Quick Take

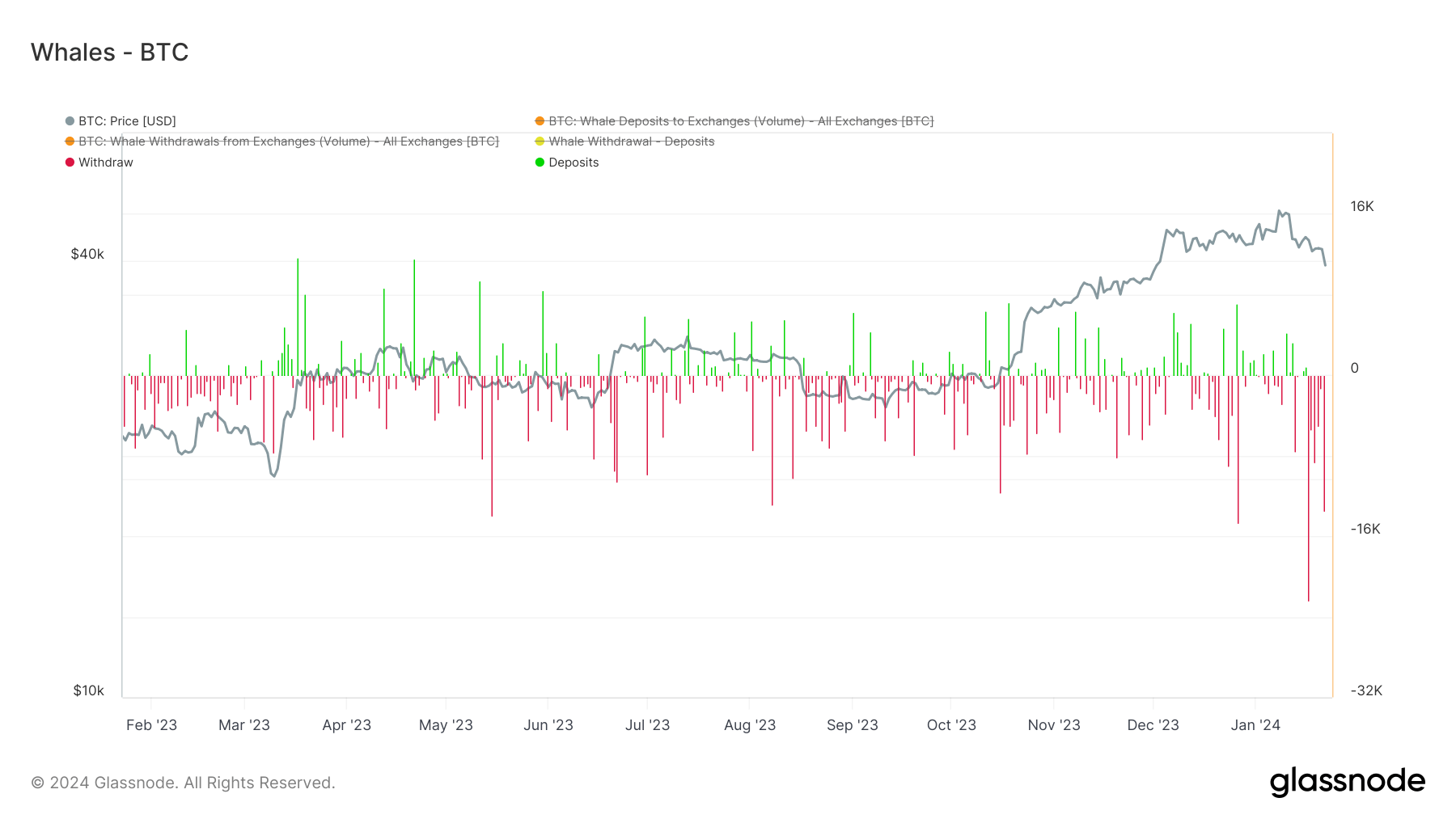

The digital asset landscape is seeing a noteworthy surge in Bitcoin whale activity, as signaled by CryptoSlate’s recent data analysis. Amid a 20% pullback from Bitcoin’s highs, these whales – entities holding 1k BTC or more – appear to be capitalizing on the opportunity to accumulate. A marked uptick in activity reveals a withdrawal of approximately 38k Bitcoin from exchanges, notably surpassing the 24k BTC deposited on Jan. 22. This suggests a penchant for buying, even as the price dips under $40,000.

