Quick Take

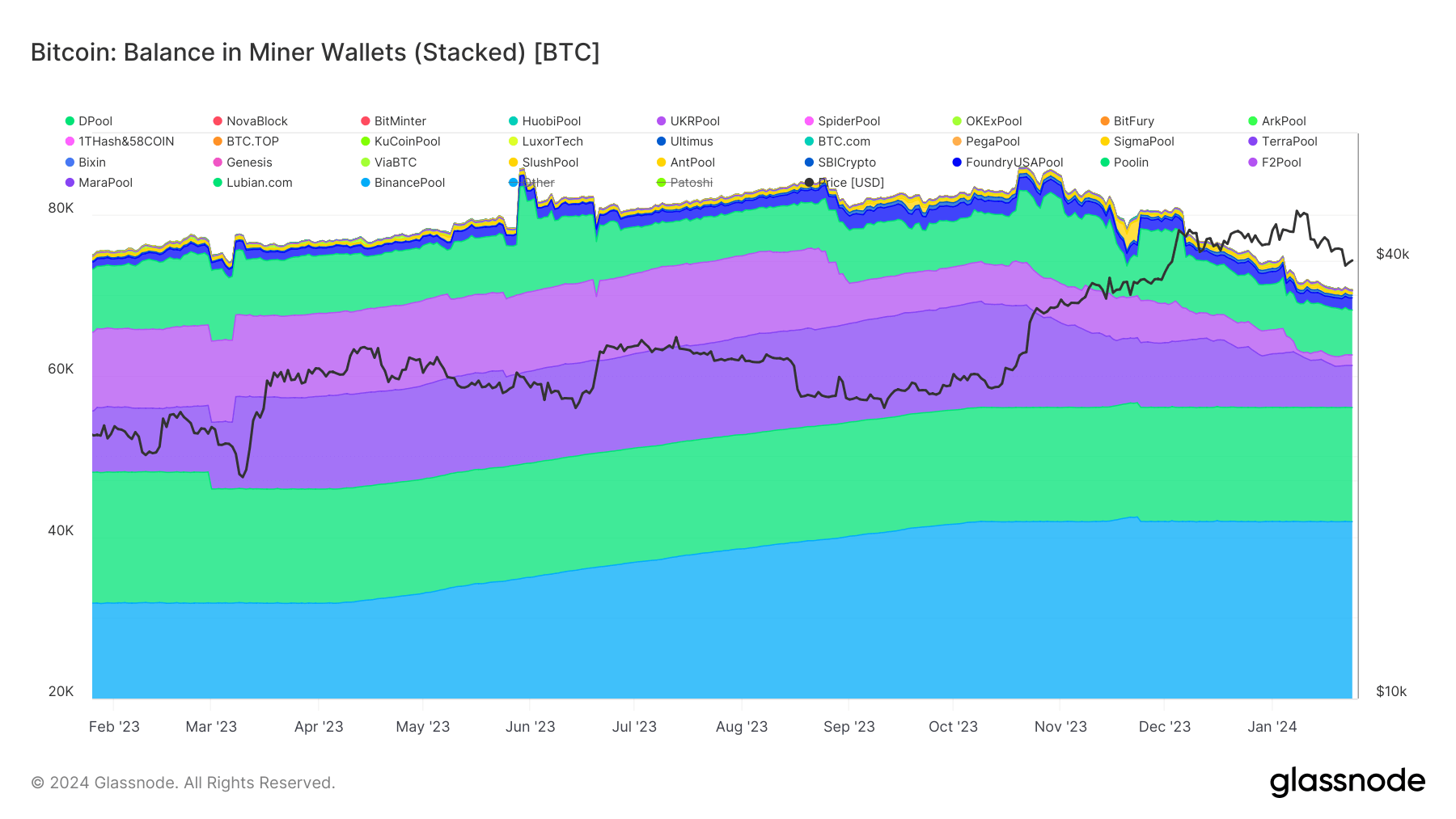

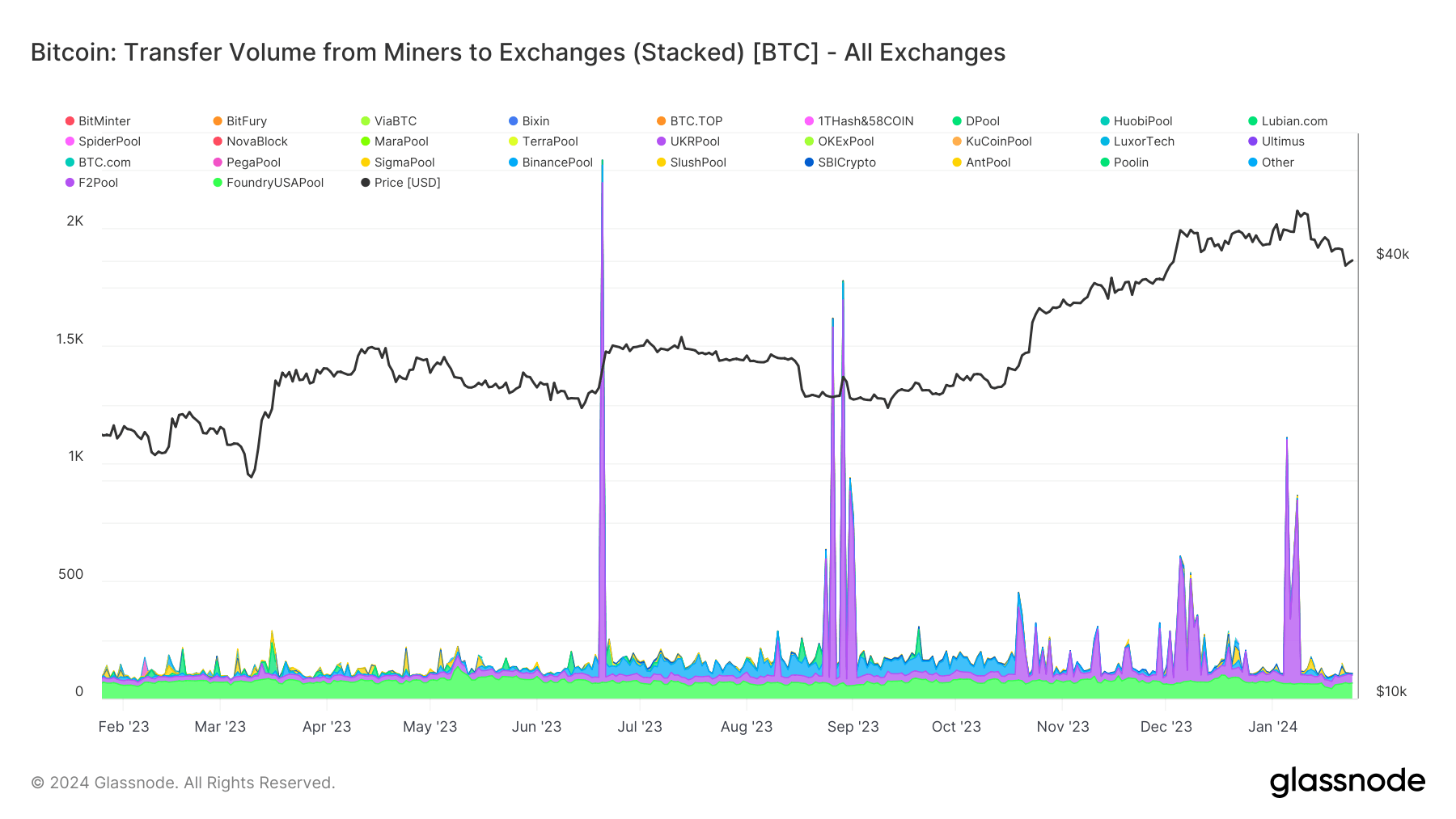

In an intriguing turn of events, the total Bitcoin supply held in miner addresses has dipped to a level not observed since August 2021. Miner balances hold approximately 1.187 million Bitcoin, marking a significant departure of 15k BTC since Oct. 2023. These changes, however, do not necessarily indicate that miners are offloading their Bitcoin holdings. The data suggests a minimal amount of Bitcoin has been transferred to exchanges, implying that we are most likely witnessing a reorganization of wallets rather than a sell-off.

Interestingly, the F2 Pool seems to be the primary source of Bitcoin sent to exchanges, a trend traced back to early January. Could this potentially introduce further sell pressure if these miners decided to sell their holdings? Factors include the lowest Bitcoin fees since the November frenzy of Inscriptions and a looming Bitcoin halving in April.

