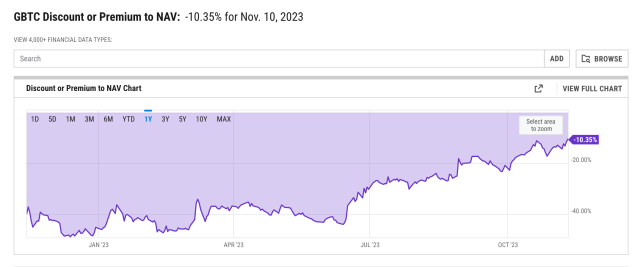

The largest Bitcoin trust in the world, the Grayscale Bitcoin Trust (GBTC) has been closing ranks around its premium over the last year. After hitting an all-time low of -48.89% in December 2022, the gap has been effectively closed to the point that it has reached a two-year high.

GBTC Premium Sitting At -10.35%

The GBTC premium to NAV is the difference in how much a Bitcoin is priced in the Bitcoin trust compared to how much the cryptocurrency is trading on the open market. When the figure is positive (high), it means there is a lot of demand for the trust and it trading higher than spot volumes. But when the figure is negative (low), it means that BTC in the trust is trading lower than spot market prices.

This means that when the GBTC premium was at its lowest in 2022, BTC in the trust was trading at nearly half the price of what BTC was trading for at the time. For many investors, this presented an opportunity to get in at a low price and it seems that bet has paid off.

On November 10, 2023, the GBTC premium hit its highest level in two years. Data from YCharts shows that the premium was sitting at -10.35% on Friday, an over 150% increase from its lows back in December 2022.

This has been a culmination of the steady increase in the premium over the last year as investor confidence in the crypto market began to return. The recent Bitcoin and crypto market recovery has also sustained this recovery as is evident in the steady rise in the premium since October.

Grayscale Moves To Convert Bitcoin Trust To Spot ETF

Grayscale first moved to convert its Bitcoin Trust to a Spot ETF back in 2022. The argument was that the United States Securities and Exchange Commission (SEC) had already approved multiple Bitcoin Futures ETFs and a spot ETF should be allowed.

However, the SEC has kicked against this which resulted in Grayscale suing the regulator after being rejected for the second time. The court will eventually side with Grayscale, asking the SEC to review the application for a Spot Bitcoin ETF.

The latest developments in Grayscale’s bid to transform its Bitcoin Trust to a Spot ETF came last week when reports emerged that the SEC is currently in negotiations with the company over its filing. According to Craig Salm, Grayscale’s CLO, it is only a matter of when, not if, the SEC approves the applications.

Grayscale is currently one of 12 applicants who are looking to launch a Spot Bitcoin ETF. The regulator still has leeway to continue to postpone its decision. However, 2024 has been put forward as a possible timeline for the SEC to approve the first Spot BTC ETF.