The Bitcoin price has risen above $35,000 for the first time since early May 2022, for which there are a number of reasons beyond mere speculation. These are the five most important reasons.

#1 BlackRock’s Spot Bitcoin ETF Approval Looms Large

The primary driver behind the surge seems to be the growing anticipation surrounding the possible green light for a Spot Bitcoin ETF. The epicenter of this surge is the potential approval of BlackRock’s spot Bitcoin ETF.

Fueling these speculations was a revelation from Scott Johnsson, a respected finance lawyer from Davis Polk. He noted, “So two things caught my eye from the latest iShares (Blackrock) S-1 amendment: They’ve obtained a CUSIP in preparation for a launch. They may be looking to seed with cash this month.”

This sentiment was further amplified by an image making rounds on X, highlighting the BlackRock iShares Bitcoin Trust’s listing on the Depository Trust & Clearing Corporation (DTCC) with the ticker IBTC. Adding depth to these rumors, Bloomberg’s Eric Balchunas commented, “The iShares Bitcoin Trust has been listed on the DTCC. And the ticker will be $IBTC. Again all part of the process of bringing an ETF to market.”

However, James Seyffart from Bloomberg threw in a note of caution by mentioning, “There is no set time. Could literally be days, or months or years theoretically.”

#2 Grayscale’s ETF Dispute Reaches A Conclusion

Yesterday marked a significant juncture in the prolonged tussle between Grayscale and the U.S. Securities and Exchange Commission (SEC). The DC Circuit Court of Appeals put an end to the court case, compelling the SEC to revisit its earlier decision to decline Grayscale’s proposal to transition its Grayscale Bitcoin Trust (GBTC) into a spot ETF.

This conclusion by the court affirms its preliminary judgment from two months prior, wherein it critiqued the SEC’s denial as being “arbitrary and capricious.” The SEC refrained from appealing the ruling, making the court’s latest action procedural.

The onus now shifts back to the SEC, leaving it with the choice to either sanction Grayscale’s application or to spurn it based on alternative grounds. This event, albeit procedural, enhances the narrative suggesting an impending spot ETF approval by the SEC.

#3 Bitcoin Short Sellers Are Squeezed

A large portion of the market was caught on the wrong foot. Short seller got rekt. Coinglass’s data reveals that a whopping $161 million in BTC futures shorts were liquidated just yesterday, with an additional $35 million already today. Drawing attention to this trend, Julio Moreno, CryptoQuant’s head of research, pointed out:

The surge in Bitcoin’s price has been primarily fueled by short sellers having to cover. As prices soared past $31K, we observed a notable drop in Open Interest. It’s intriguing to see a rally that doesn’t primarily start with everyone going long.

Adding to the narrative, Joe Consorti, a market analyst with The Bitcoin Layer, remarked, “as Bitcoin surged to $31,000, there was a noticeable accumulation of futures positions, reminiscent of the rally we saw from $25k to $30k in late June. Price surges driven by leverage can be precarious, akin to structures built on unstable grounds.”

