On-chain data shows the ten largest Ethereum whales have continued to expand their holdings recently, now carrying 41 million ETH.

Ethereum Top 10 Whales Have Set A New All-Time High For Their Holdings

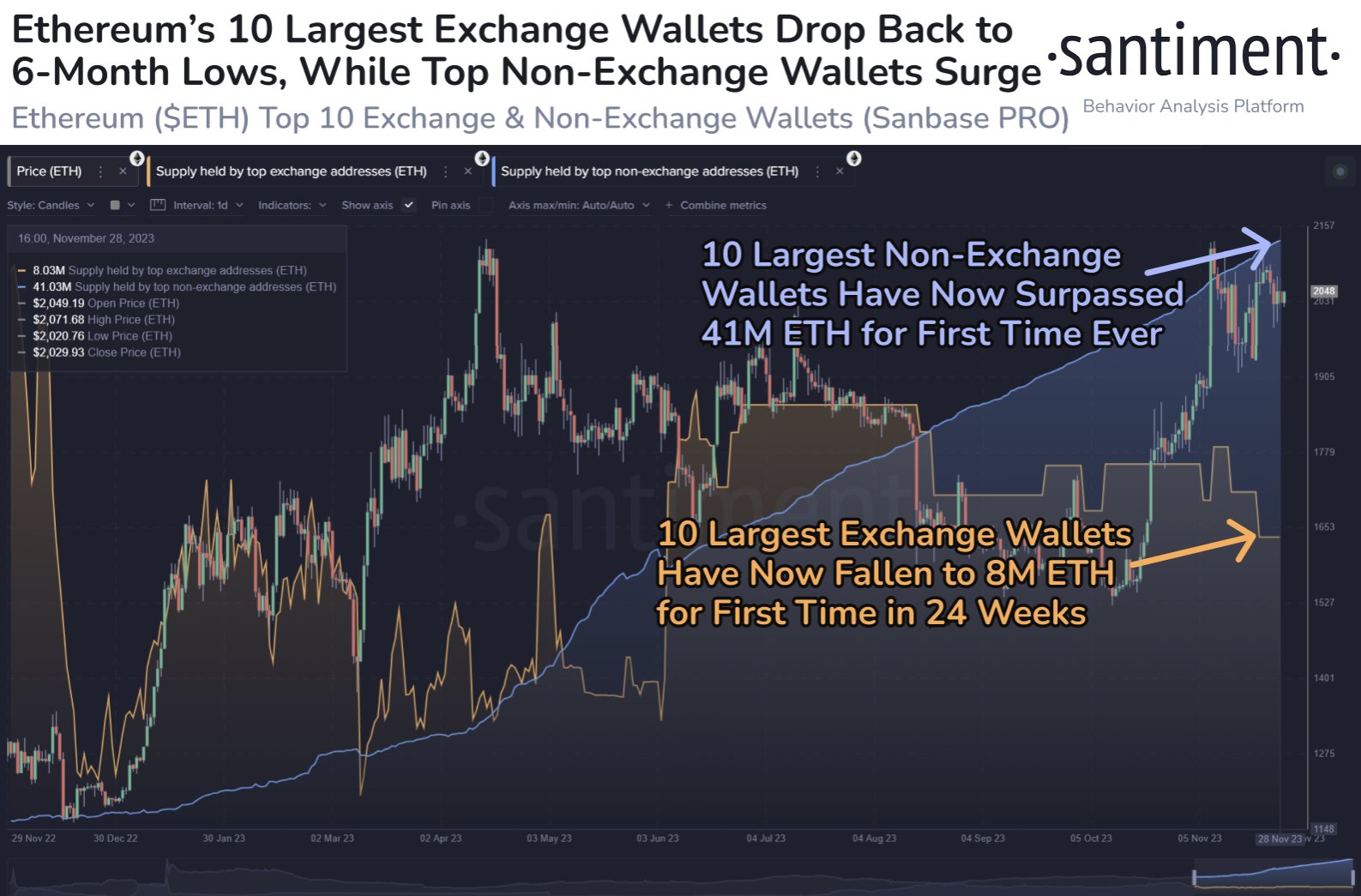

According to data from the on-chain analytics firm Santiment, the largest whale wallets have continued to display an optimistic pattern for the cryptocurrency. There are two indicators of interest here: the supply held by top exchange wallets and the supply held by top non-exchange wallets.

The former keeps track of the total amount of Ethereum that the ten largest wallets attached to centralized exchanges are holding right now. In comparison, the latter measures the amount sitting in the ten largest self-custodial wallets on the blockchain.

Both types of addresses would count as “whales,” but those attached to the exchanges would be more likely to control an entity like the platform itself rather than a “normal” investor, like a self-custodial wallet would most likely be.

The chart below shows how the Ethereum supply held by these two cohorts has changed over the past year.

The graph shows that the supply held by the top ten whales outside exchanges has been constantly going up during the past year, while the addresses attached to exchanges have been rather up and down.

Generally, investors keep their coins inside self-custodial wallets whenever they want to hold onto them for extended periods. So, these off-exchange whales continuing to increase their supply is undoubtedly a positive sign for the cryptocurrency.

As is apparent from the chart, the supply of these whales has crossed the 41 million ETH mark following the latest continuation of the uptrend, which is a new all-time high.

While this rise has come, the top ten Ethereum exchange wallets have seen a plunge instead, as they now hold just 8 million ETH, the lowest amount in about 24 weeks.

A shift of supply towards self-custody is always a good sign for the health of the market, as bankruptcies like that of the FTX exchange already showed during this bear market what happens when central platforms like these go bust.

The less ETH that’s present on the exchanges, the less the price would be affected if they happen to go out of business. And that’s not all; the supply on exchanges can also be considered the available selling supply of ETH, which has also reduced with this drawdown.

Therefore, this pattern of the self-custodial wallets growing in size while the exchanges lose coins is an encouraging development for the asset. Though while that may be true, supply concentrating on just ten wallets is still something negative, as these humongous entities now control one-third of the supply.

ETH Price

At the time of writing, Ethereum is trading just below the $2,100 mark, down 1% in the past week.