Quick Take

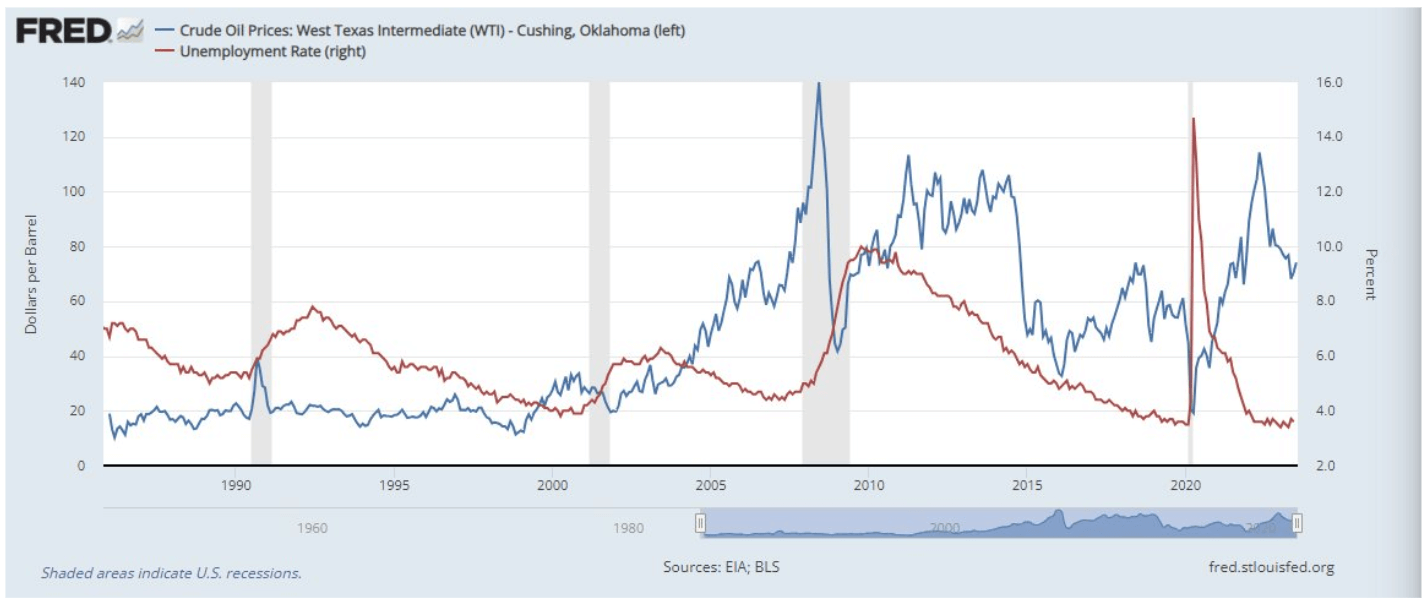

The intricate relationship between crude oil prices and unemployment is a subject of close examination in the current economic landscape. Oil prices are on an upward trajectory, currently around $80 per barrel, a notable increase from the $66 per barrel seen in March.

Such a rise in oil prices can induce a cascading effect, escalating the prices of goods, particularly food and energy. This leads to inflationary pressures, a concern for the Federal Reserve as it counteracts its goal of preserving price stability.

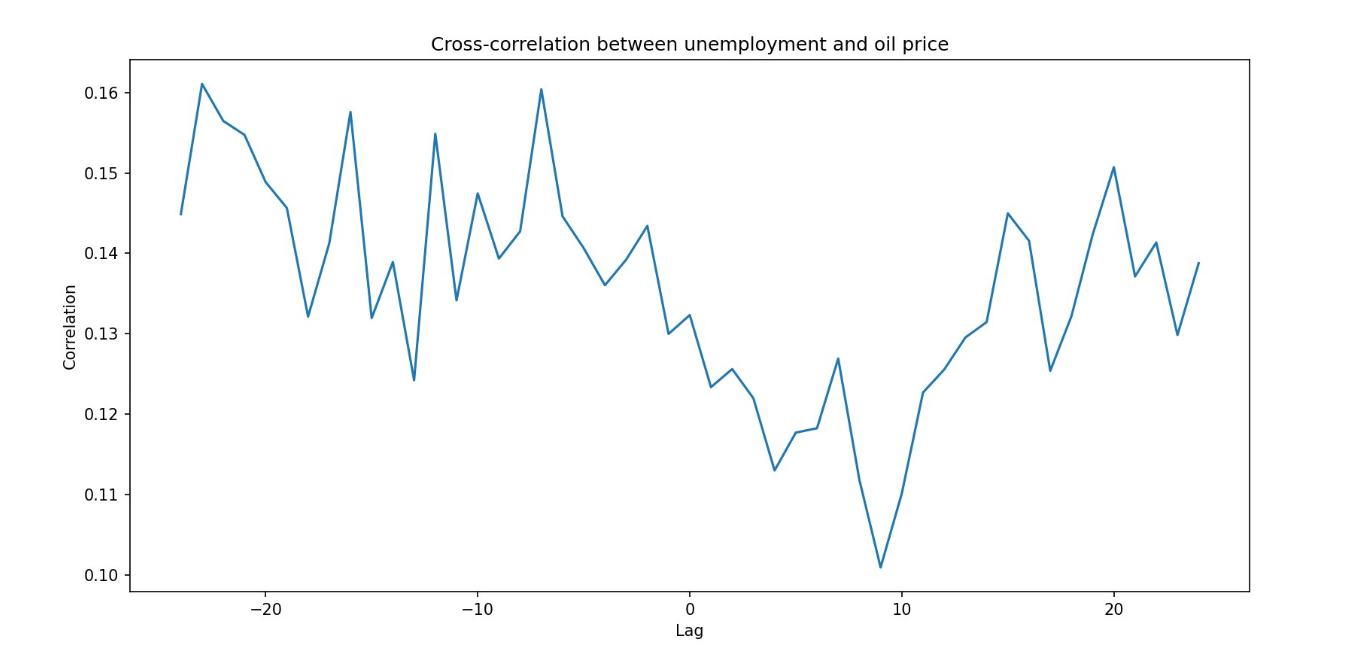

Fascinatingly, the interplay between oil prices and unemployment usually follows a specific trend. An increase in oil prices often precedes a rise in unemployment, which, excluding the COVID-19 pandemic, has led to a recession three out of four times. This correlation typically takes about six months to manifest.

The market is currently observing a negative year-over-year comparison for oil, which bodes well for the Consumer Price Index (CPI) metric.

However, given the current rising trend of oil prices, this situation demands careful monitoring. It is crucial for economic participants to vigilantly monitor these shifts to predict and lessen potential negative impacts on unemployment and inflation

This point is supported by Viraj Patel, FX & Global Macro Strategist:

“Unless oil gets back to $100/bbl it’s not ‘inflationary’. At best recent rally in commodities is less deflationary”

The post Are the complex interplays between crude oil prices and unemployment rates cause for concern? appeared first on CryptoSlate.