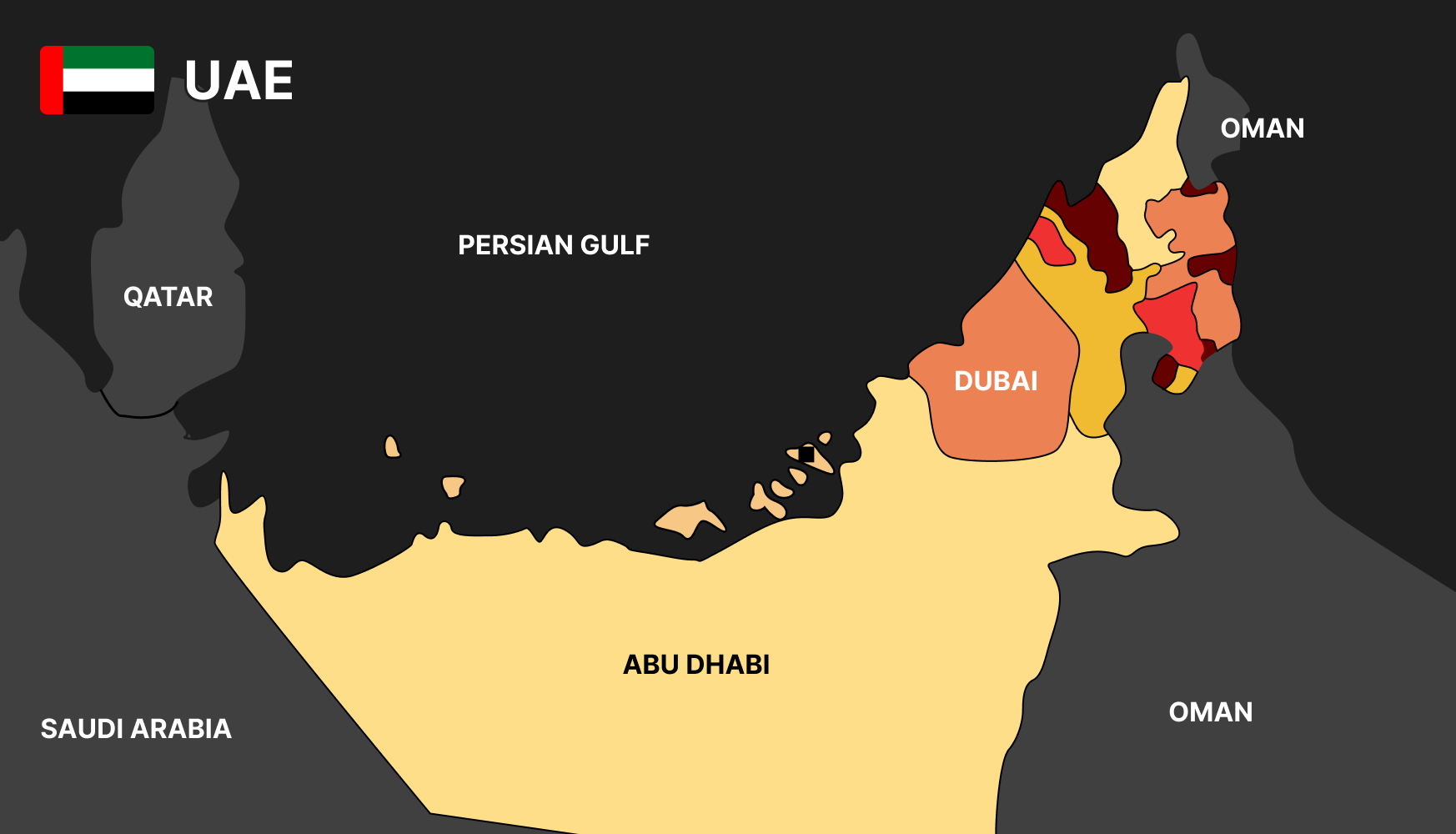

In the realm of Bitcoin mining, the United Arab Emirates (UAE) has emerged as a force to be reckoned with, spearheaded by none other than Abu Dhabi’s sovereign wealth fund. This strategic move has transformed the UAE into a burgeoning hub for BTC mining, fueled by political stability, entrepreneurial spirit, and abundant energy resources.

