The Bitcoin price has been experiencing a sharp rally since last Thursday, when BlackRock filed its application for a Bitcoin spot ETF. Since hitting its local low of $24,819 right along the Tether FUD, the BTC price has risen by over 16% since the BlackRock news broke.

Bitcoin Hits $138,070 On Binance US

However, this is in no way an explanation for the following news: Some Binance US users are reporting that the Bitcoin price has hit a whopping price of over $138,000 on the exchange. The popular Twitter account @MikeBurgersburg wrote: “Lololololol- Bitcoin hit $138,070 on Binance US a little bit ago. Everything ok over there, CZ?”.

The anomaly was also shared by Twitter user @OperationAjax, who posted the screenshot below, writing: “I think someone broke the moneymaker on @BinanceUS lol. Someone put them on “UltraWASH Mode” and sent #BTC/ Tether to $140,000/BTC.”

At press time, neither Binance US nor Binance CEO Changpeng Zhao have commented on the anomaly in the Bitcoin price. Therefore, it can only be speculated what happened. The most likely explanation is an internal data glitch.

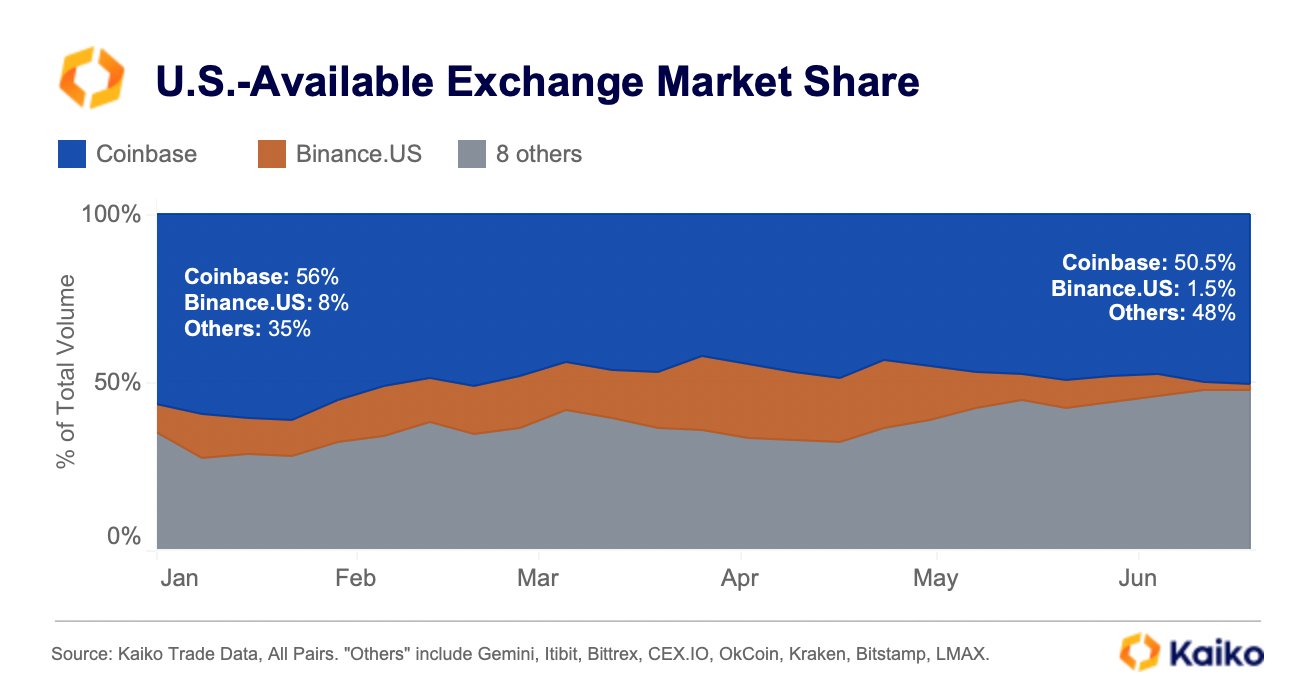

But, other reasons are also conceivable, such as insufficient liquidity on the exchange, which led to the phenomenal price. As market data provider Kaiko reported yesterday, Binance US trading volumes have plummeted since the beginning of the year.

“The U.S. crypto exchange market is more fraught than ever,” Kaiko wrote via Twitter, sharing the chart below, which shows that Binance US’s share of the American market has plummeted from 8% at the start of the year to 1.5% currently.

However, against the theory of insufficient liquidity speaks the fact that the price is currently no longer displayed on Binance US. In this respect, a data error seems more likely.

Pressure On Binance May Increase Further

Meanwhile, pressure on Binance in the US could continue to mount, even though the US Securities and Exchange Commission (SEC) and Binance US reached a tentative agreement last Friday, 16 June, over the threat of an asset freeze.

As NewsBTC reported, the proposed measures include restricting Binance officials’ access to private keys and disclosing business expenses. The settlement still needs to be approved by the relevant federal judge.

Otherwise, Travis Kling, former equity portfolio manager and senior investment adviser at Ikigai Asset Management, commented via Twitter that there is currently a lot of chatter about the Blackrock Bitcoin ETF, “and rightfully so.” However, Kling sees Binance as an obstacle to the ETF, indirectly implying that Operation Choke Point 2.0 is not over yet:

One thing I’ll say- there is no chance, and I mean zero, that this ETF is approved with Binance in its current position of market dominance. If this ETF is approved, Binance is either gone entirely or their role in price discovery is massively diminished. If Binance holds on to its current level of influence, no chance this ETF is approved.

At press time, the Bitcoin price was at $28,859, breaking the downtrend that persisted since mid-April this year.