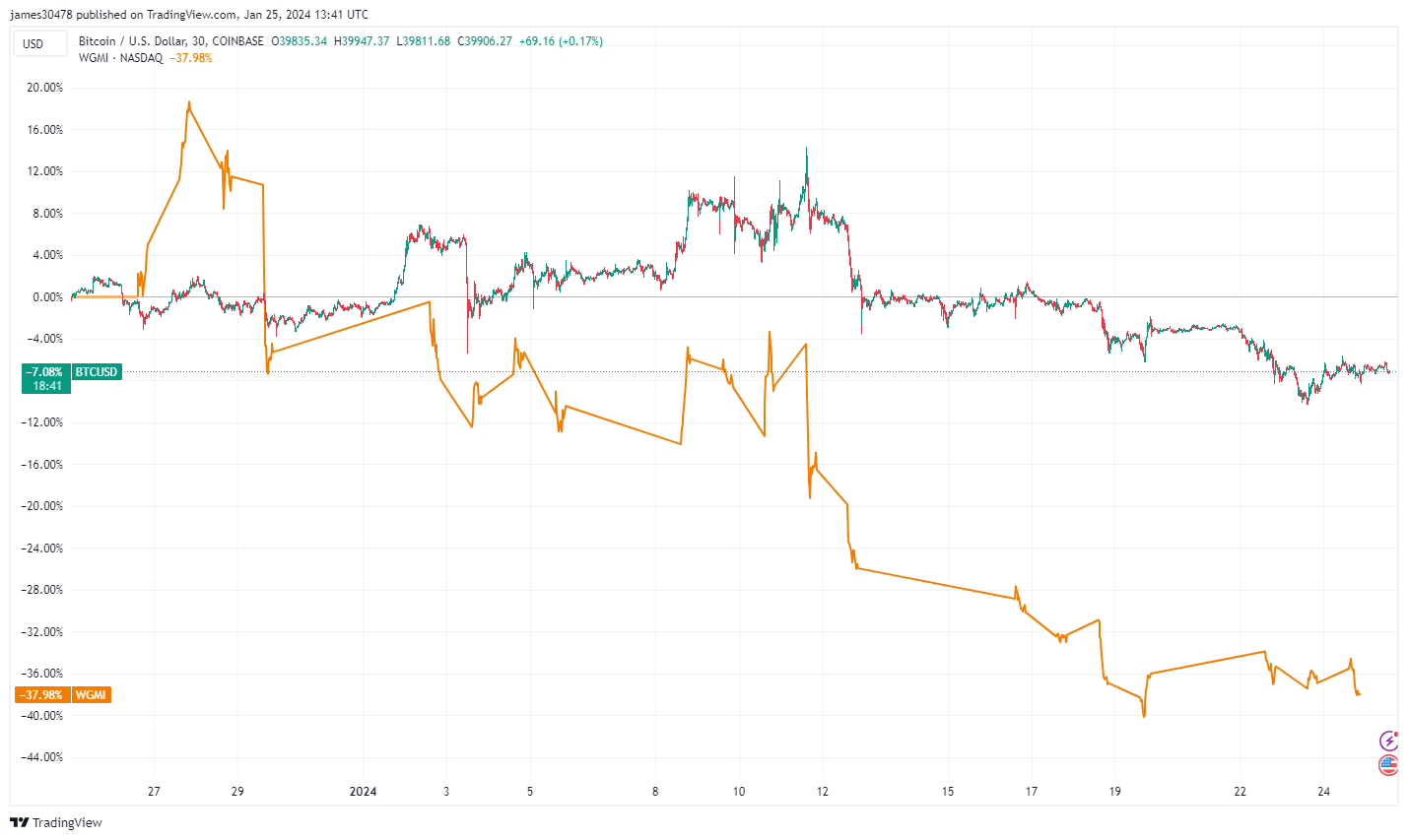

Moreover, the mining proxy ETF, WGMI, has seen a significant decrease, down 38% in just one month, and a decline in Bitcoin price, contributing to this speculation and leaving unanswered questions for miners.

The post Bitcoin miner balances hit 18-month low amid wallet reorganization signals appeared first on CryptoSlate.