Ethereum has plunged below $1,700 during the past day. Here’s the on-chain indicator that may have signaled this dip in advance.

Ethereum Age Consumed Metric Saw A Spike Before The Price Decline

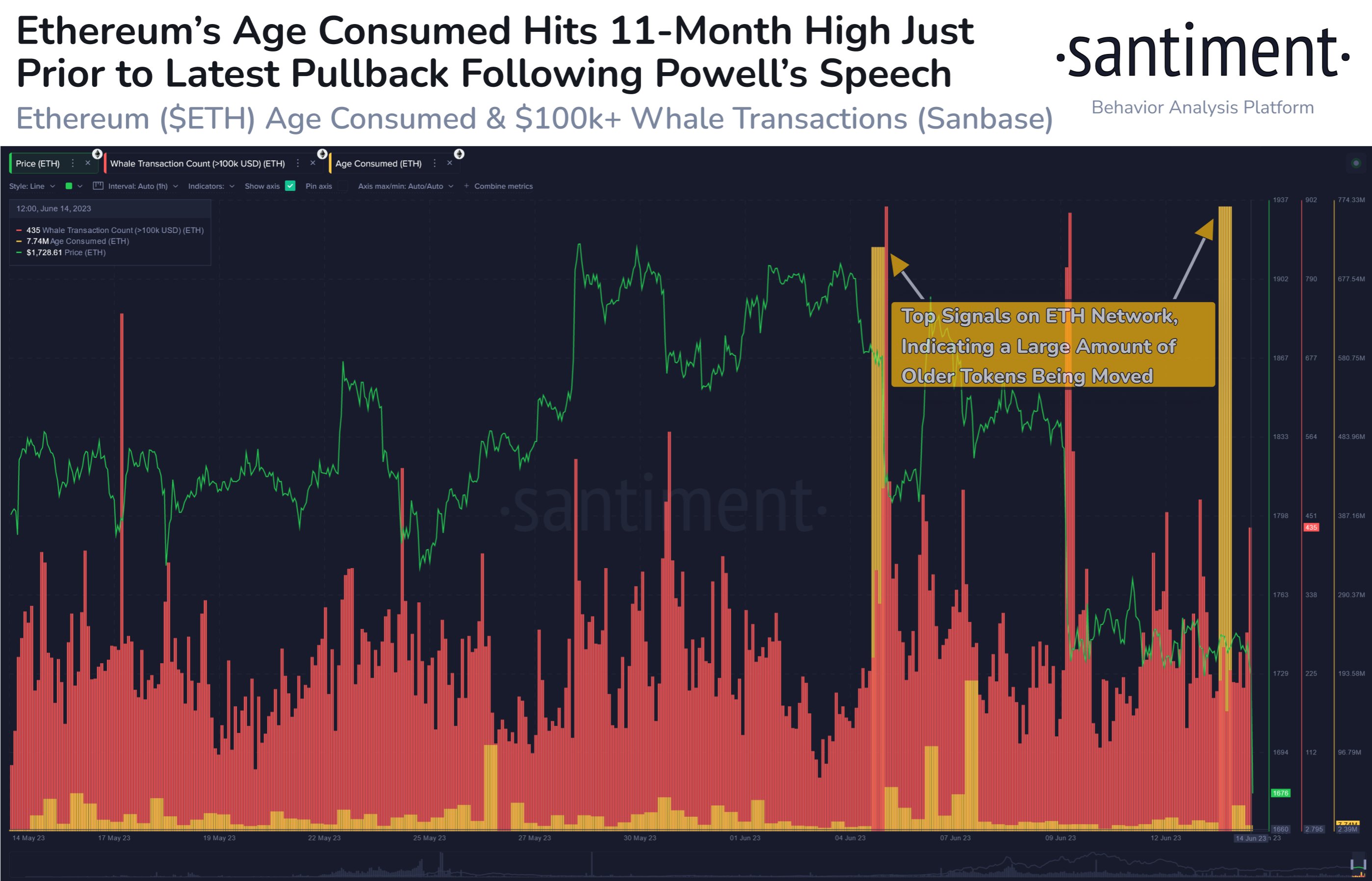

According to data from the on-chain analytics firm Santiment, institutional investors look to have been expecting the move to take place. The indicator of interest here is the “ETH age consumed,” which first finds the total number of coins moving on the Ethereum blockchain. Then it multiplies this value by the days these coins had been dormant before their movement.

So, in this way, the metric keeps track of how many coins are being sold/moved each day and uses their age as a weighting factor. This means that many old coins are moved to the network whenever this indicator’s value is high.

Naturally, low values of the metric, on the other hand, would imply that there aren’t many coins moving on the chain right now or some coins with a low average age are being transferred.

Now, here is a chart that shows the trend in the Ethereum age consumed over the past month:

As displayed in the above graph, the Ethereum age consumed metric had recently registered a very large spike. This would suggest the potential movement of many dormant coins on the chain during this surge.

Generally, when such large spikes in the indicator are observed, it’s a sign of selling from the long-term holders (LTHs). The LTH cohort includes all the investors holding onto their coins since more than 155 days ago.

These holders are the experienced hands in the market who don’t easily sell even when the market is distressed. Because of this reason, their movements can be something to watch out for, as when they do finally sell, it’s usually not a positive sign for the price.

The chart shows that the LTHs had also shown a large move earlier in the month. Shortly after these investors became active, the cryptocurrency price plunged.

This time, the spike in the Ethereum age consumed also seems to have preceded a price decline, as the cryptocurrency’s value has now dropped below the $1,700 level.

This latest price plunge has come after the news that the US Federal Reserve isn’t raising interest rates this time, but more hikes would be coming later in the year to fight inflation.

Santiment suggests that the spike in the age consumed metric before the price decline could imply that the institutions already expected the move, hence why they shifted their coins early.

ETH Price

At the time of writing, Ethereum is trading around $1,600, down 11% in the last week.