Bitcoin’s (BTC) current sideways price action has left investors wondering what the future holds for the world’s largest cryptocurrency. The upcoming interest rate hikes by the Federal Reserve (Fed) may pose the next big challenge for Bitcoin, according to the crypto market analysis firm Blofin Academy.

Is Bitcoin Ready For The Heat Of Interest Rate Hikes?

The US economy has shown considerable resilience in recent months, prompting the Fed to consider raising interest rates to prevent inflation. However, this could be bad news for the crypto market, as higher interest rates tend to make traditional investments more attractive, potentially leading to a decrease in demand for Bitcoin and other cryptocurrencies.

The correlation between interest rates and Bitcoin’s price action has been observed in the past. When interest rates rise, investors tend to move their money into traditional investment vehicles such as stocks and bonds, leading to a decrease in demand for cryptocurrencies.

However, it’s worth noting that Bitcoin has often been viewed as a hedge against inflation, which means that it could still hold some appeal for investors during times of economic uncertainty.

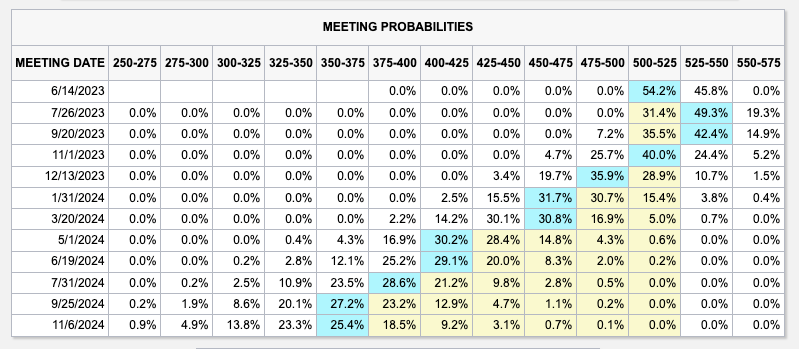

The next scheduled Fed meeting is set to take place on June 14, 2023, where the central bank will likely discuss the possibility of raising interest rates in response to the current state of the US economy.

Macro Determinants Leave Crypto Traders Waiting

Noelle Acheson, owner of the “Crypto Is Macro Now” newsletter, has cautioned against investors piling into the crypto market at this time. While the upside potential for Bitcoin remains significant, Acheson suggests that there is currently no compelling reason for investors to take on additional risk.

According to Acheson, there are few macro determinants at the moment, such as debt limit negotiations and Fed rate policy, which are leaving investors waiting for more clarity before making any major investment decisions. As a result, there is a sense of caution in the market as traders wait to see how these macro factors will play out.

Despite the lack of clarity, Acheson notes that there is not much reason for existing crypto holders to sell their holdings. This suggests that the current wait-and-see period is not necessarily a sign of bearish sentiment in the market, but rather a period of caution as investors await more information.

Acheson also notes that there may be some downside movement in the near term, but the belief in a potential rally is not strong enough to warrant the possibility of missing out on any potential gains. As a result, there has been some buying and selling in the market, but not enough to significantly increase volatility despite low volumes and liquidity.

At the time of writing, Bitcoin is trading at $26,700, reflecting a 1.2% increase over the last 24 hours. However, the 50-day Moving Average (MA) has placed the largest cryptocurrency in a narrow range between $26,200 and $26,800. This means that Bitcoin may struggle to surpass its current trading range in the near term, as the 50-day MA is currently situated at the upper end of this range on the 1-hour chart, making it a challenging level to breach.

While Bitcoin has experienced some upside movements in recent weeks, the current trading range suggests that further gains may be limited until there is a significant shift in market sentiment or the emergence of a bullish catalyst.

Featured image from iStock, chart from TradingView.com