An analyst has explained that a pattern in Grayscale Bitcoin Trust (GBTC) could suggest a potential 50% rise for BTC may be ahead.

Bitcoin & GBTC Have Seen A Decoupling In Recent Months

In a new post on X, analyst James V. Straten has discussed the correlation between GBTC and BTC that has been present over the years. The Grayscale Bitcoin Trust is an investment vehicle that holds Bitcoin and allows exposure to these holdings through its shares.

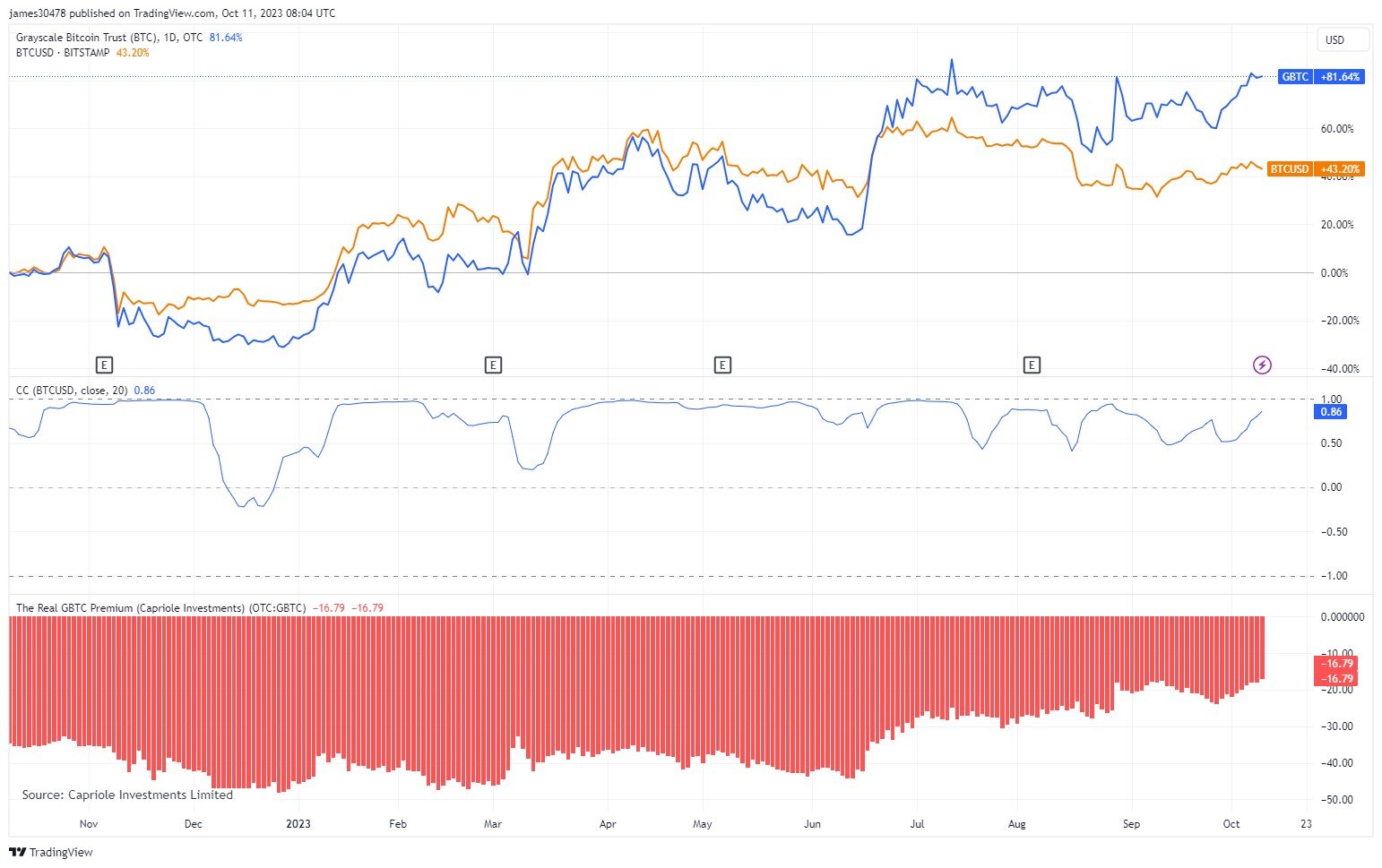

The chart below shows the trend in the percentage performance of Bitcoin and GBTC, as well as the correlation coefficient between them, over the past year.

The “correlation coefficient” here refers to a metric that tells us how tied the prices of any two assets are. When this metric has a positive value, the given commodities show positive correlations as they replicate each other’s moves. The closer the metric is to 1, the stronger this relationship is.

On the other hand, negative values imply the assets are responding to each other’s moves by moving in the opposite direction. The strongest negative correlation occurs at a value of -1.

Naturally, when the correlation coefficient is around zero, there isn’t any correlation between the commodities, as their prices move independently.

From the above graph, it’s apparent that Bitcoin and GBTC have often had a correlation coefficient close to 1, implying that there has been a robust positive correlation between the two.

There have been some temporary periods of deviation, mainly during drawdowns in the cryptocurrency’s price and other significant events like the SVB collapse. The correlation reverted to the norm soon after these, however.

Straten says this correlation is especially striking in a 5-year timeframe, where it becomes 100%. The analyst also notes, however, that the two assets have decoupled since June.

As is visible in the chart, GBTC has enjoyed some sharp uptrend recently, while BTC has been mostly flat. GBTC’s performance currently stands at +81% during the past year, while Bitcoin is up about 43%.

“GBTC will be the first to be approved for the spot ETF before Blackrock and others,” says Straten, referring to what British HODL, another analyst, said earlier. “Price action agrees with this. Irrespective of whether it’s late Q3 or early Q4, it’s a six-month window from now.”

Based on this, the analyst believes that either Bitcoin will have to close up the gap created between it and GBTC since June, which would mean a price jump of around 50%, or GBTC would have to come down towards BTC. Straten believes the latter scenario to be unlikely, however.

BTC Price

Bitcoin has declined over the past few days as its price has dropped to just $27,100.