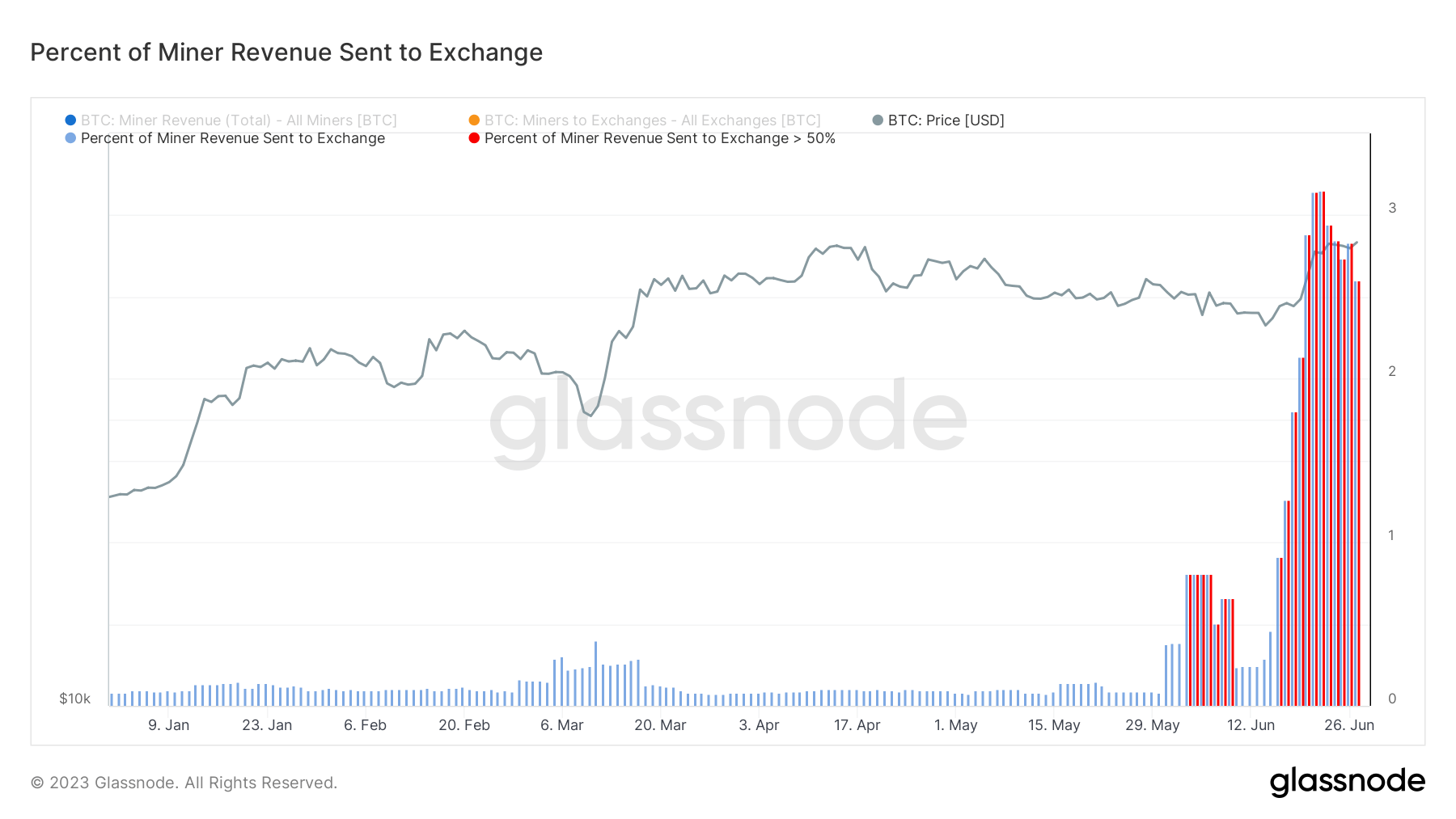

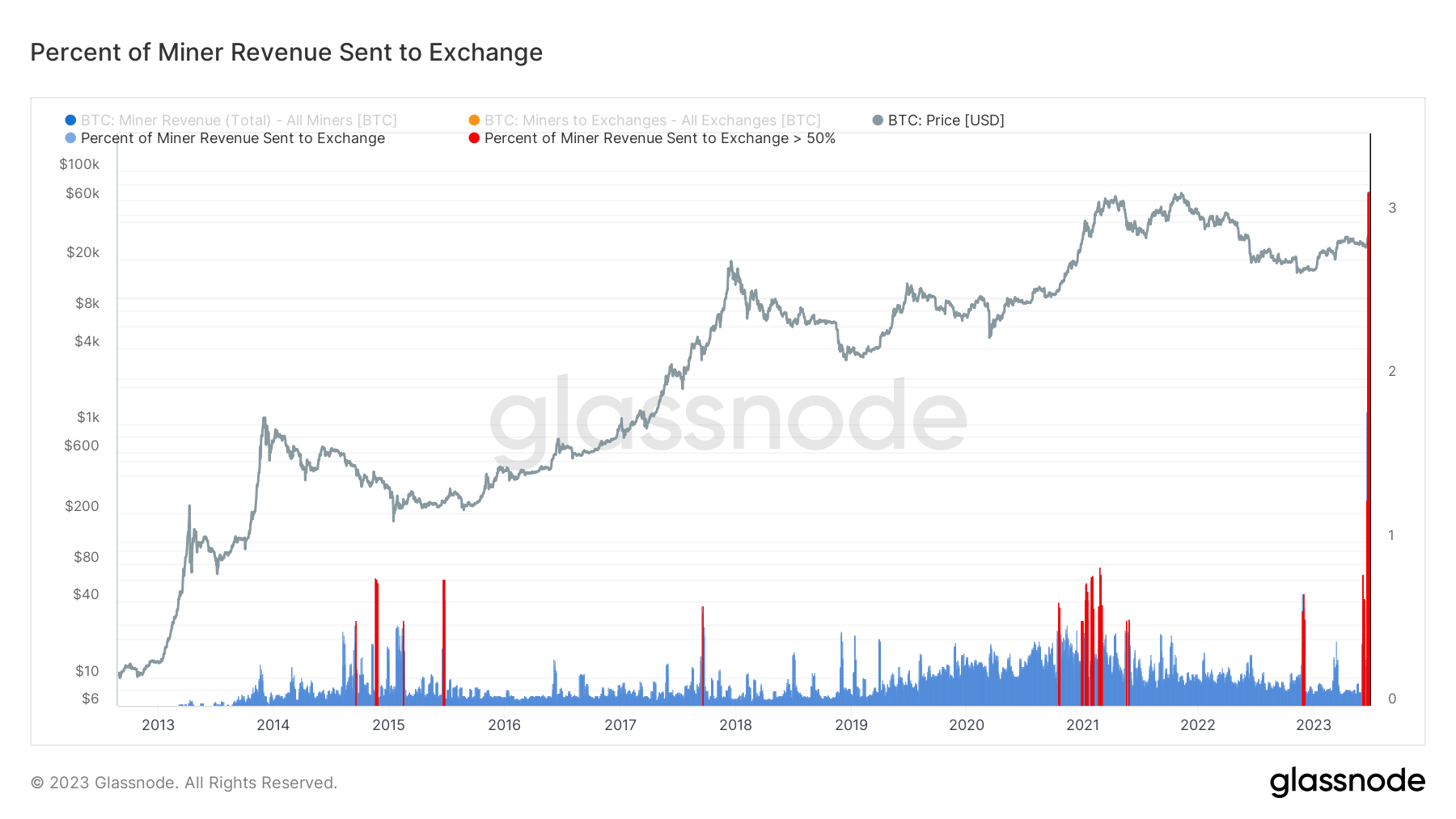

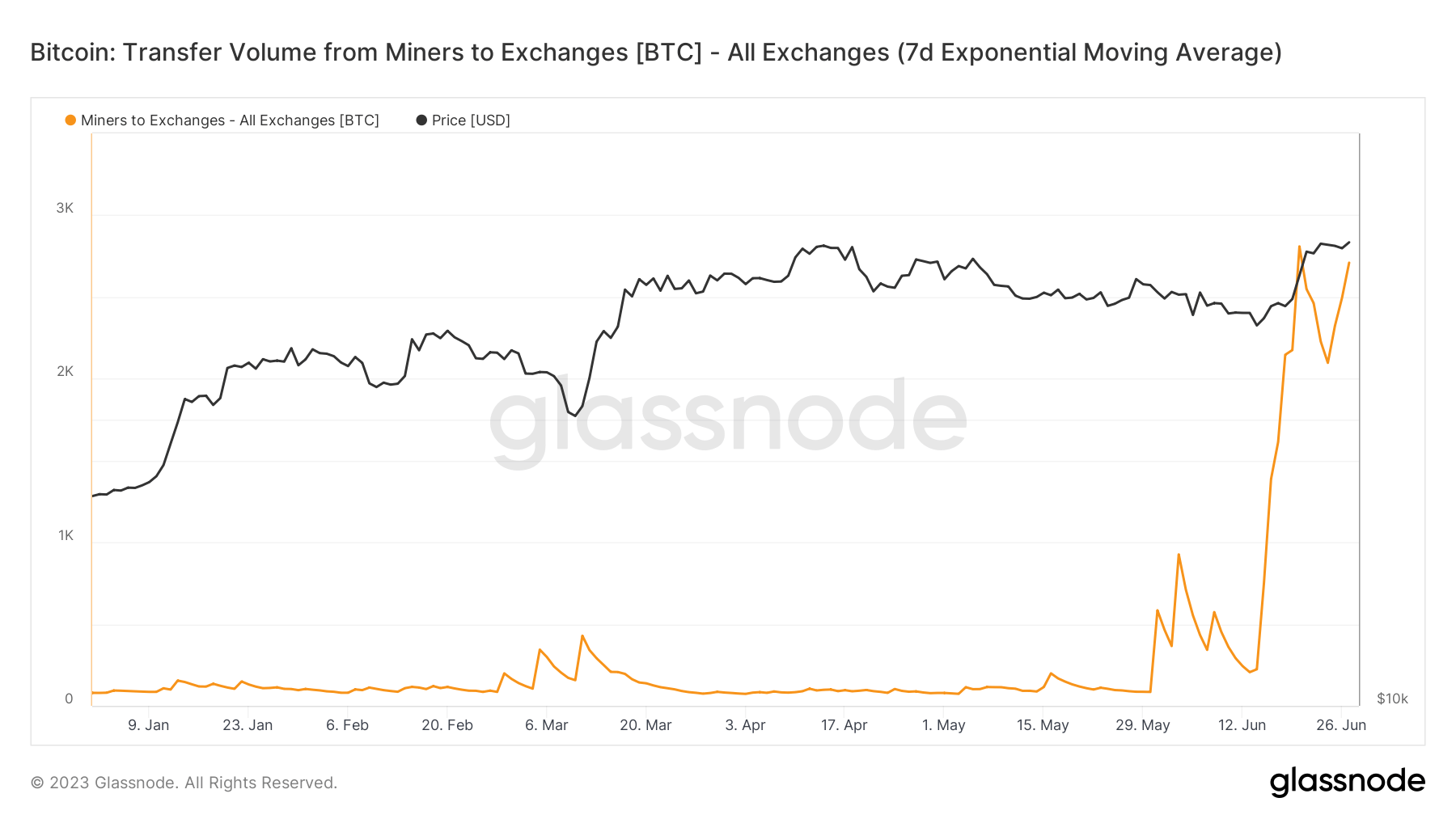

Bitcoin’s recent price surge has triggered a massive sell-off among miners, with on-chain data revealing that miners sent an equivalent of 260% of their daily mining revenue to exchanges on June 27.

Understanding the behavior of Bitcoin miners and their Bitcoin balances is crucial as miners play a pivotal role in the Bitcoin ecosystem, and their actions can significantly influence market trends. When miners transfer their Bitcoin holdings to exchanges, it often indicates an intent to sell, which can exert downward pressure on Bitcoin’s price due to increased supply.

The recent spike in miner transfers to exchanges is just off from the all-time high recorded on June 22, when miners sent an equivalent of 315% of their daily mining revenue to exchanges. These are notable and rare spikes, significantly surpassing previous records.

For context, the last all-time high was recorded on January 31, 2021, when miners sent an equivalent of 79% of their daily revenue to exchanges. Similarly, on February 25, 2021, approximately 78% of miners’ daily revenue was sent to exchanges.

