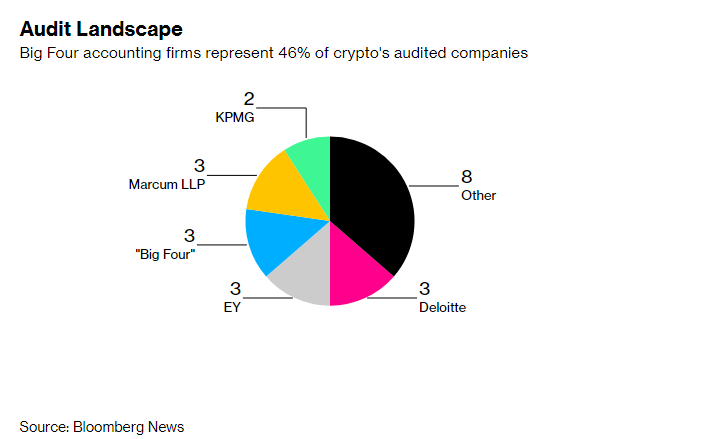

Many of the most well-known crypto firms are not adhering to basic governance standards, the findings of a Bloomberg survey have shown. Only 31 out of the 60 polled firms “currently procure a full financial audit or reserve attestations from an independent auditor.” Industry participants have said many crypto firms are not audited because the “Big Four” accounting firms are not willing to have them as clients.

Many Crypto Firms Lack Independent Boards

Some of the most influential cryptocurrency firms are not adhering to established corporate governance standards and many others are believed to be operating outside the norm, a Bloomberg study has found. The study also found that out of the 60 crypto industry firms that were polled, about 10 companies did not have a board with at least one non-executive director.

According to the study report, Tether, Huobi and Magic Eden are among those firms without independent company boards. In instances where a board actually exists, the report said these were either advisory in nature or mainly comprised of company executives, hence they cannot pass as independent boards. Binance, the largest cryptocurrency exchange by volume traded, is set to have a formal board in place by the end of the year, the report said.

Although many investors in crypto firms are said to be insisting on increased transparency and accountability following crypto exchange FTX’s collapse, the Bloomberg study found that just over half (31) of the firms “currently procure a full financial audit or reserve attestations from an independent auditor.” On the other hand, the findings showed that the audit status of some 22 out of the 60 companies is unknown. Only seven companies said they were not audited.

Blockchain Technology’s Appeal Said to Be Undermined by Opaqueness of Crypto Firms

Meanwhile, Ruth Foxe Blader, a partner at venture capital firm Anthemis, is quoted in the report lamenting the crypto industry’s opaqueness which contradicts the blockchain technology’s promise of transparency and tamperproof record-keeping.

“It’s an industry of anonymity that’s masquerading as transparency,” Blader reportedly said.

Blader argued that crypto firms should be subjected to the same basic standards — such as audits and independent boards — as other firms, because that is what any investor would expect, particularly for a company operating in the financial services industry.

While the study findings paint a picture of an industry whose participants are unwilling to be audited, some have said the real issue is the so-called Big Four accounting firms’ reluctance to take on crypto firms as clients. This argument is seemingly backed by the France-based accounting group Mazars Group’s decision to stop vouching for reserves held by crypto exchanges. As reported by Bitcoin.com News, Mazars Group ended offering such services in Dec. 2022 after citing concerns about the public’s understanding of such reports.

Meanwhile, the experts quoted in the Bloomberg report have warned that without an extensive regulatory framework in place, the crypto industry participants will not be inclined to do more to appease investors and clients that are said to be demanding greater transparency.

What are your thoughts on this story? Let us know what you think in the comments section below.