Quick Take

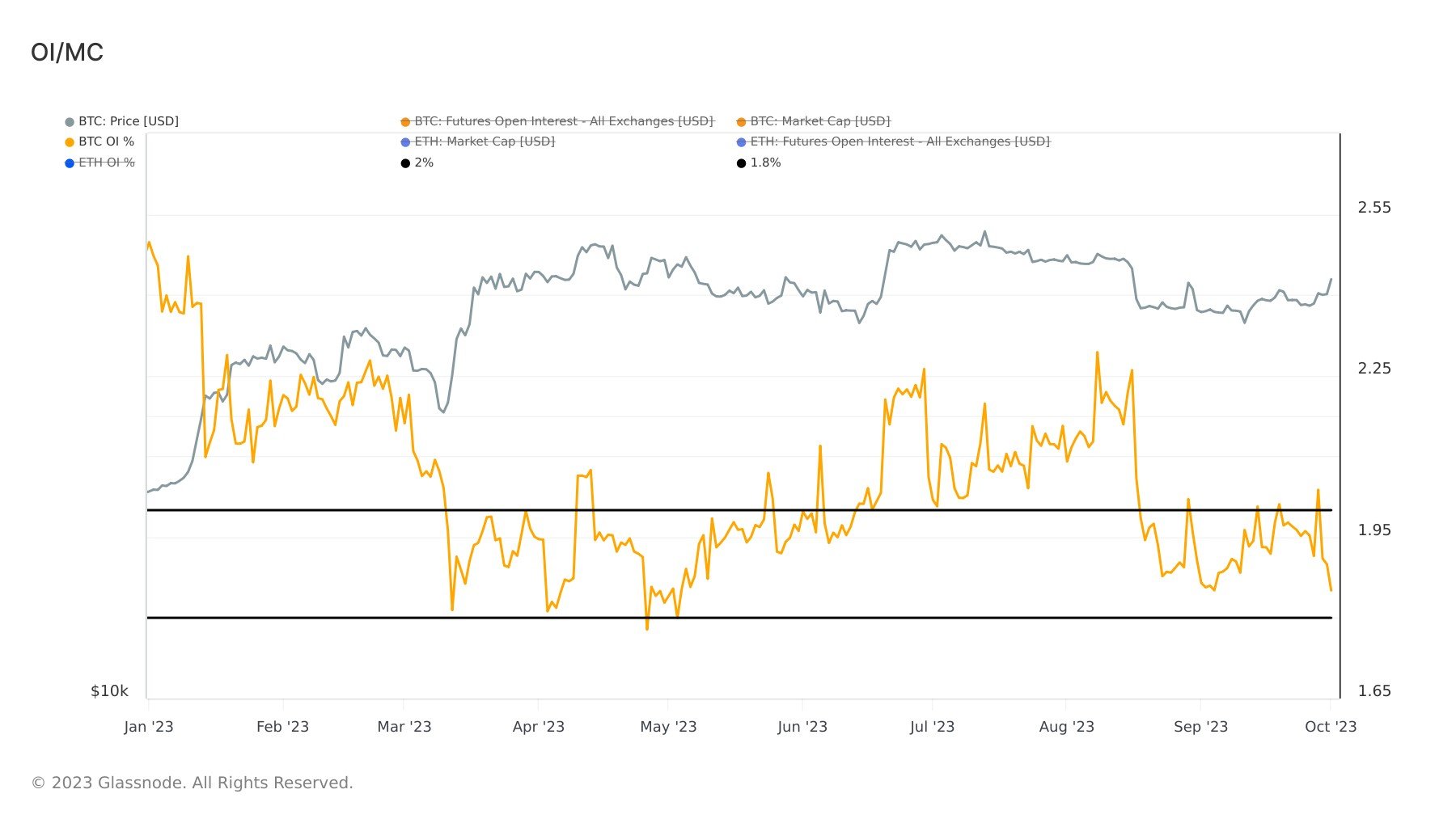

The cryptocurrency market is witnessing a fascinating juxtaposition as Bitcoin surpasses the $28,000 mark, experiencing a 70% price increase since the start of the year. In stark contrast, however, lies Bitcoin’s open interest. Regarded as an aggregate of funds in open futures contracts, it is currently undergoing a steady decline, suggesting a decrease in speculative activity. However, open interest – as a percentage of Bitcoin’s market cap – is nearing 1.82% year-to-date.

This indicates a notable contraction of market speculation, a stark departure from the norm in Bitcoin’s typically volatile market. The simultaneous rise in Bitcoin’s price and a fall in open interest, down by 28% from the beginning of the year, reflect a market less driven by speculation and more by long-term investor confidence. It underlines a potential shift in investor behavior, with possible implications for the overall stability of the cryptocurrency market.

The post Open interest wanes as Bitcoin deleverages while hitting $28K appeared first on CryptoSlate.