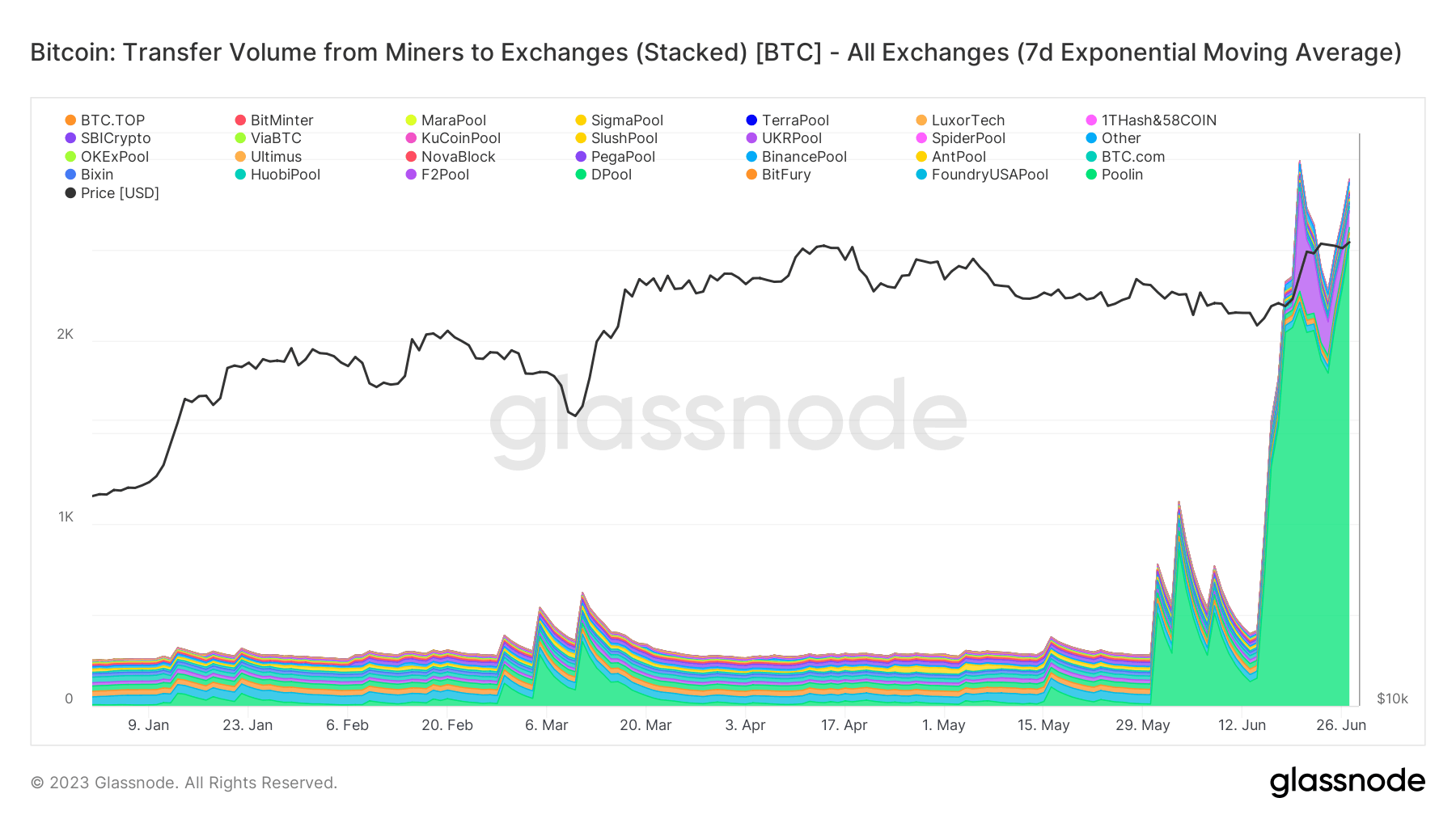

The recent surge in miners’ transfers to exchanges can be attributed mainly to Poolin, one of the largest Bitcoin mining pools. On June 27, Poolin sent over 2,529 BTC to exchanges, contributing significantly to the overall spike. Since the beginning of June, Poolin has sent approximately 28,202.6 BTC to exchanges, indicating a substantial increase in their selling activity.

On June 27, the total transfer volume from miners to exchanges reached a staggering 2,709.4 BTC. A significant portion of this volume was contributed by Poolin, which transferred 2,259.8 BTC to exchanges. This means that Poolin’s transfers accounted for over 83% of the total transfer volume for the day. This concentration of exchange transfers from a single mining pool underscores large mining operations’ influence on the Bitcoin market.

These developments suggest that Bitcoin miners capitalize on the recent price surge to secure profits. While this activity can exert short-term selling pressure on Bitcoin’s price, it also indicates their confidence in the market’s liquidity and ability to sell at higher prices. However, if this trend continues, it could potentially lead to increased price volatility in the short term.

The post Miners sent 260% of their daily revenue to exchanges appeared first on CryptoSlate.