Dogecoin (DOGE) has recently experienced a rather rough ride. The daily chart of Dogecoin was overly bearish, with trading volumes stunted and negative sentiment growing among investors.

In the face of the recent downturn in Dogecoin’s fortunes, many investors are grappling with the question of whether it’s time to cut their losses and move on.

The bearish trend in the Dogecoin daily chart has cast a cloud of uncertainty over the future of this once-popular cryptocurrency.

As the popular meme coin struggles to regain its footing, investors are left to ponder what factors have contributed to its decline.

Uncertainty Looms As Dogecoin Faces Price Slump

DOGE has experienced a bearish breakout from its previous price consolidation range since May 8, according to TradingView. This comes after DOGE hit the price ceiling near $0.1000 on April 18, after which it sustained a price dump.

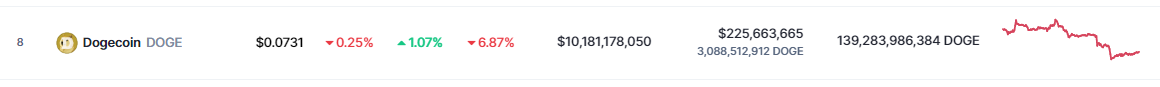

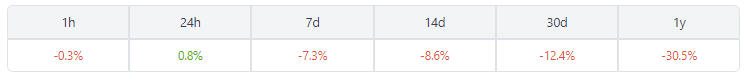

The current DOGE price of $0.0731 on CoinGecko suggests a mixed bag of fortunes, with a slight 1.07% rally in the past 24 hours and a slump of 6.8% over the past seven days.

However, the overall trend indicates a depreciation of over 20% since the second half of April.

Investors are now questioning whether the price dip is temporary or a sign of more trouble ahead for the meme-inspired cryptocurrency.

DOGE has always been a volatile investment option, with its price going through several cycles of surges and crashes.

However, the recent slump in the coin’s price has been particularly worrying, as it appears to be part of a larger trend of bearishness in the cryptocurrency market.

On Low Trading Volumes And Sudden Price Swings

The recent bearish breakout and price slump of Dogecoin has raised questions among traders about what lies ahead. With the cryptocurrency market in a state of flux, it’s important to keep a close eye on the factors that could influence DOGE’s price movements in the coming days and weeks.

One key factor to watch out for is trading volume. Low trading volumes can make DOGE vulnerable to sudden price swings, which could either trigger a sharp price increase or a steep decline.

In addition, negative sentiment towards DOGE could exacerbate its current bearish trend, as more traders become wary of investing in a cryptocurrency that seems to be losing its momentum.

Another factor to consider is the broader cryptocurrency market. DOGE’s performance are often closely tied to the overall market sentiment, so any major changes in the market could have a significant impact on the coin’s price movements.

In particular, news or developments related to major cryptocurrencies such as Bitcoin and Ethereum could influence DOGE’s price trends.

While there is always the potential for DOGE to bounce back, sellers could gain more ground if low trading volumes and bearish sentiment persist in the coming days and weeks.

-Featured image from PetHelpful