Stablecoins, the digital assets designed to maintain a stable value by pegging them to traditional currencies, have come under scrutiny once again.

Italy’s prominent banking authority has raised concerns about the instability of these supposedly pegged stablecoins and emphasized the need for a comprehensive regulatory framework to mitigate potential risks.

In their latest report titled “Markets, Infrastructures and Payment Systems,” the country’s central bank has urged regulators to impose robust and risk-based regulations on stablecoin issuers. The call for greater oversight aims to avert a worst-case scenario and ensure the stability and integrity of the digital currency landscape.

As the discussion around stablecoins continues to gain momentum, industry players and regulatory bodies are faced with the task of striking a delicate balance between innovation and risk mitigation to safeguard the financial ecosystem.

Unveiling The Instability Of Stablecoins

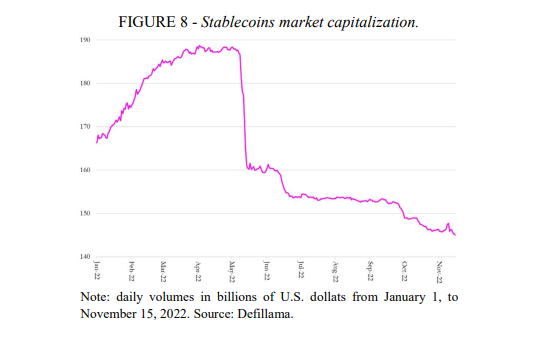

In the report, the central bank highlighted the precarious nature of stablecoins, stating that they “have not proved stable at all,” in reference to their inability to maintain a stable value as intended.

The report further emphasized the detrimental impact of cryptocurrencies on consumers, particularly due to the frequent “boom and bust cycles” that have occurred in an inadequately regulated environment.

The lack of proper oversight has led to significant harm to consumers, prompting the banking authority to call for regulatory attention to be focused on stablecoin issuers.

Regulatory Intervention

The banking authority underscored the importance of regulating stablecoin issuers, given their close association with decentralized finance (DeFi).

Recognizing the significant role stablecoins play in the DeFi ecosystem, the report emphasized the necessity of implementing robust and risk-based regulations to prevent potential runs on stablecoin issuers. Such regulatory measures are deemed crucial to reduce the fragility of the DeFi ecosystem.

The report further emphasized the need for synchronization between policy interventions on stablecoins and DeFi. As the adoption of stablecoins continues to grow, it is anticipated that this digital asset class will drive new waves of innovation in DeFi, fostering increased interconnection between traditional finance and decentralized finance.

Hence, the banking authority stressed the importance of implementing well-coordinated policies to ensure the stability and integrity of both stablecoins and the broader DeFi landscape.

As the call for regulatory action on stablecoins gains momentum, industry participants and regulatory bodies face the challenging task of striking a delicate balance between fostering innovation and mitigating risks.

The pursuit of a robust regulatory framework for stablecoins is crucial to safeguarding consumers, preventing potential collapses, and maintaining the stability of the evolving digital currency ecosystem.

Featured image from Paxful