheet and reduce its debt obligations.

Bitfarms BTC production rise 17% YOY

According to Bitfarms, its Bitcoin production increased 17% on the year-on-year metrics in March to 424 BTC despite the energy curtailment issues it had in Quebec and Paraguay.

“13.7 BTC mined daily on average, equivalent to about $390,000 per day and approximately $12.1 million for the month.”

In March, the BTC miner said it sold 394 BTC at an average selling price of $24,700 per BTC for $9.7 million. Bitfarms added that it reduced its debt obligations by $2 million, leaving a balance of $21 million as of March 31.

The firm explained that the weather conditions in Quebec and Paraguay impacted its operation, leading to energy curtailments.

Meanwhile, the miner said it holds 435 BTC in custody — approximately $12.4 million. It also holds $29 million in cash and its equivalents and has a $22 million credit line for pre-paid deposits to be applied against future miner purchase agreements.

Bitfarms CEO said the firm “improved [its] financial position in March 2023, reflecting stable production and an increasing BTC price.”

“424 new BTC mined, up 9.6% from March 2022 and up 16.8% from February 2023.”

The chief mining officer of the firm, Ben Gagnon, added:

“[Bitfarms] successfully piloted a new feature in our proprietary management system to track real time energy consumption on an individual miner basis. Real time tracking allows for machine optimization and is scheduled to be deployed company-wide in April.”

The post Bitfarms Q1 Bitcoin production rose 35% to 1,297 BTC YOY appeared first on CryptoSlate.