As the world pays attention to this Middle Eastern powerhouse, Jaran Mellerud, Business Development Associate at Luxor, delved into the captivating story of how Abu Dhabi’s sovereign wealth fund is propelling the UAE’s Bitcoin mining expansion to unprecedented heights.

Bitcoin Mining – A Collaborative Vision

At the forefront of this grand endeavor is Abu Dhabi’s sovereign wealth fund, acting as the catalyst for the UAE’s Bitcoin mining ascent. In late 2021, their digital asset arm, Zero Two (formerly FS Innovation), forged a partnership with local bitcoin mining company Phoenix Technology. The result? A colossal 650 MW hydro-cooled mining farm in Abu Dhabi, boasting a staggering $2 billion investment and solidifying its status as the largest single bitcoin mining site ever.

“In the realm of Bitcoin mining, size does matter. And the UAE is making sure it plays in the big leagues,” remarked Jaran Mellerud, a prominent figure in the crypto space.

The ambitious spirit of Abu Dhabi’s sovereign wealth fund didn’t stop there. In February 2023, Zero Two cemented its position by joining forces with the renowned US public miner, Marathon. This latest partnership marks the establishment of two immersion-cooled facilities in Abu Dhabi, with a combined capacity of 250 MW. Zero Two will own 200 MW, while Marathon will operate the remaining 50 MW.

“The collaboration between Zero Two and Marathon exemplifies the UAE’s commitment to solidifying its position as a serious and ambitious player in the global bitcoin mining landscape,” explained industry expert Jaran Mellerud.

Setting The Benchmark

With these groundbreaking initiatives, the UAE has positioned itself as the leading bitcoin mining nation in the Middle East. While its neighboring countries boast substantial energy resources, it is the innovative prowess of the UAE that places it at the forefront of the industry.

“All these energy-rich countries may have enormous Bitcoin mining potential, but the innovative UAE is leading the way,” emphasized Mellerud.

While the UAE’s abundant energy resources have undoubtedly contributed to its mining prowess, the nation’s commitment to expanding its electricity supply solidifies its dominance. As an OPEC member and one of the world’s top oil producers, the UAE has leveraged its position to diversify its energy sources.

“The UAE keeps expanding its electricity supply at a pace that North American and European consumers can only dream of,” explained Mellerud.

The UAE’s efforts have resulted in the opening of Barakah, the largest nuclear power plant in the Arab world, generating an estimated 19% of the country’s electricity. Furthermore, plans are underway for a massive solar buildout, which will see the UAE harness the power of its vast, sun-drenched deserts.

Bitcoin Mining As A Catalyst For Energy Flexibility

The marriage of Bitcoin mining and the UAE’s expanding electricity supply holds tremendous potential. Bitcoin miners possess a unique advantage as flexible electricity consumers, capable of providing much-needed demand flexibility to inflexible nuclear-powered grids.

“Bitcoin miners are uniquely flexible electricity consumers and can thus provide much-needed demand flexibility to inflexible nuclear-powered grids,” highlighted Mellerud.

By capitalizing on this synergy, the UAE’s electricity system can reduce its seasonal-dependent demand and enhance efficiency and resilience.

Mellerud concluded, “The UAE keeps expanding its electricity supply at a pace that North American and European consumers can only dream of,” adding: “Overall, the UAE will become an increasingly important BTC mining country over the next couple of years and could provide a case study for other Middle East countries to follow.”

At press time, the BTC price stood at $30,662, trading just below the mid-range resistance at $30,700.