Quick Take

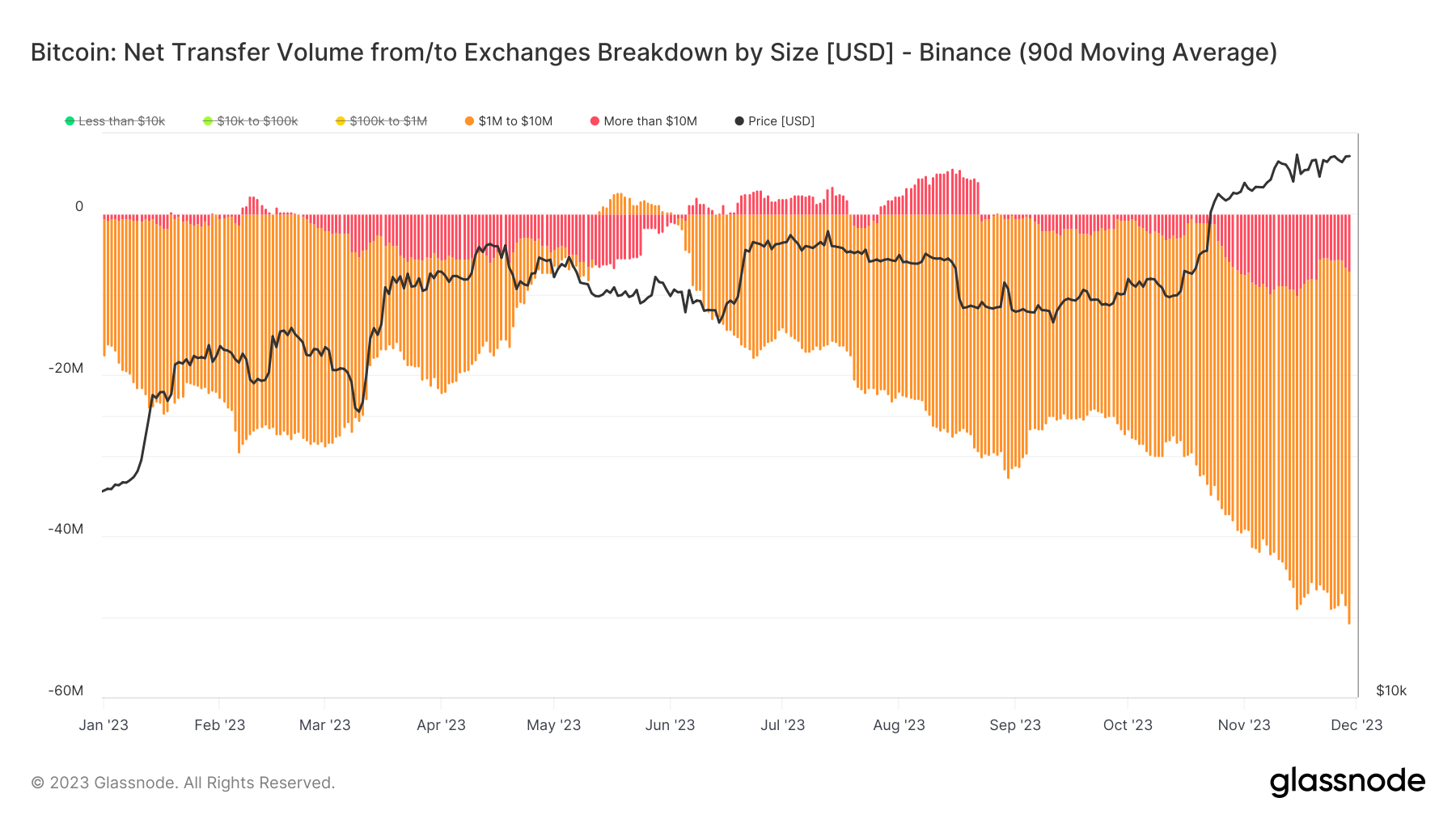

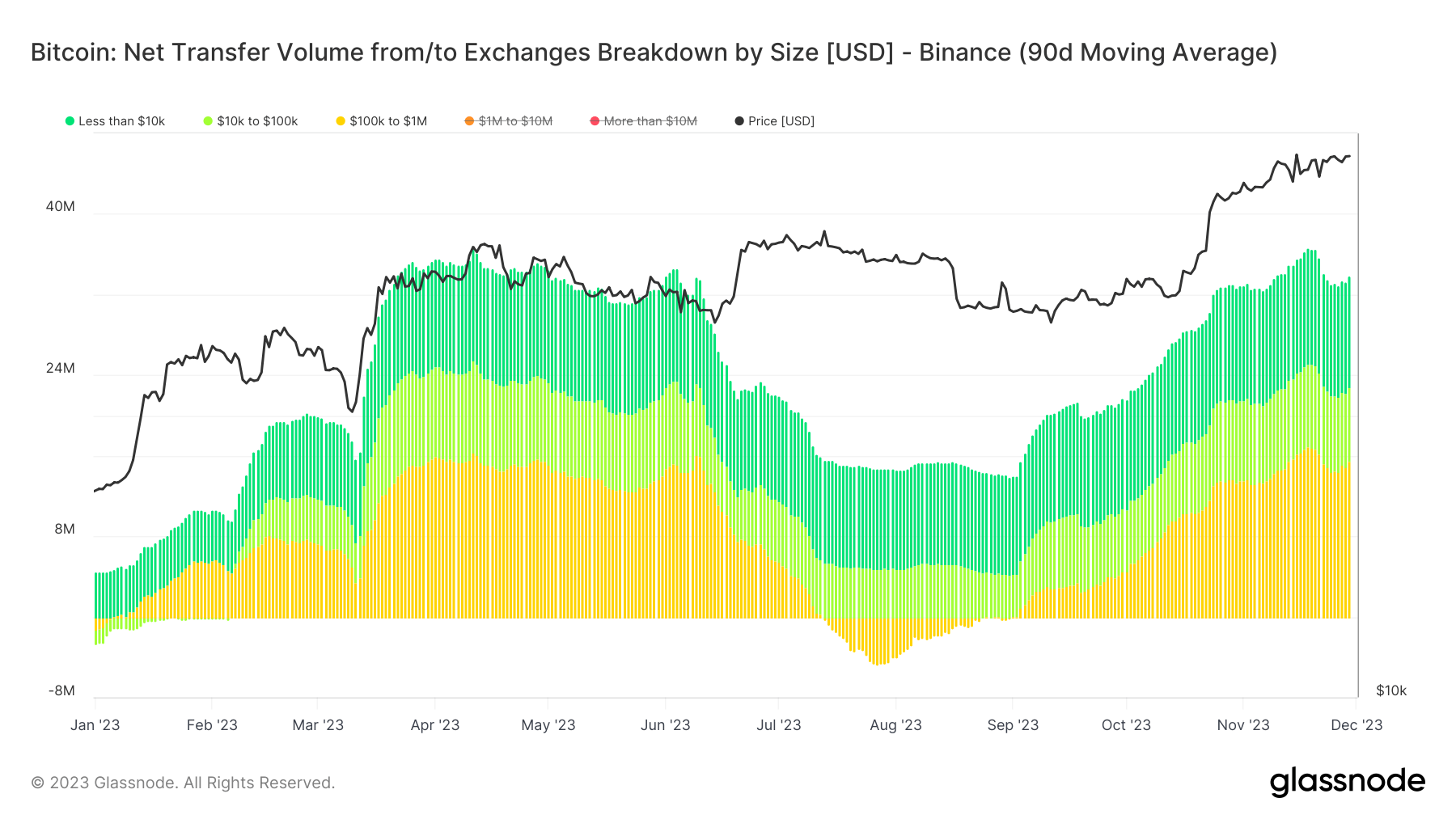

The current year has witnessed a unique trend on Binance, one of the world’s largest digital exchanges. By analyzing the netflows, a stark divergence can be observed with transactions of $1 million or more and those less than $1 million.

Larger transactions are experiencing predominantly outflows, indicating that whales, or large holders of Bitcoin, are moving their assets out of the exchange.

Conversely, most transactions below $1 million are inflows, suggesting that smaller or ‘retail’ investors are bringing more Bitcoin onto the exchange.

This pattern has persisted and even exacerbated in the past two weeks following the news of Changpeng Zhao, the founder of Binance, stepping down from his position. The whales continue to offload their coins, while the retail segment of the market keeps seeing an increase in inflows.

This divergence between large and small transaction flows can potentially impact the Bitcoin market’s liquidity and volatility, particularly on Binance. For example, the withdrawal of whales could decrease the liquidity on the exchange, making it more difficult to buy or sell large amounts of Bitcoin without causing substantial price changes. Meanwhile, the influx of retail investors could increase volatility as their trading behavior is often more unpredictable and driven by market sentiment.

The post Binance sees whale outflows and retail inflows amidst leadership shuffle appeared first on CryptoSlate.