In a recent analysis titled “2024 Halving Analysis: Understanding Market Cycles and Opportunities Created by the Halving,” Blockware Intelligence delves into the intriguing possibility of Bitcoin’s price reaching $400,000 during the next halving epoch. The report takes a comprehensive look at the factors contributing to Bitcoin’s unique market cycles and the potential impact of the upcoming halving on its price trajectory.

Unlike traditional commodities, BTC boasts an algorithmically determined supply schedule that remains unalterable. The research highlights the critical role of the mining subsidy halving in driving BTC’s cyclical price nature, underpinned by its transparent blockchain and predictable supply schedule.

1. Bitcoin Halvings Reduce Sell Pressure

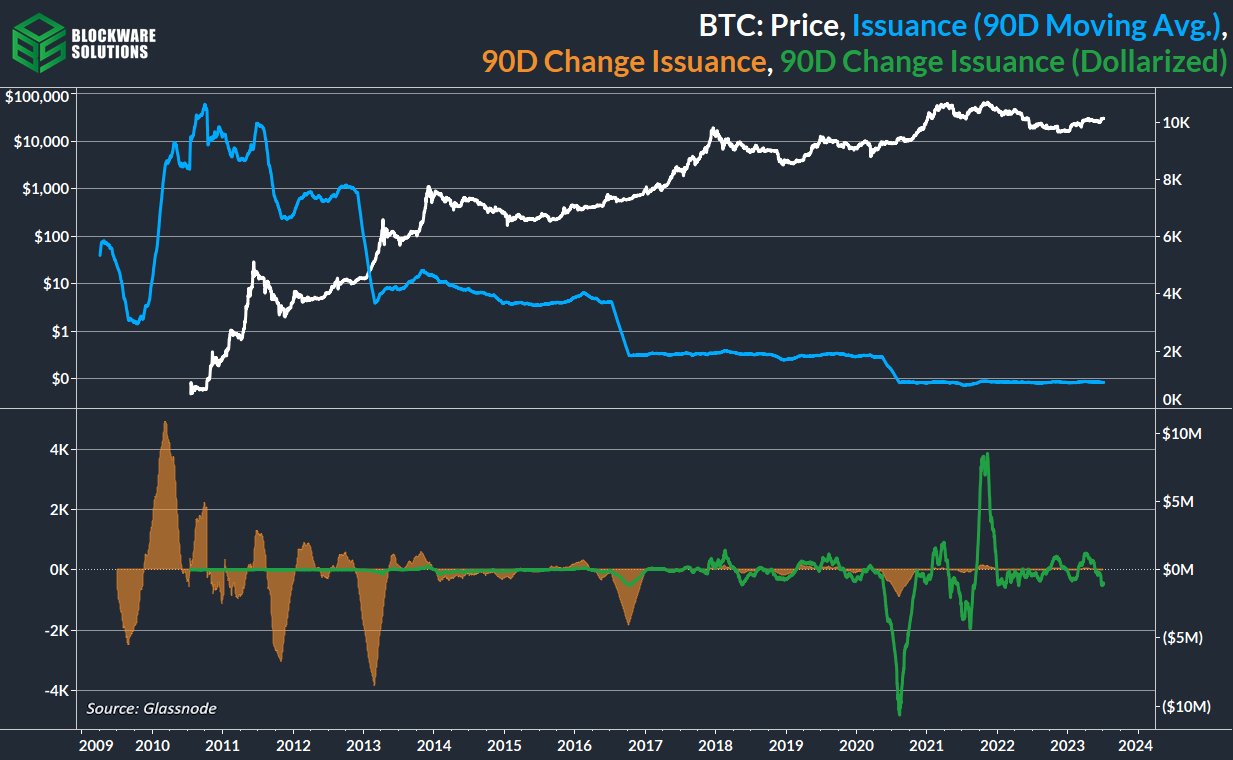

A central factor identified in the research is the role of mining subsidy halvings in shaping Bitcoin’s market cycles. The report asserts that miners, responsible for a significant portion of sell pressure, receive newly minted BTC, much of which they must sell to cover operational costs.

However, the halving events serve to weed out inefficient miners, leading to reduced sell pressure. The study proposes that this reduction could lead to a drastic drop in yearly mined Bitcoin.

Assuming a $35,000 BTC price after the halving, the USD value of BTC mined per year could drop from $11.5 billion to $5.7 billion. That is 164,250 BTC less mined every year, more than MicroStrategy’s entire Bitcoin treasury. This reduction, combined with the elimination of weaker miners, contributes to the upward drift of BTC’s price, spurring new adoption waves.

