There has been a significant shift in the distribution of Bitcoin supply since the beginning of the year. While the distribution of Bitcoin holdings is a regular occurrence and follows market cycles, the launch of spot Bitcoin ETFs in the U.S. seems to have spearheaded these changes.

It’s important to understand the supply distribution across different Bitcoin holding cohorts. It offers insights into market sentiment, potential liquidity shifts, and the balance between retail and institutional participation. Large movements in holdings can indicate institutional activity, strategic accumulation, or redistribution of assets in response to market developments. Tracking these changes can show early signals of broader market trends, shifts in investor behavior, and potential price movements.

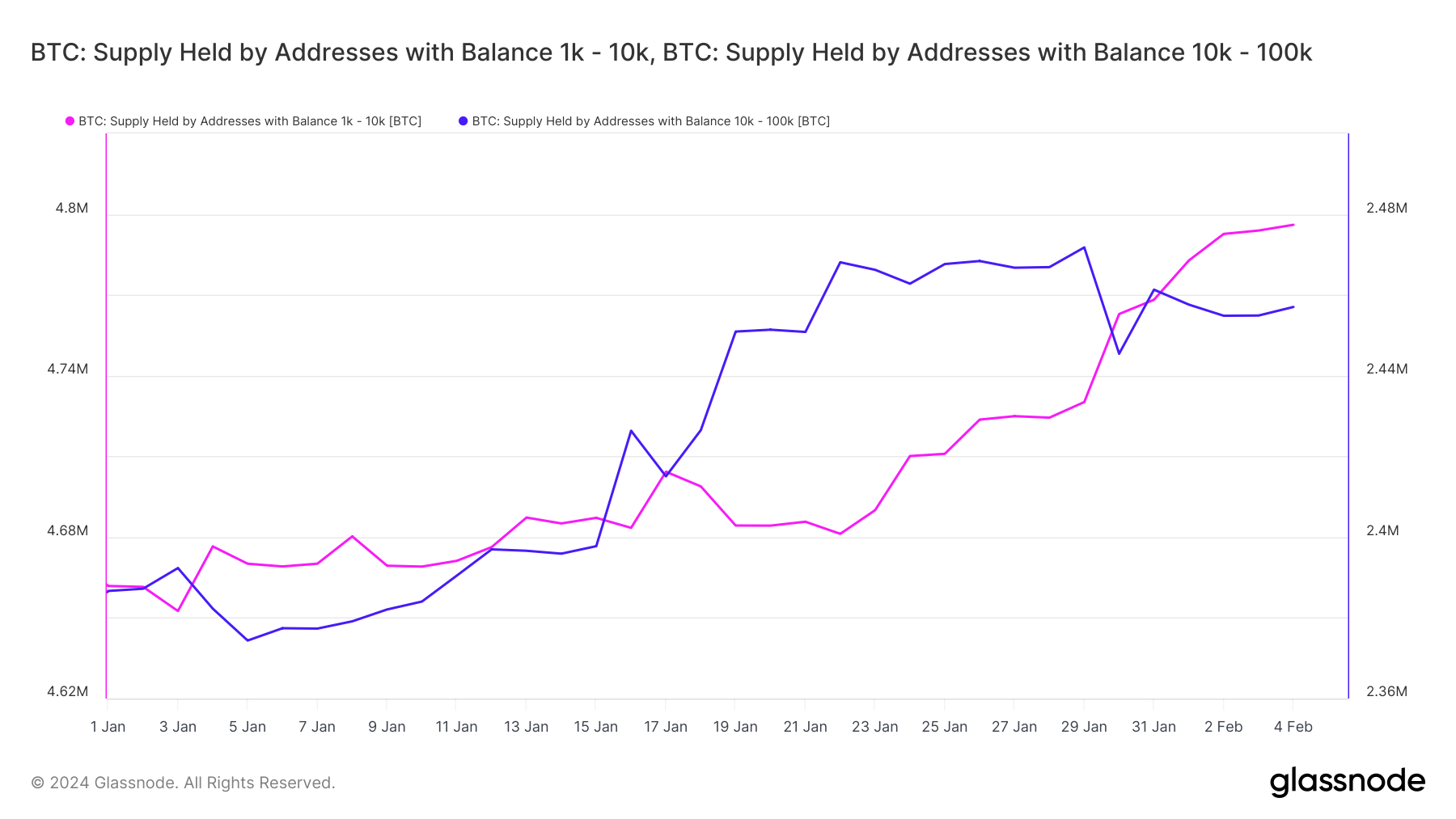

Addresses holding between 10,000 and 100,000 BTC experienced the largest increase in balance, up by 2.97% Year-To-Date (YTD), while those with balances between 1,000 and 10,000 BTC saw their balance increase by 2.89% YTD.

