The government finds its hands somewhat tied at present on measures it can take to boost economic growth.

The parlous state of public finances – the government borrowed £25bn alone in April – means that neither meaningful tax cuts nor increases in public spending that lift productivity are feasible just now.

So it is no surprise to see that, as they search for other levers to pull, ministers have alighted on the nation’s retirement savings.

An estimated £1.4trn resides in private sector “defined benefit” (sometimes called final salary) pension schemes while a further £1.1trn is estimated to sit in “defined contribution” (sometimes called money purchase) schemes.

That is an awful lot of money.

Read more

How the government has been forced to rethink pension policy

Generation of women in debt after ‘absolutely devastating’ state pension fallout

Most of it, though, is invested in places other than the UK stock market – one of the main ways in which money is channelled to businesses that need it to support their expansion plans.

Paris protests: Demonstrators descend on Euronext offices and call on President Macron to resign over reforms

Plans to accelerate rise in state pension age frozen

How falling life expectancy, Generation X and the backlash in France have pushed the UK government to rethink pension policy

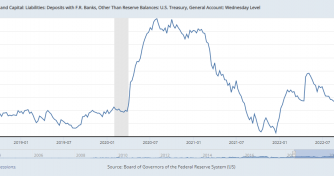

At the beginning of the century, UK equities accounted for around half of the money tied up in UK pension funds, but they now account for below 10% of scheme assets.

Getting pension funds to invest more in the UK

Ministers would like to see more of it invested in the UK.

Some of that would be in UK-listed companies but the government would also like to see it invested in infrastructure projects.

The reasoning is that, as infrastructure assets take many years to build and generate an income stream, pension funds are the natural and obvious investors in some projects because they can afford to take a long-term view.

To an extent, that is already happening. Insurers like Legal & General and M&G have been investing more in infrastructure for some time now, as well as other related activities, such as building rental homes.

But the government clearly thinks more should be done.

Please use Chrome browser for a more accessible video player

Tackling UK pension funds perceived as too risk-averse and cautious

To that end, ministers are reportedly looking at the pension protection fund (PPF), the lifeboat scheme which protects people with a defined benefit pension when an employer becomes insolvent.

The Financial Times (FT) reported on Friday that proposals being considered by the Treasury would see the PPF’s remit widened so it has a more active role in taking on company pension plans that have not failed.

The Treasury does not appear to be alone in thinking along these lines.

The Daily Telegraph reports today that the Tony Blair Institute will recommend next week that sponsors of the smallest 4,500 defined benefit schemes should be allowed the option of transferring to the PPF.

The idea behind this – extending the PPF’s reach to the pension scheme of companies that are alive as well as dead – is that the fund, which is a public corporation and answerable to the Work and Pensions Secretary Mel Stride, could then direct more money into start-ups and fast-growing businesses.

It speaks to the fact ministers believe UK pension fund managers are being too risk-averse and too cautious in how they invest people’s retirement savings.

Ministers believe that approach is holding back the economy.

As Andrew Griffith, the City minister, told the Telegraph today: “We are working on removing points of friction, streamlining our regulations and encouraging a greater culture of risk-taking.”

Be the first to get Breaking News

Install the Sky News app for free

A potential benefit for savers

Mr Griffith said, in time, this would also benefit pensions savers.

He went on: “[We have to] move the emphasis away from funds running themselves for the minimum cost to funds looking properly at performance and that is what matters here because it is about making sure long-term savers get the most prosperous retirement that they can.”

Beefing up the PPF’s remit is one of only a number of ideas being kicked around.

A Canadian-style idea

Another that has attracted interest is Canadian-style “collective defined contribution” schemes.

These schemes, which have also been widely adopted in Denmark, the Netherlands and Australia, aim to offer a mid-point between more generous defined benefit schemes and the less generous defined contribution schemes in which employers and employees pool retirement savings into a fund aimed to provide members with an income in retirement.

Unlike a defined benefit scheme, that income is not guaranteed, but unlike a defined contribution scheme it would also seek to protect members from the vagaries of market performance and the risk that a worker might see the value of their savings plunge in a crash shortly before they were due to start accessing them in retirement.

These schemes have been touted as spreading risk between the generations and Royal Mail has set one up for its employees.

Not everyone is convinced

Not everyone is keen on this idea, though.

John Ralfe, the independent pensions consultant, has pointed out the very act of pooling retirement savings does not of itself boost investment returns for retirees – it still all hangs on how successfully, or otherwise, that money is invested.

Another idea being widely discussed is the idea of directing pension schemes to place 5% of their assets into a £50bn growth fund that could, for example, invest in the UK’s burgeoning tech sector.

It was floated as an idea earlier this year by Nicholas Lyons, the Lord Mayor of London, who is currently on secondment from the life and pensions company Phoenix Group.

Mr Lyons’s idea has not won universal support – Amanda Blanc, the chief executive of insurer Aviva, said this week she did not think compulsion was a good idea.

The Pensions and Lifetime Savings Association, the trade body for those involved in workplace pensions, also dislikes the idea of compulsion.

Listen and subscribe to the Ian King Business Podcast here

But someone who does think it is worth looking at is Rachel Reeves, the shadow chancellor, who told the Financial Times (FT) this week she backed the idea.

Ms Reeves said compulsion might not be necessary, given the goodwill in the sector towards investing more in the UK, but added: “nothing is off the table”.

She told the FT, in the same interview, she also favoured consolidation of smaller pension schemes to more easily build scale.

The direction of travel, then, is clear. It feels as if more government intervention in how occupational pension schemes are operated and how they invest is coming, regardless of who wins the next election.