Quick Take

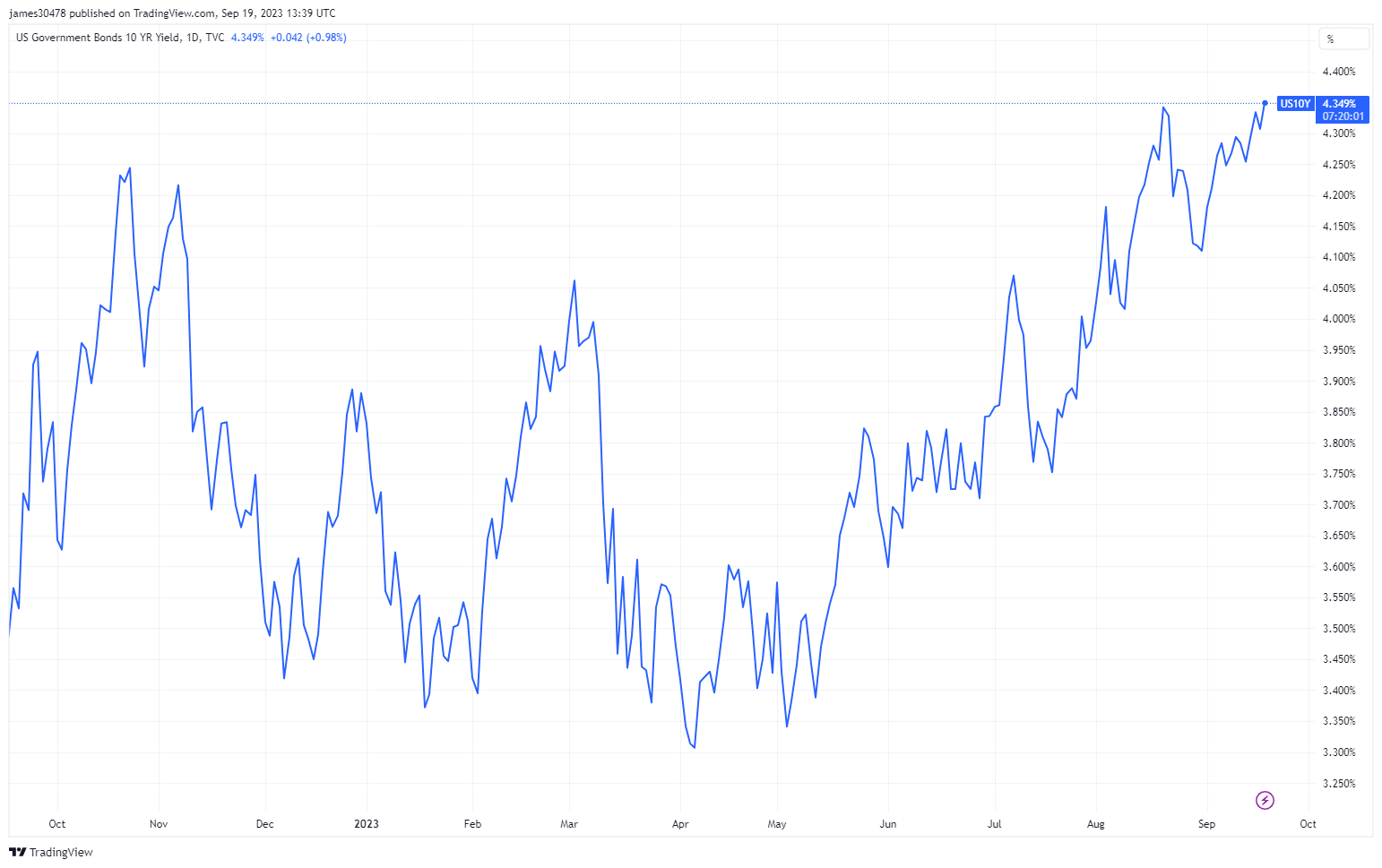

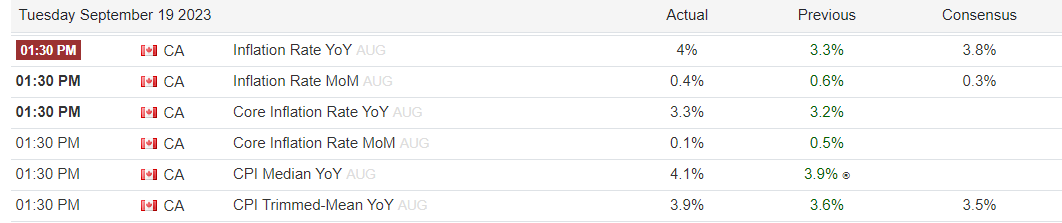

The trajectory of the 10-year treasury yield took a surprising turn as it charted a new cycle high at 4.3%. This was propelled by an unexpectedly high Consumer Price Index (CPI) print for Canada, which emerged as a significant variable in the financial landscape.

Bucking predictions, inflation rose beyond the anticipated 3.8% to reach 4%. This deviation from projected figures signifies a robust inflationary environment, underpinning the upward trend in treasury yields.

Meanwhile, the financial sphere anticipates the forthcoming U.S. Federal Open Market Committee (FOMC) decision. The prevalent conjecture is that the committee will opt for a rate pause, maintaining the fed funds rate between 5.25% and 5.50%.

This decision could potentially provide some stability amidst the inflation-induced volatility and might be a key factor influencing the future direction of treasury yields.

The post Unexpected inflation surge in Canada propels 10-year treasury yield to new highs appeared first on CryptoSlate.