2. Halving Brings New Demand

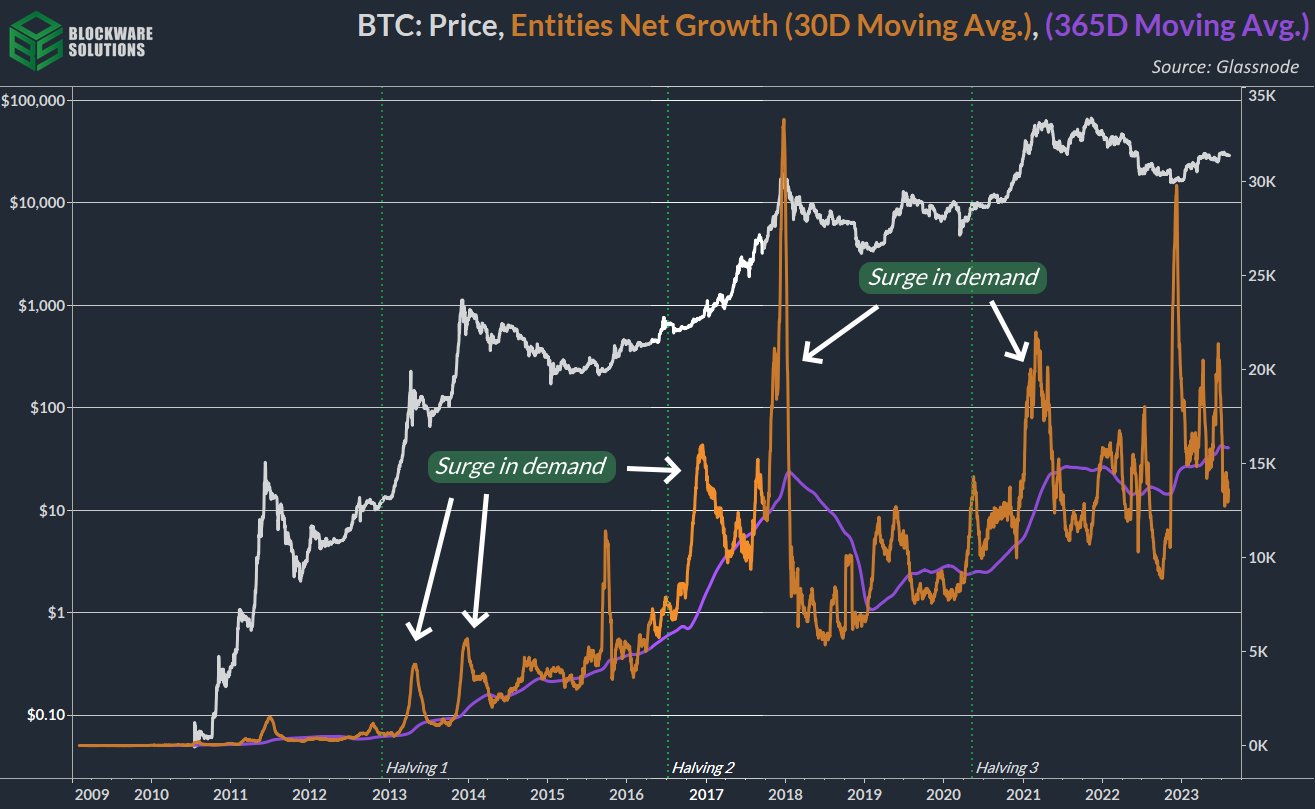

With supply diminishing due to halvings, the research emphasizes that demand becomes the primary determinant of BTC’s market price. Historical data indicates that a surge in demand typically follows halving events.

Market participants, equipped with an understanding of the supply-side dynamics introduced by halvings, prepare to deploy capital at the first signs of upward momentum, potentially leading to substantial price appreciation. This surge in demand is particularly evident in on-chain data, validating the positive sentiment surrounding halving events.

3. Halvings Cannot Be “Priced In”

Contrary to the notion that halvings can be fully anticipated and priced in by the market, the report contends that the predictable nature of halvings doesn’t eliminate their impact. Attempting to front-run halving events could lead to more miners joining the network, introducing additional sell pressure and curtailing price appreciation.

Furthermore, the weakest miners, those with outdated equipment or high operational costs, are often the first to exit post-halving, significantly reducing sell pressure. This process leads to a more significant profit margin for surviving miners, further alleviating sell pressure.