Withdrawals have been outstripping deposits for six consecutive days. This divergence hit its peak on Jan. 17, with a staggering 22k Bitcoin difference. Jan. 22 witnessed a similar trend, albeit on a slightly reduced scale, with a 13k Bitcoin difference.

This trend of higher withdrawals than deposits suggests that whales are currently more inclined to move their Bitcoin holdings out of exchanges.

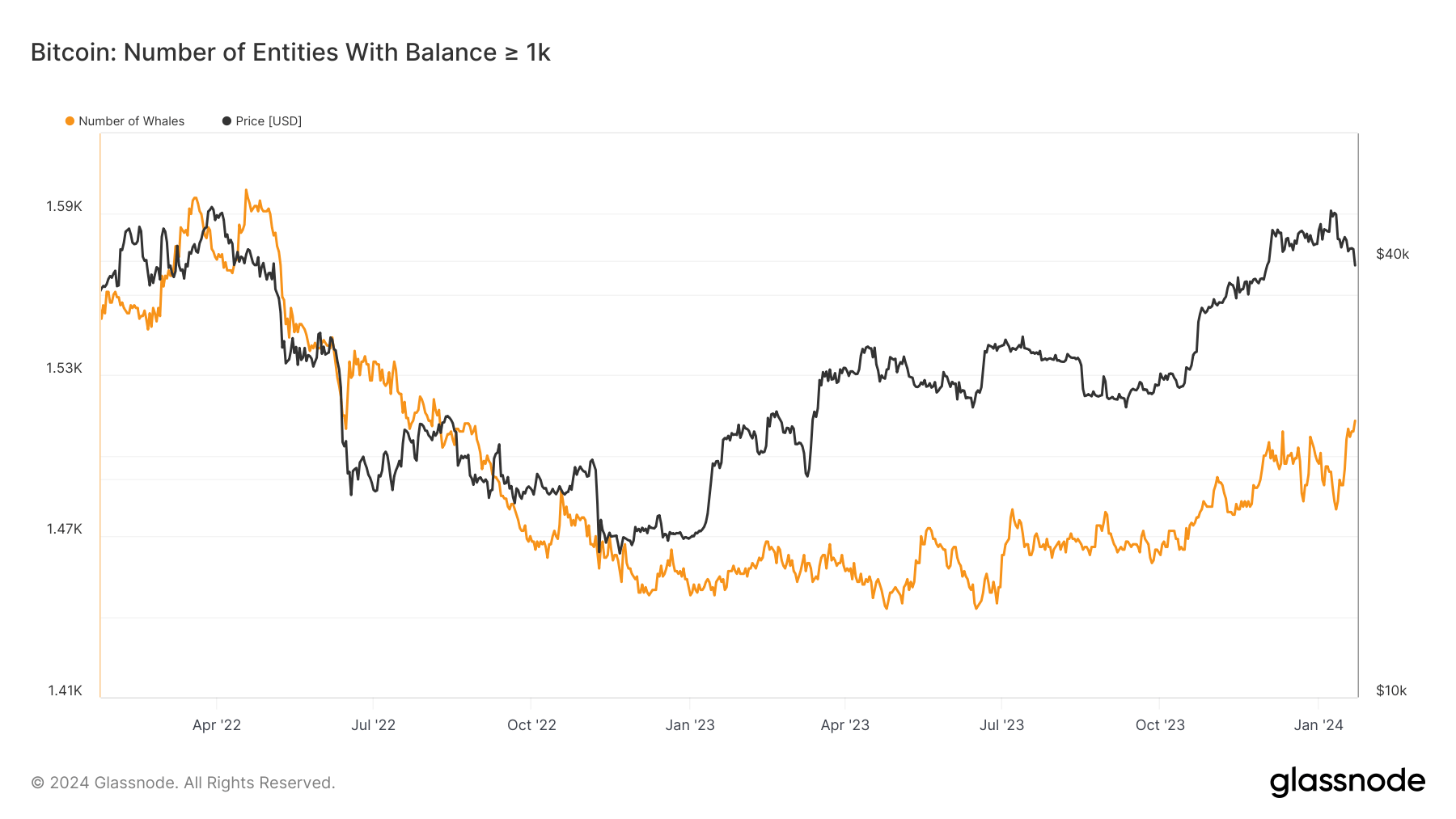

Simultaneously, the number of Bitcoin whales is increasing. The count has grown from 1,480 BTC to 1,513 BTC, a measure not seen since July 2022.

The post Surge in Bitcoin whale transactions defies market downturn appeared first on CryptoSlate.