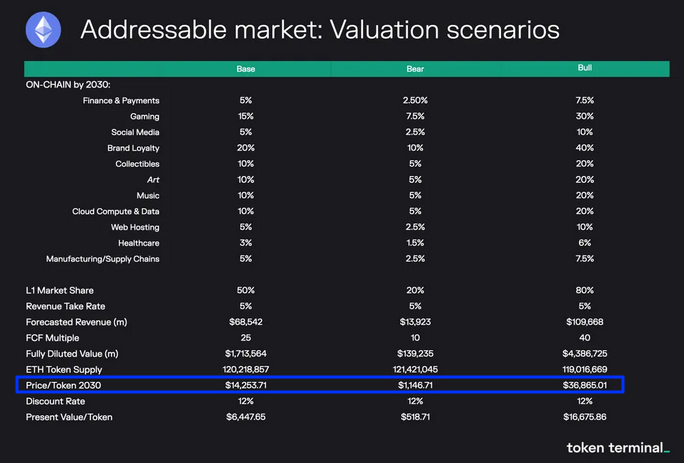

Token Terminal, a blockchain analytics platform, predicts Ethereum (ETH), the world’s second most valuable cryptocurrency, can soar above $36,800 by the decade’s end based on total addressable market projects.

In an in-depth analysis covering Ethereum on November 23, the analytics platform laid out several reasons that will drive the coin to astronomical levels, nearly 18X from spot levels.

Ethereum Is King, Predicted To Process $14 Trillion In Value By 2030

The Token Terminal report cited strengthening network effects, increasing token scarcity, and successful transition to proof-of-stake (PoS) consensus as possible price drivers accelerating the rally towards $36,800. The first-mover advantage and network effects, among others, have given Ethereum a competitive advantage over rival smart contract platforms, including Solana (SOL) and Cardano (ADA).

Users can deploy decentralized finance (DeFi) solutions in these competing networks, mint non-fungible tokens (NFTs), and overly participate in web3 development. Even so, Token Terminal observes that despite Ethereum’s limited scalability and fluctuating gas fees, which tend to rise in trending markets and intense network activity, discouraging engagement, it stands to dominate in the years ahead.

Quantifying future adoption, Token Terminal estimates that by 2030, approximately half of the finance industry’s trillion-dollar revenue will likely be flowing through Ethereum. To put a figure to this, the blockchain analytics platform estimates that over $14 trillion in value will be settled on-chain, with Ethereum as the preferred network.

The finance industry generates over $28 trillion in annual revenue, growing at a compound annual growth rate (CAGR) of 7.5%.

As it is, this mega valuation expected to flow through Ethereum is more than 10X the total crypto market when writing on November 2023. According to CoinMarketCap, it is slightly over $1.4 trillion with Bitcoin commanding roughly 51%.

Making projections from this outlook, the blockchain analytics platform noted that the expected adoption via emerging verticals, including identity, content streaming, and even the Internet of Things, could see ETH soar year-over-year in the next seven years.

Potential Challenges That Might Slow Adoption

Still, the study notes that challenges in the future might slow down adoption, potentially stifling growth and prices. Top of the list is the risk associated with regulation. As crypto finds adoption, the research notes that governments might try to interfere to maintain order.

At the same time, there could be unforeseen changes to the network design tradeoffs, the success and subsequent dominance of layer-2s forcing venture capitals to prioritize funding for off-chain projects and note those deploying on the mainnet.

Additionally, Token Terminal said even a bug being discovered on-chain, leading to losses and, thus, a dent in confidence, cannot be discounted in the long-term.