Quick Take

The United Kingdom is currently facing a challenging financial environment as its household and government debt levels rise alarmingly. Household debt has skyrocketed, reaching 200% of the country’s Gross Domestic Product (GDP), while the government debt has equally grown, constituting 100% of GDP. The impending threat of interest rate hikes makes these soaring debt levels potentially unsustainable.

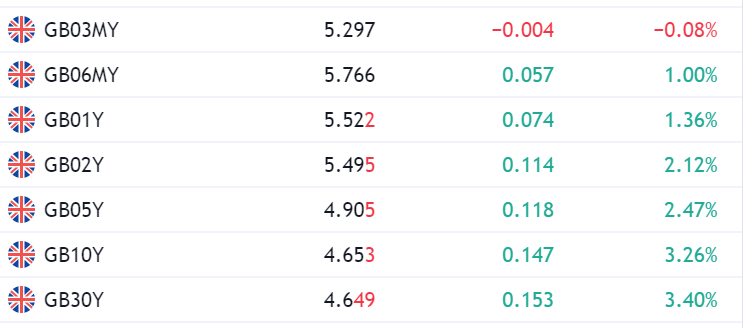

As it stands, the Bank of England’s base interest rate is 5%. However, market analysts predict a significant chance – 50%, to be precise – that this rate could jump to 6.75% by early 2024. Such an increase would further elevate yields along the yield curve, exceeding the rates seen during the pension crisis of the past year.

Fueling this potentially volatile situation is the UK’s concerning inflation rate. The Consumer Price Index (CPI) inflation is currently at a notable 8.7%, with core inflation hitting 7.1%. These figures dramatically contrast the Bank of England’s previous rates of 1.75% and 0.25% from a year and a year and a half ago, respectively, highlighting the extent to which the Bank has lagged in its response.

With these financial storms brewing, the UK finds itself at a crucial economic juncture. The fallout from these economic stressors will likely influence the country’s fiscal health for the foreseeable future. In this climate of uncertainty, the Bank of England’s future actions and their impact on the nation’s economy are under intense scrutiny.

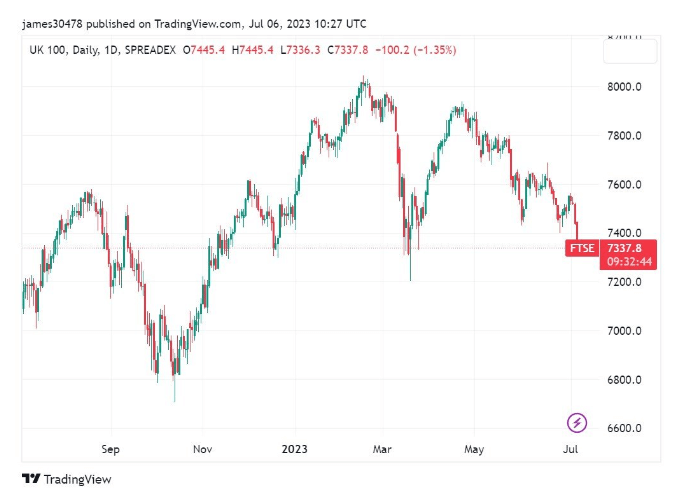

Moreover, the FTSE 100 index, representing the top 100 UK stocks, has hit a new low for the year, dropping to 7286, which is more than 2% down from the previous day.

The post Is the UK heading towards a sovereign debt crisis? appeared first on CryptoSlate.