On-chain data shows that the Dogecoin trading volume has spiked to high levels following the 9% rally that the meme coin has enjoyed recently.

Dogecoin Trading Volume Is Now At Highest Point Since Start Of April

According to data from the on-chain analytics firm Santiment, DOGE has seen a significant uplift in interest among traders with the latest surge in the asset’s value.

The indicator of relevance here is the “trading volume,” which measures the daily total amount of a given cryptocurrency that’s being transacted on the blockchain.

When the value of this metric is high, it means a large number of coins of the asset in question are being moved around on the network right now. Such a trend can be a sign that the traders are actively participating in the market currently.

On the other hand, low values of the indicator imply the asset is observing a low amount of activity at the moment. This kind of trend may suggest that there isn’t much interest in the coin among the general investor.

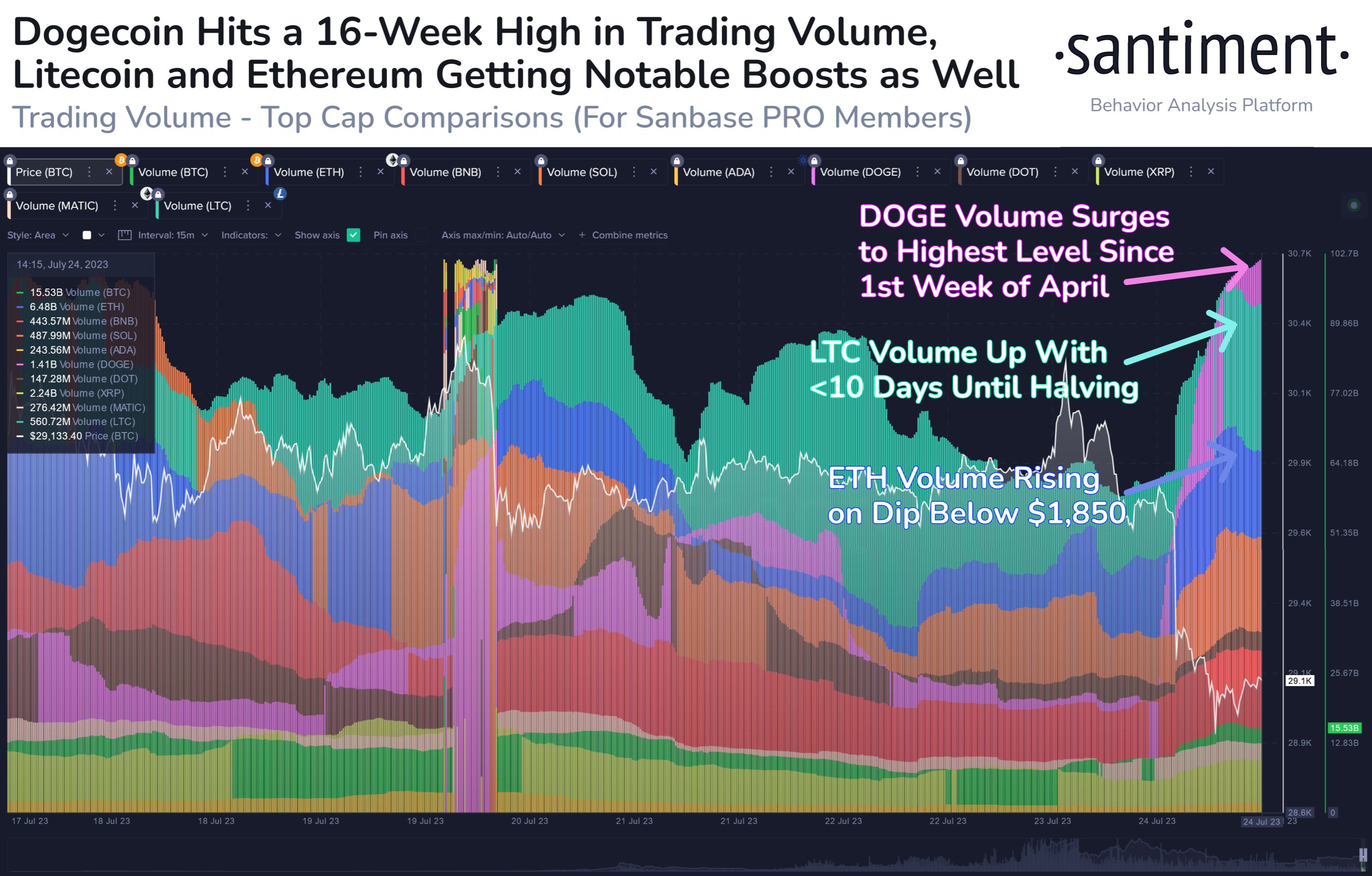

Now, here is a chart that shows the trend in the trading volume for some of the largest assets in the market (including Dogecoin) over the last week or so:

As shown in the above graph, the Dogecoin trading volume has observed a significant uplift during the past day. The main reason behind this spike looks to be the sharp rally that the meme coin has seen in this period, where it has outperformed all the other top assets.

Usually, investors find such sharp price action to be exciting, so it’s not unexpected that they have been attracted to the cryptocurrency following this latest rally.

The current levels of the DOGE trading volume are the highest that they have been since the first week of April, around 16 weeks ago. Such a surge in interest in the meme coin can be a positive development for the rally’s sustainability, as a large number of traders need to be present to provide the constant fuel such moves require.

Besides Dogecoin, two other top assets have also seen their volumes go up during the same period: Litecoin (LTC) and Ethereum (ETH). The rise in the metric for the former has come as the much-anticipated halving (where the asset’s block rewards will be permanently cut in half) is only nine days away now.

While for Ethereum, the surge in interest has curiously come after the cryptocurrency has fallen toward the $1,850 level. This volume increase may be driven by the panic sellers, but it’s also possible that it could be a sign of dip buying – in which case, naturally, the price could benefit from a turnaround.

DOGE Price

At the time of writing, Dogecoin is trading around $0.078, up 12% in the last week.