4. Bitcoin Cycle Volatility & Historical Performance

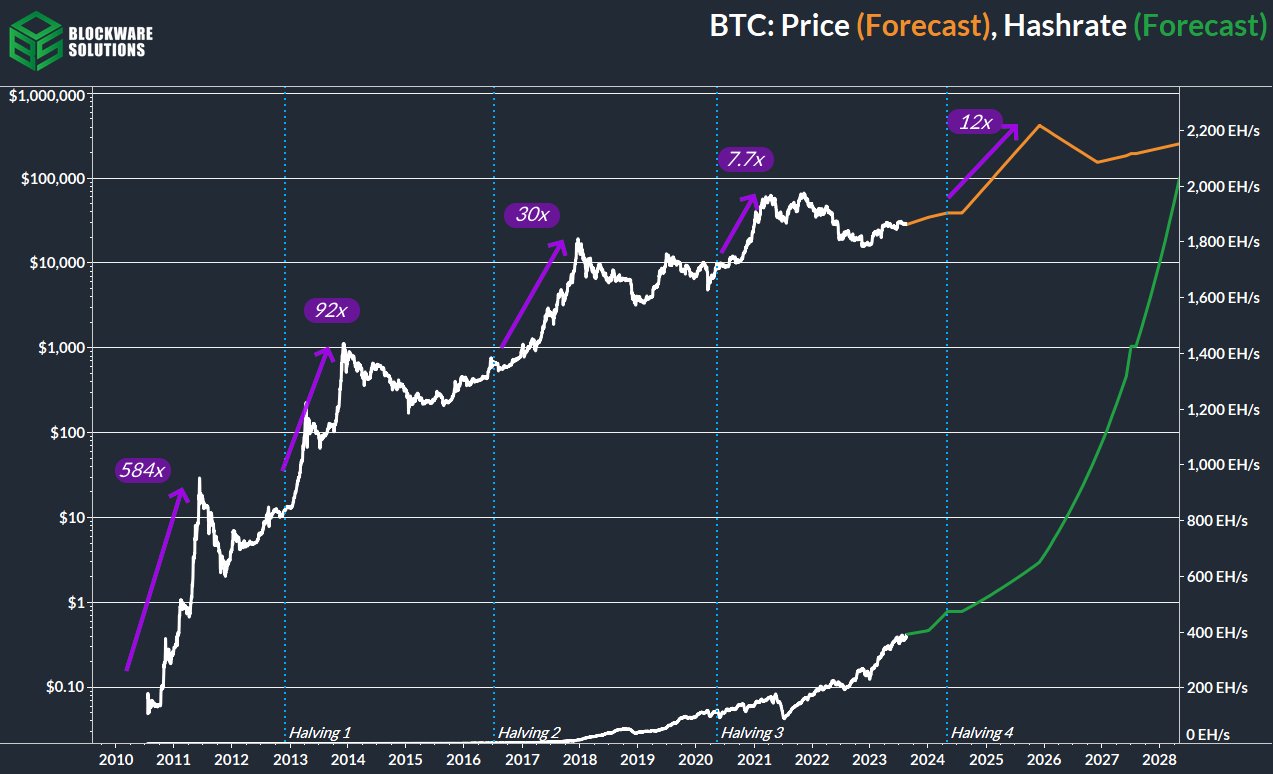

The research addresses Bitcoin’s notorious volatility, attributing it to halving-related shocks and rapid global adoption. Each halving cycle, consisting of stages such as Halving, Bull Market, Bear Market, and Recovery, results in distinct price movements.

However, the report emphasizes that over longer timeframes, Bitcoin’s volatility is skewed towards upside gains. Historical data reveals that the price of BTC has consistently increased from the halving to the subsequent bull market top, with impressive multiples achieved during each epoch.

For instance, considering previous epochs, the price of Bitcoin experienced the following multiples from the halving to the bull market top:

- 2009-2011: 584x

- 2012-2015: 92x

- 2016-2019: 30x

- 2020-2024: 7.7x

These historical performance figures underline Bitcoin’s potential for significant growth within each halving cycle.

5. “Diminishing Returns” Reconsidered

A common skepticism about halvings stems from concerns that as existing BTC holdings grow relative to new supply, diminishing returns might set in. The research counters this notion, suggesting that the amount of actively traded BTC is a crucial determinant of the price. With a significant portion of Bitcoin held by long-term holders who refrain from selling at current prices, halving-induced reductions in sell pressure could intensify, potentially driving larger bull runs.

6. Juxtaposition with Gold

Drawing a parallel between Bitcoin and gold, the report highlights Bitcoin’s favorable attributes, such as its absolute scarcity and enhanced portability, divisibility, and fungibility compared to gold.

Furthermore, it underscores that after the 2024 halving, Bitcoin’s inflation rate is projected to dip below 1%, less than half of gold’s rate. The analysis suggests that a price of $400,000 per BTC could position its market cap nearly on par with gold, driven by the bullish catalysts triggered by halvings.

At press time, the BTC price stood at $26,124.