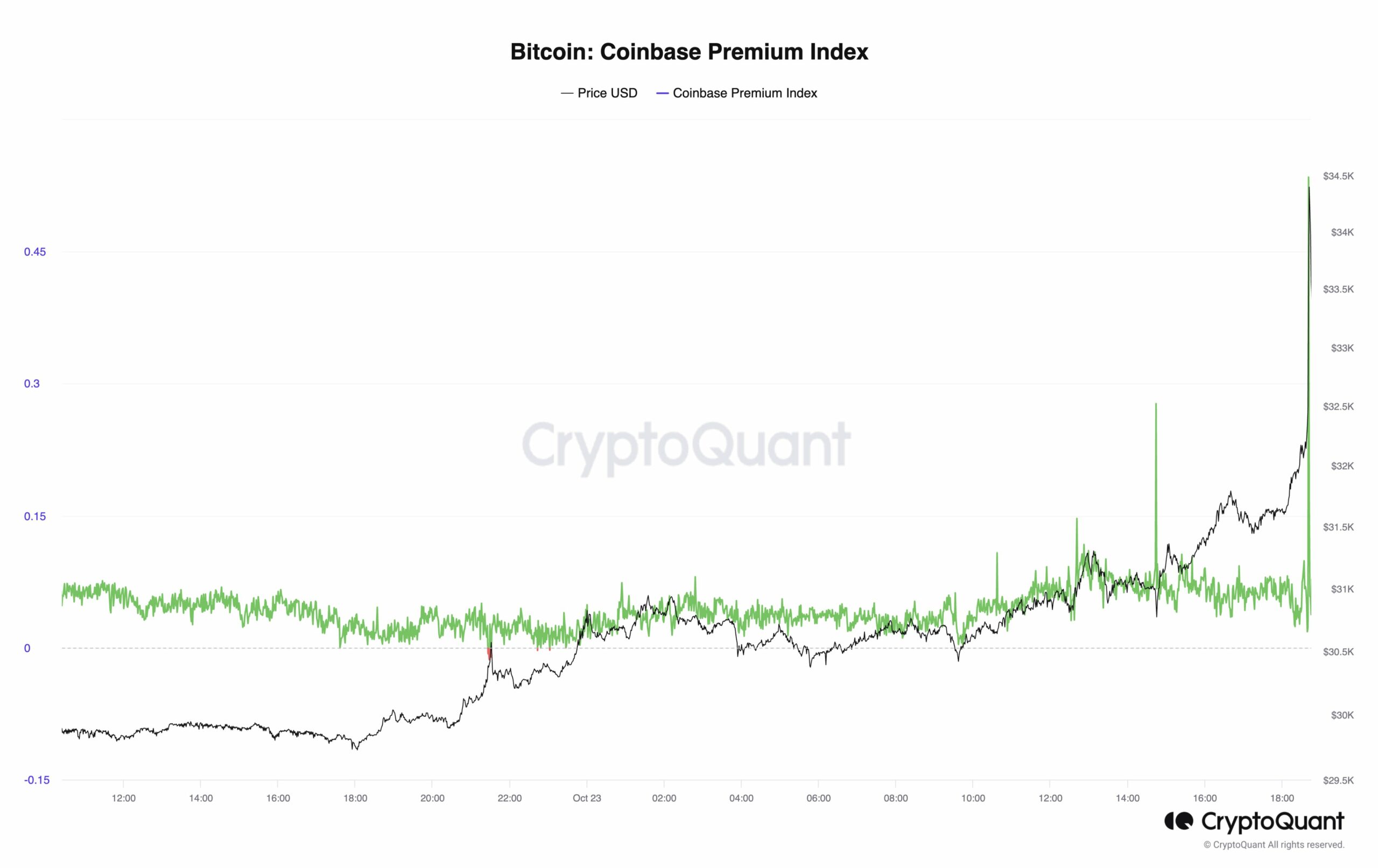

#4 Emergence Of TWAP Buying And Coinbase Premium

In an analysis that has intrigued many in the crypto community, Skew, a well-regarded analyst, highlighted an interesting pattern in Bitcoin’s trading. “There’s a discernible TWAP buyer that has been active since Bitcoin hit around $30.6K. The impact of this TWAP buying on the price trajectory seems more pronounced this time around,” Skew observed.

Digging deeper into the numbers, he added, “If we’re estimating, it appears to be about 500k clips roughly every hour, which would equate to about $6 million. Over five such instances, this would accumulate to $30 million.”

For those unfamiliar, TWAP, or “Time Weighted Average Price,” is an algorithmic trading strategy. Its goal is to execute orders over a certain time frame, ensuring that the average price during that period is achieved. This method is especially useful for huge orders, helping mitigate any drastic price shifts in the market. Essentially, it indicates a major player, possibly an institutional investor, making significant Bitcoin acquisitions.

Skew also touched upon the Coinbase factor: “BTC Coinbase Spot: With such aggressive TWAP buying, there needs to be substantial liquidity to cater to such a buyer. Presently, market makers seem to be the ones offloading to this buyer. If we peek at the order book, there appears to be a slight skew towards more ask liquidity around the $37K mark.”

This observation aligns with the insights of CryptoQuant CEO Ki Young Ju, who commented on the sudden spike in the BTC Coinbase premium, stating, “BTC Coinbase premium just skyrocketed.”

#5 Max Pain For Gamma Shorts In The Options Market

The often-complex landscape of the options market has also played a pivotal role in shaping Bitcoin’s price move. Alex Thorn, the Head of Firmwide Research at Galaxy, drew attention to this phenomenon, stating, “We are approaching max pain for gamma shorts.”

Yesterday, NewsBTC reported a significant insight: the manner in which options market makers in Bitcoin were positioning themselves had the potential to heighten the intensity of any upward price trajectory for Bitcoin in the short term. Alex Thorn elaborated on this, noting, “Options market makers in Bitcoin are increasingly short gamma as BTC spot price moves up. […] This should amplify the explosiveness of any short-term upward move in the near term.”

Further underlining this trend, Thorn pointed to data from Amber and explained, “At $32.5k, market makers need to buy $20 million of delta for every subsequent 1% move higher.” Thorn’s analysis appears to have been spot-on.

At press time, BTC traded at $34,029.