Exchange balance data reflects investor behavior and is a crucial metric in cryptocurrency trading. It indicates whether investors are more inclined to store their Bitcoin holdings off-exchange, which can signal a bullish sentiment, or to keep them on exchanges for potential sale or trade, often seen as a bearish indicator.

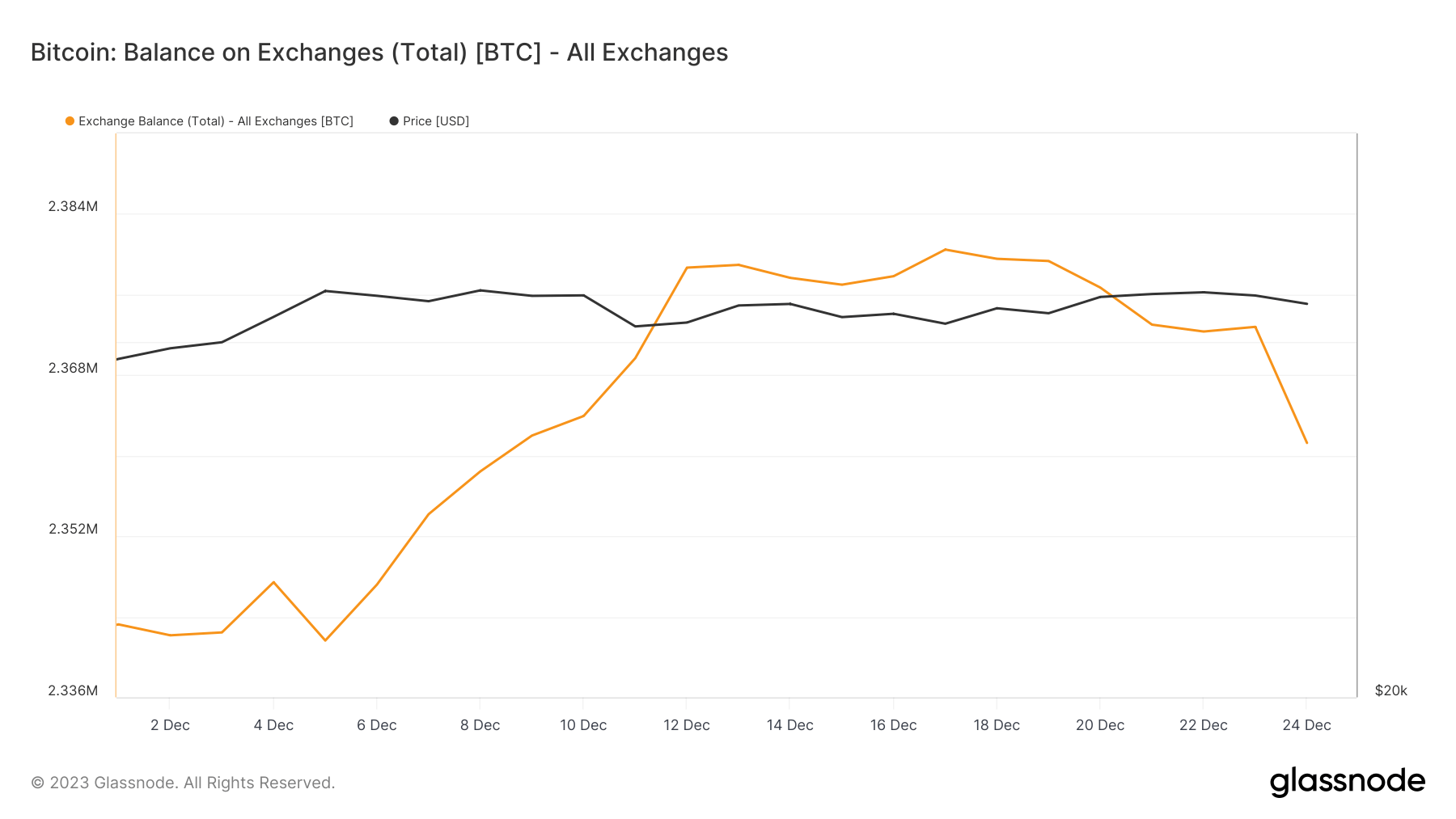

December’s data on BTC exchange balances shows the market’s temperament. Initially, there was a slight increase in the total exchange balance, climbing from 2.34 million BTC on Dec. 1 to 2.38 million BTC by Dec. 17. This uptick was followed by a marginal decrease to 2.36 million BTC by Dec. 24. These fluctuations point to a moderate level of market activity with no significant trend towards either accumulating or liquidating BTC holdings in large volumes.

