Data shows the Bitcoin Net Taker Volume has turned significantly positive recently, a sign that may be bullish for the asset.

Bitcoin Net Taker Volume Has Risen To Positive Values Recently

In a new post on X, the CryptoQuant Netherlands Community Manager, Maartunn, pointed out that buying activity appears to be occurring in the market. The relevant indicator here is the “Net Taker Volume,” which measures the difference between the Bitcoin taker buy and taker sell volumes.

When this metric has a positive value, the taker’s buy volume is greater than the taker’s current sales volume. This suggests that the investors are willing to pay more than the spot price to buy the asset; thus, the majority of the market is bullish.

On the other hand, negative values imply a bearish mentality is the dominant force in the BTC sector, as the holders are willing to sell coins at a lower price.

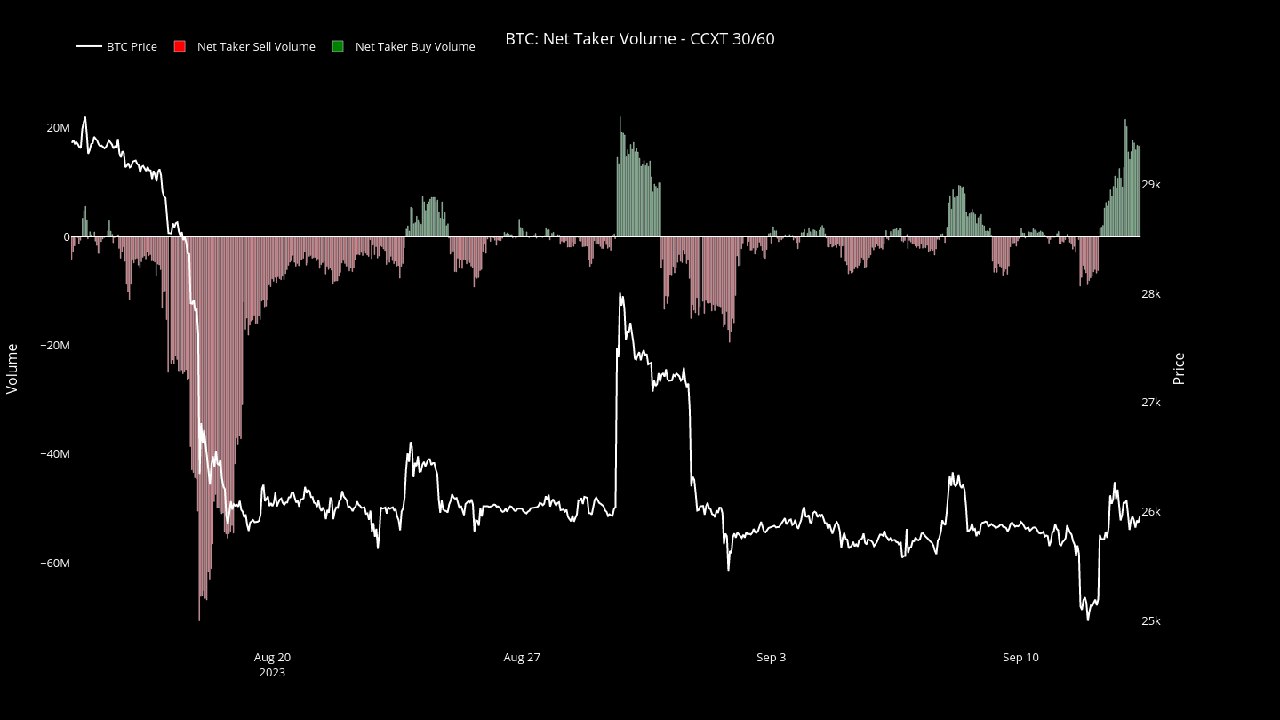

Now, here is a chart that shows the trend in the Bitcoin Net Taker Volume over the last few weeks:

As displayed in the above graph, the Bitcoin Net Taker Volume had a negative value when the dip toward the $25,000 level occurred a few days back. Still, before long, the indicator had registered a rise and entered positive territory.

With this switch towards a bullish mentality, the BTC spot price had observed a sharp recovery below the $26,000 mark. The chart shows that the metric’s value has only grown more positive since the surge, suggesting that significant buying could be occurring right now.

The price, however, has only consolidated sideways while this has happened. As for what this may mean, the analyst notes, “either limit sellers are taking control, or this thing will explode soon.”

Signs of dropping values of the Net Taker Volume may be worth watching out for, as the Grayscale rally last month had initially seen a sharp surge in the indicator. Still, soon enough, the metric had started to slide back down, potentially resulting in the asset’s retrace.

A few days back, another analyst shared a chart showing that the miners had made significant deposits to the spot exchanges.

Generally, miners transfer their coins to these platforms for selling purposes, so this spike could have been a sign that these chain validators had been gearing up for a dump.

The spike had occurred after BTC’s drop to $25,000, implying that the miners had perhaps panicked at the drop, and, hence, had made the deposits as a reaction.

It would appear that the market outweighed the selling pressure caused by this cohort in the end, as the net taker volume had turned positive, and the market had registered a successful rebound.

BTC Price

While Bitcoin has registered some uptrend in the past two days, the overall picture hasn’t changed for the cryptocurrency; its price remains in tight consolidation.