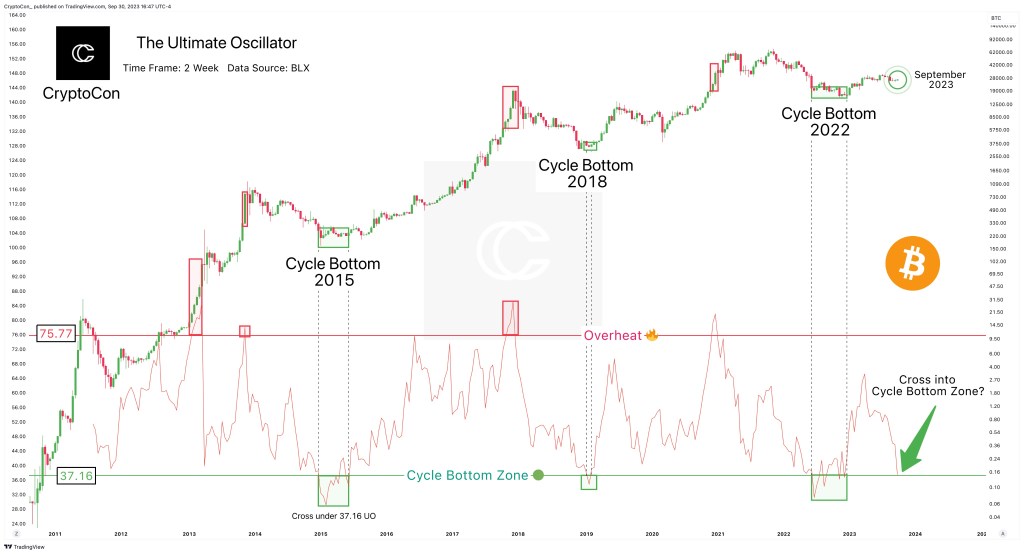

Bitcoin prices could be bottoming, looking at price charts, and this might be one more opportunity for the savvy to accumulate before prices rip higher, according to one optimistic analyst. Taking to X, the analyst, Cryptocon_, said the “Ultimate Oscillator” indicator suggests that Bitcoin is at a “cyclical bottom,” adding that for the “first time,” the indicator has crossed into the cycle bottom zone in the two-week time frame.

Bitcoin Likely Bottoming: Here’s Why

Whether this prognosis is accurate depends on how Bitcoin prices pan out in the next few trading sessions. However, Bitcoin prices have since added roughly 4% since Cryptocon_ first laid out the analysis.

Bitcoin is changing hands at around $28,000, up 12% from September lows. Following the sharp expansion on October 1 lifted BTC above September 2023 highs, a strong start for Q4 2023.

The Ultimate Oscillator is a momentum indicator built on moving averages. Technically, the indicator is based on the idea that prices tend to close near the highs or lows of the recent trading range.

Accordingly, based on Cryptocon_, Bitcoin is presently at “cyclical bottoms,” the same zone where BTC found support in the tail end of 2022 before bouncing off strongly in Q1 2023.

If historical performance guides, Cryptocon_ believes “Bitcoin is offering traders one last accumulation opportunity,” but “most people will squander the pullback predicting and worrying about the macro.” Current macroeconomic conditions favor another round of interest rate hikes, especially in the United States. Although the Federal Reserve (Fed) kept rates unchanged in the last session, there are concerns that another hawkish environment could crash the crypto market like it did in 2022.

Is BTC Heading Back To $32,000?

At press time, Bitcoin is trading above August 29 highs in what appears to be a continuation of the bull run set in motion in late August. Still, it is unclear whether Bitcoin bulls have the momentum to push on.

The daily trading chart shows that the coin is still trending inside the bear candlestick of August 17. The bar was wide-ranging with high trading volumes, cementing the bearish preview that continues to hold from the volume analysis perspective.

Despite buyers expecting more gains in the sessions ahead, there must be a solid close above August 17 with rising trading volumes, completely reversing losses of mid-August. This move will likely cancel out the bearish preview that, as aforementioned, holds. This might set the ball rolling for a leg up to $30,000 and $32,000 in the sessions ahead.