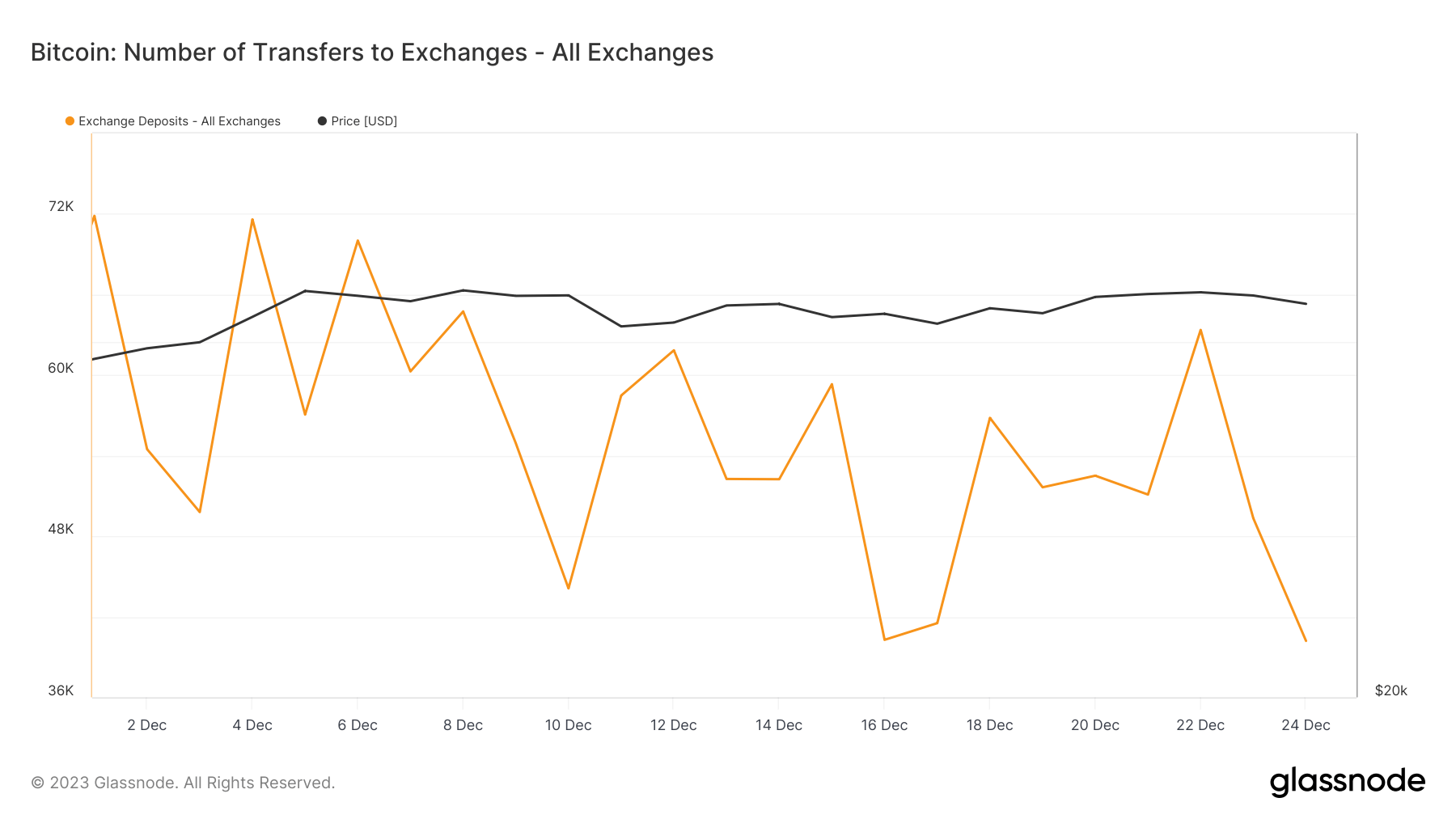

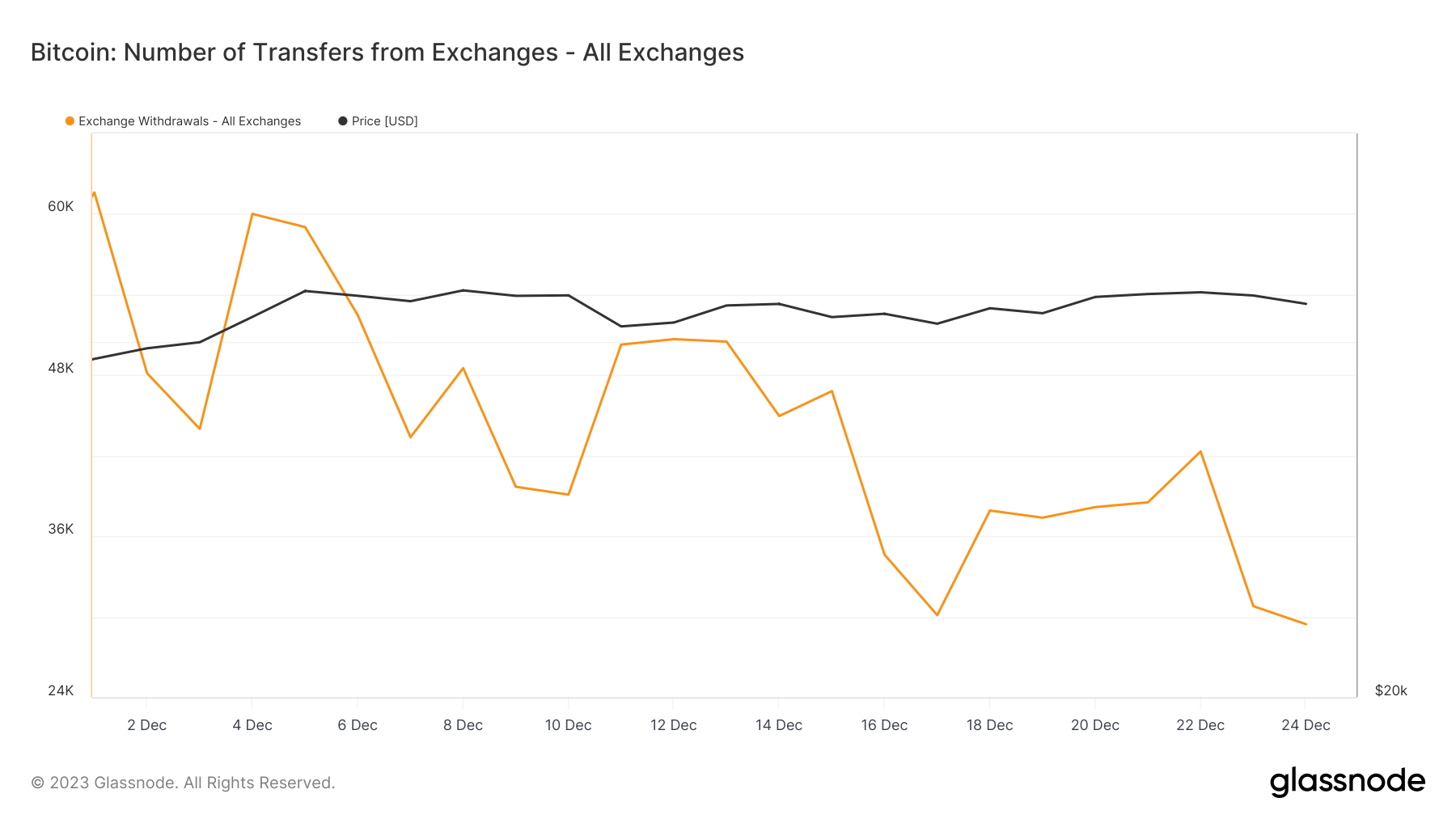

A deeper dive into the withdrawals and deposits of BTC during this period reveals more nuanced details about what the market is doing. Exchange withdrawals steadily decreased from 61,600 BTC at the start of the month to 29,446 BTC by its end. Simultaneously, deposits also saw a reduction, declining from 71,857 BTC to 40,203 BTC.

A concurrent decrease in both withdrawals and deposits may suggest a reduction in trading activity, alongside a growing tendency among investors to hold their assets off-exchange. Traditionally, such a pattern is associated with a bullish outlook on the future value of BTC.