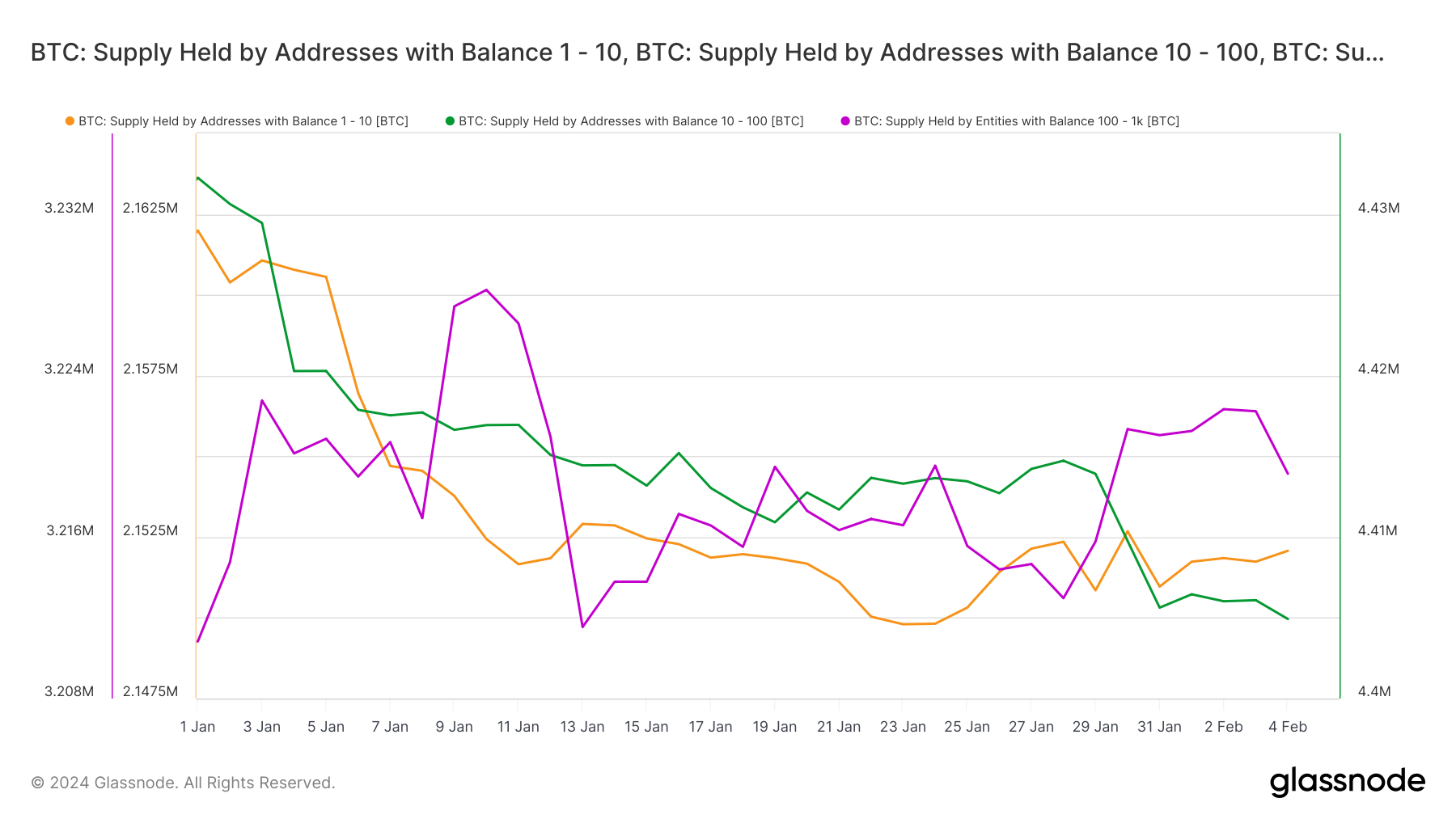

Conversely, addresses holding between 100 and 1,000 BTC recorded the largest drop, decreasing by -3.32%.

The observed increase in Bitcoin holdings among addresses with large balances (1,000 to 10,000 BTC and 10,000 to 100,000 BTC) contrasts with the decrease among smaller balance addresses (100 to 1,000 BTC). The significant uptick in holdings among the largest cohorts indicates institutional accumulation and strategic behavior by large investors. This could be driven by the legitimization and increased accessibility of Bitcoin through the launch of spot ETFs, offering a regulated and potentially safer investment avenue for substantial capital inflows.

The growth in balances of large holding addresses could also reflect increased confidence in Bitcoin’s long-term prospects, likely buoyed by the introduction and popularity of spot Bitcoin ETFs. This could indicate market maturation and acceptance within traditional financial systems.

The decline in holdings among addresses with balances between 100 and 1,000 BTC could indicate a move towards diversification and risk management strategies, possibly influenced by the availability of Bitcoin exposure through ETFs. Investors in this cohort may be reallocating assets to balance their portfolios across different asset classes within the more familiar framework of ETFs.

Another possible reason why smaller cohorts may have experienced declines in their Bitcoin holdings is profit-taking. Increased market liquidity following the launch of the ETFs has certainly caused short-term and smaller holders to facilitate easier profit-taking. Investors with smaller balances might be more inclined to capitalize on price movements, especially seeing how the ETF introduction led to short-term price increases.

The post How ETFs affected Bitcoin’s supply distribution across cohorts appeared first on CryptoSlate.