On-chain data shows that Bitcoin miners have deposited around 315% of their daily revenue to exchanges recently, a new all-time high.

Bitcoin Miners Have Sent $128 Million To Exchange Addresses

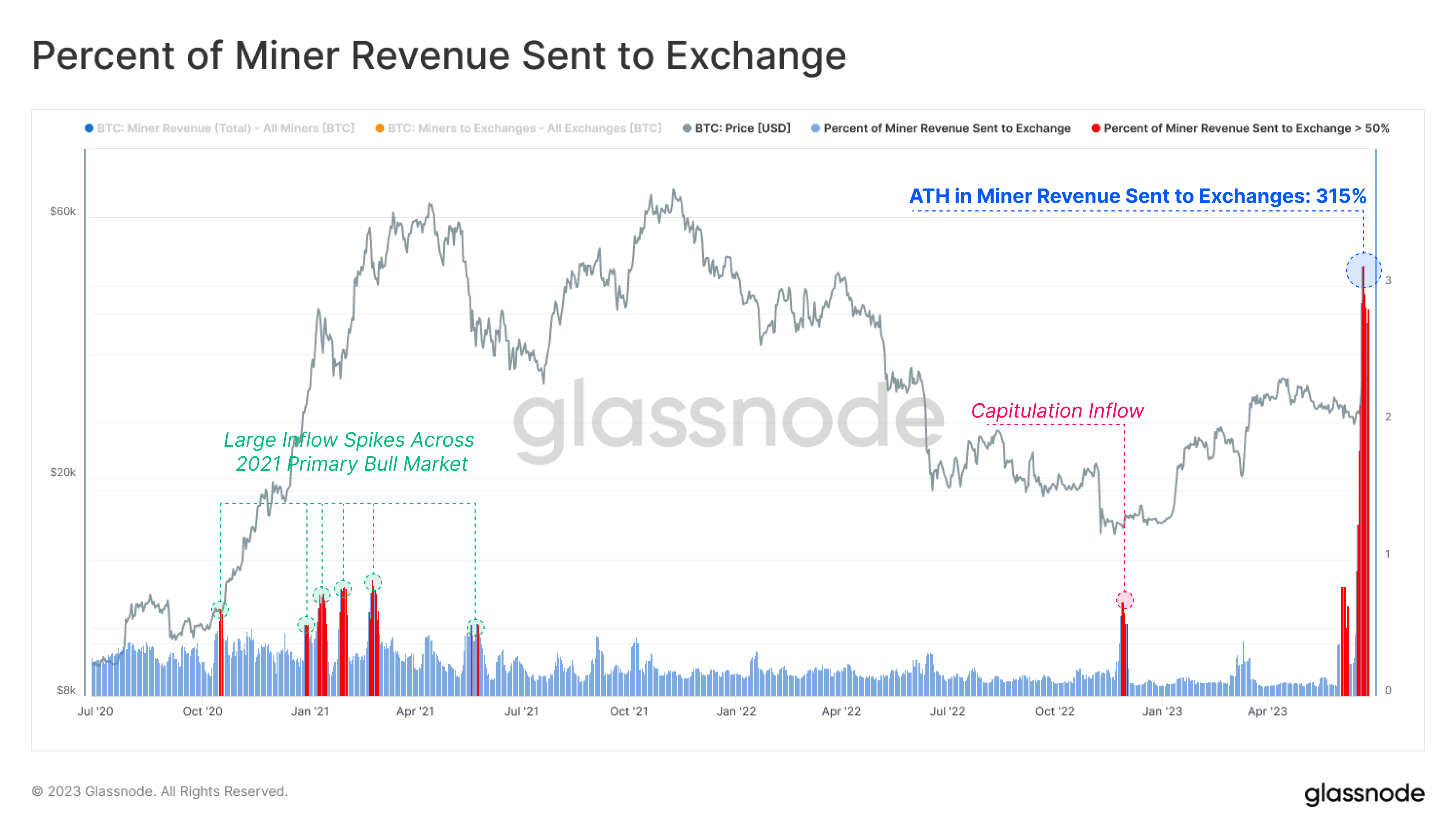

According to data from the on-chain analytics firm Glassnode, the Bitcoin miners have sent a record amount of their revenue to exchanges recently. The relevant indicator here is the “percent miner revenue sent to exchanges,” which measures the Bitcoin miner inflows to exchanges in terms of the percentage of their total daily revenue.

When the value of the indicator is high, it means that the miners are sending a high amount to exchanges compared to their daily revenue right now. Generally, these chain validators deposit their coins to exchanges for selling-related purposes.

The miner revenue here naturally refers to the sum of the block rewards (which the miners receive for solving blocks on the network) and the transaction fees (which they get for processing individual transfers).

Miners have constant running costs like electricity bills, so it’s normal to see them selling some of their reserves at exchanges in order to continue their operations.

To gauge the degree of their selling, it’s not always relevant to just look at the pure number of coins that they are selling, as these costs and revenues can change. This is why the inflows have been measured as a percentage of their daily revenue here, which can also make comparison to history simpler.

When miners sell amounts more than even their daily revenue, it can be a sign that some of these investors are looking to exit the market. Thus, extraordinarily high values of the percent miner revenue sent to exchanges can be bearish for the cryptocurrency.

Now, here is a chart that shows the trend in this Bitcoin indicator over the past few years:

As highlighted in the above graph, the indicator’s value has spiked to some pretty high values recently. In fact, at the peak of this spike, the metric touched a value of 315%, which is a new all-time high. 315% of the daily Bitcoin miner revenue is currently equivalent to about $128 million.

From the chart, it’s visible that the selling sprees that miners went on during the 2021 bull rally were significantly smaller in scale than these latest high values. The capitulation following the FTX crash, too, saw the indicator hit much smaller levels.

The current spike in the indicator is probably a sign that the miners are striking while the iron is still hot and taking their profits from the recent rally.

However, it’s hard to say what impact this might have on the price. But if some of the spikes in the 2021 bull run are anything to go by, the cryptocurrency might see a local top formation here.

BTC Price

At the time of writing, Bitcoin is trading around $30,700, up 14% in the last week.