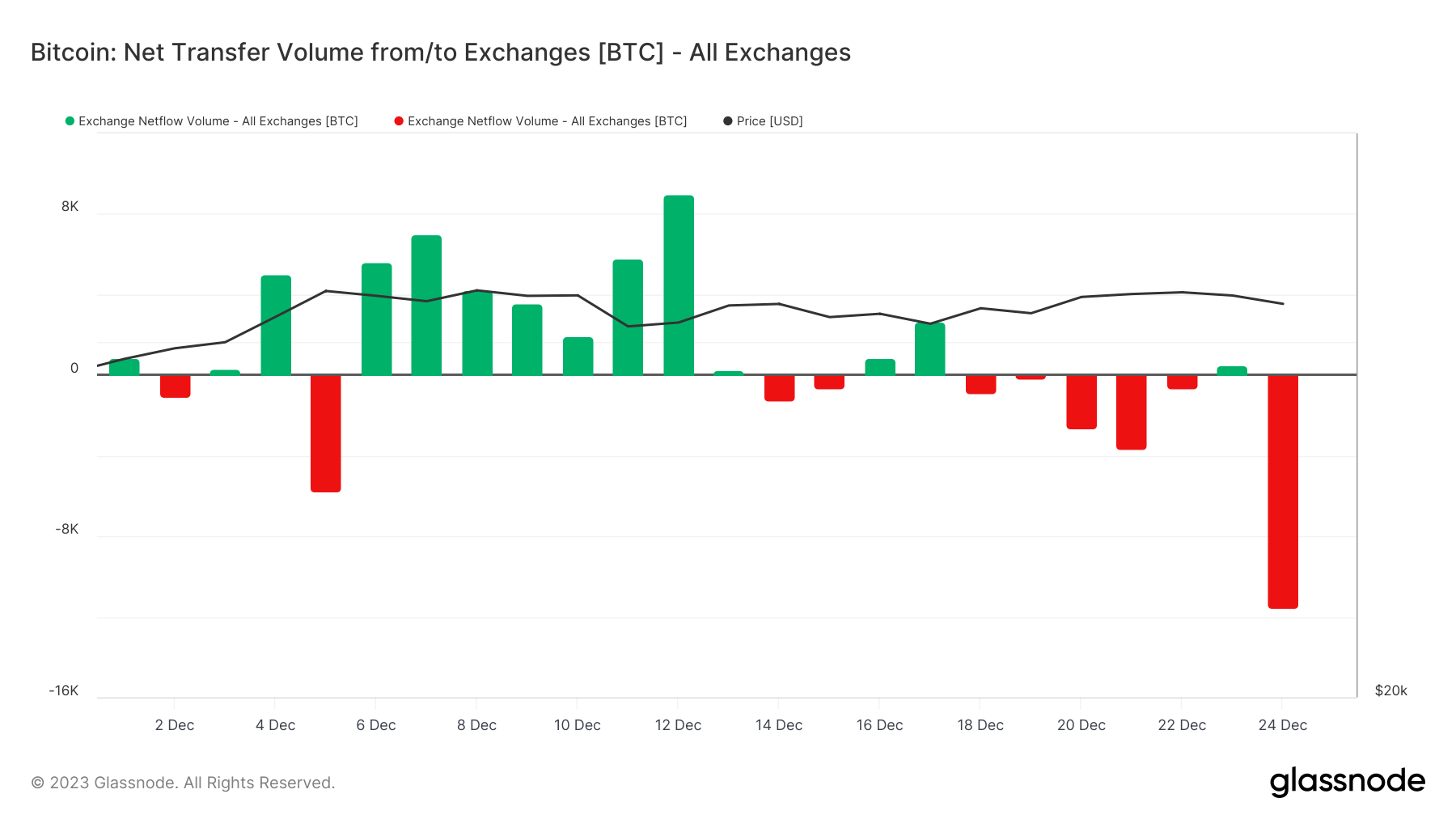

However, the exchange netflow volume is perhaps the most telling metric of this analysis. On Dec. 1, the netflow was positive, with 865.5 BTC indicating a higher inflow of BTC than outflow. This scenario dramatically shifted by Dec. 24, when the netflow turned significantly negative, registering at -11,515.7 BTC. Such a substantial negative netflow suggests that investors are moving their BTC out of exchanges at an increased rate.

These changes in balances, withdrawals, deposits, and netflow volumes show a market that is cautiously shifting towards hodling. While this shift may be driven by expectations of future price appreciation, it’s essential to consider the broader spectrum of external factors that could be influencing investor sentiment. The prevailing takeaway from this data is an apparent shift in investor behavior towards holding rather than active trading. If this trend continues, it could positively impact Bitcoin’s price dynamics in the near term, as a reduction in available supply on exchanges often creates upward pressure on prices.

The post December sees investors pulling Bitcoin off exchanges appeared first on CryptoSlate.