Data shows Tether (USDT) has recently observed growth in its dominance, while USD Coin (USDC) and others have lost market share.

USDT Dominance Has Grown To A Value Of 67.6% Now

According to data from the on-chain analytics firm Glassnode, the relative supply dominance of USDT has continued to increase recently. The “supply dominance” here refers to the percentage of the total supply of the largest stablecoins being contributed by a given stable.

The stablecoins included here are Tether (USDT), USD Coin (USDC), Binance USD (BUSD), Dai (DAI), and TrueUSD (TUSD). As is apparent, all of these assets are pegged to the US dollar.

These coins all having the same value is also why it’s possible to directly compare their supplies, as their market caps (the metric generally used for making these comparisons) and supplies are essentially the same.

When the value of the supply dominance goes up for any stablecoin, it means that its supply is now contributing a greater share towards the combined supply of these stables. Such a trend can indicate that the market’s preference for this token is going up.

On the other hand, decreasing indicator values would imply that the stablecoin is losing market share to the other top assets, as its relative supply is trending down.

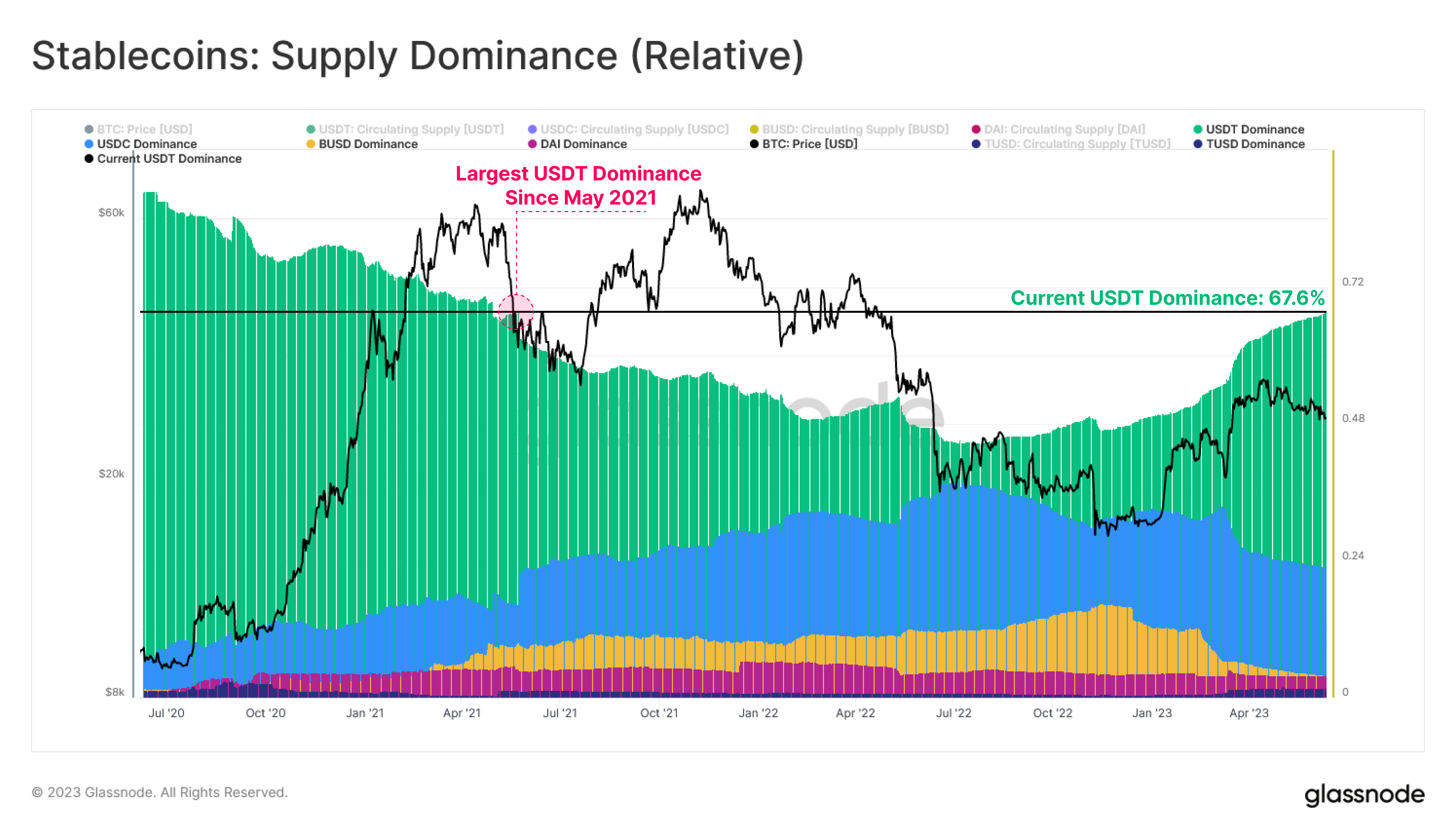

Now, here is a chart that shows the trend in the individual dominance of each of the relevant stablecoins over the last few years:

As displayed in the above graph, USDT has always been the largest stablecoin in the space, but the gap had been closing in during 2021 and 2022 as the asset’s dominance observed a decline.

USDC, the second largest token, was gaining ground during this period and had, at one point, come quite close to Tether. However, the cryptocurrency’s dominance has taken a hit in the last few months.

One reason behind this drop has been the FUD that went around a while back when the Silicon Valley Bank debacle happened and rumors spread that USD Coin may have lost its backing. In this moment of uncertainty, many investors panic-redeemed their USDC, temporarily causing the stable to lose its $1 peg.

From the chart, it’s also visible that, like USD Coin, Binance USD had been on its way up for a while, but the coin has rapidly lost market share in recent months. This is because more of the token is no longer being minted, so investors have been gradually redeeming the stable, causing its dominance to shrink to just 3.8%.

With BUSD slowly disappearing from the space and USDC’s dominance dropping off to just 23%, USDT has been picking up the market share, leading to its dominance hitting 67.6%, the highest metric value since May 2021.

BTC Price

At the time of writing, Bitcoin is trading around $26,000, down 2% in the last week.