According to CoinShare’s Digital Asset Fund Flows weekly report by analyst James Butterfill, digital asset investment products have seen net inflows for the third consecutive week totaling $15 million, despite a trading volume drop of 27% below the 2023 average. An indication of improving investor sentiment, this upward trend is marked by the continued dominance of Bitcoin, which registered $16 million in weekly inflows for the period.

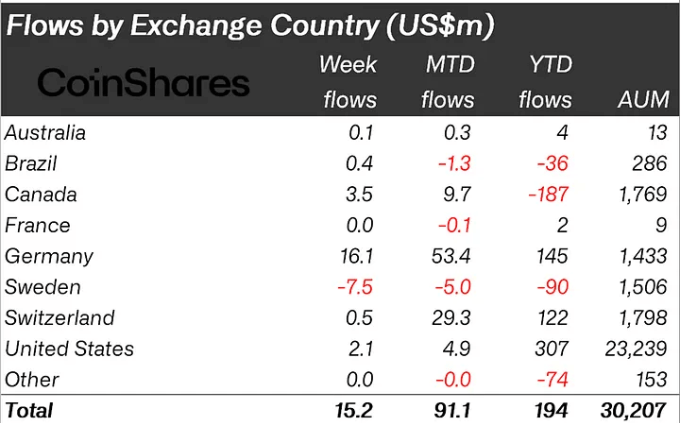

The report also highlighted the contrast in regional performance. Although the US saw minimal inflows of $2.1 million, Europe experienced total net inflows totaling $9.6 million last week, with Sweden being the only country to report outflows.

Bitcoin’s year-to-date inflows have reached a noteworthy $260 million, affirming its market dominance, with net inflows of $194 million. This performance is notable, especially considering that the report’s data, captured as of last Friday, was unlikely to consider the potential positive impact of the U.S. SEC not appealing the Grayscale legal challenge. This decision could pave the way for a spot-based ETF in the U.S.

Ethereum, despite the recent launch of a futures-based ETF, saw a decreased investor appetite with outflows of $7.5m last week, effectively correcting much of the inflows seen the prior week. The report suggests that this may reflect ongoing protocol design concerns within the Ethereum network.

While Bitcoin continues to command significant investor interest, the fluctuating dynamics within the altcoin market and diverging regional trends paint a complex picture of the current digital asset investment landscape.

CoinShares full report is available weekly.

The post Bitcoin surges in digital asset inflows as Europe outpaces the US appeared first on CryptoSlate.