Ethereum (ETH), the global runner-up in the cryptocurrency ring, is making serious moves this week, stepping closer to the coveted $3,000 mark. Could this be the opening bell for a February knockout, sending it soaring towards a staggering $4,000 finish by month’s end?

Ethereum Staking And ETF Surge: Bullish Momentum

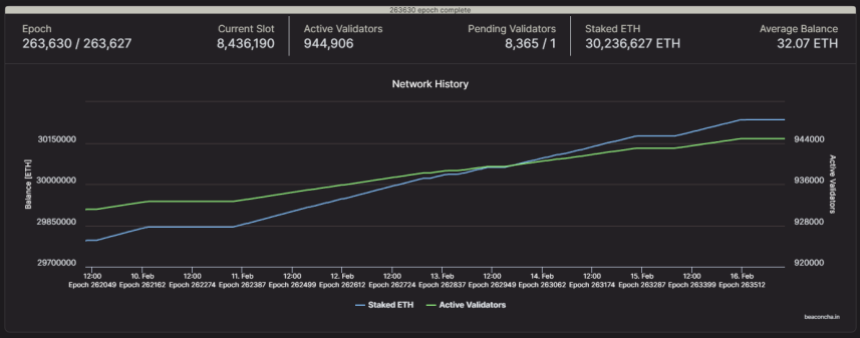

Several factors are fueling this bullish sentiment, starting with the surging popularity of ETH staking. As Ethereum 2.0 gathers momentum, more investors are locking their ETH into staking contracts, earning passive income while reducing the readily available supply in the market. This “induced market scarcity,” as experts call it, creates upward pressure on the price.

The numbers are impressive: a whopping 25% of all circulating ETH, or 30.2 million coins, are now locked in staking contracts. This represents a significant surge of 600,000 ETH deposited between February 1st and 15th. And with an annualized reward rate of 4%, the incentive to join the staking party is only growing stronger.

But staking isn’t the only force propelling ETH forward. The potential approval of an Ethereum Exchange-Traded Fund (ETF) has also injected optimism into the market. Such a product would make it easier for institutional investors to enter the crypto space, potentially leading to significant inflows and price appreciation.

Furthermore, the recent Dencun upgrade on the Sepolia testnet, promising improved network performance and lower transaction costs, has been met with positive reactions from stakeholders. This could attract more developers and users to the Ethereum DeFi ecosystem, boosting its utility and ultimately driving demand for ETH.

Obstacles Ahead: ETH’s Journey Towards $4,000

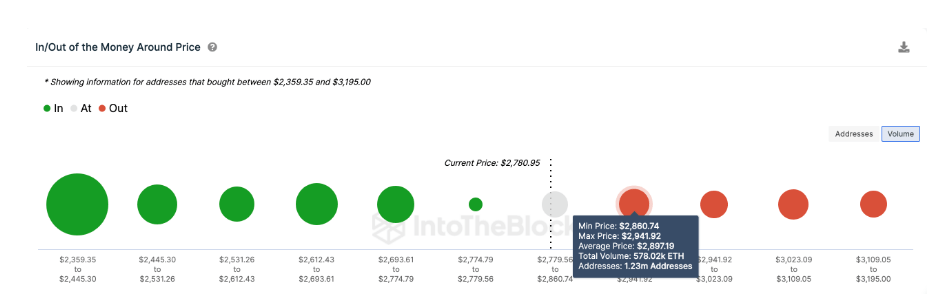

However, the path to $4,000 isn’t without its obstacles. A major resistance level looms at $2,850, where approximately 1.23 million addresses, holding a combined 578,000 ETH, bought in. These holders might be tempted to take profits as the price approaches their break-even point, creating a temporary hurdle.

Additionally, a price dip below $2,500 could trigger panic selling among investors who bought at higher prices. While some experts suggest that such a scenario might be mitigated by “frantic last-minute purchases” to avoid losses, it underscores the inherent volatility of the cryptocurrency market.

IntoTheBlock’s global in/out of the money (GIOM) data further emphasizes this point. This data groups all existing ETH holders based on their historical buy-in prices. According to GIOM, the cluster of holders at the $2,850 resistance level represents a potential selling pressure. However, if the bulls can overcome this hurdle, another leg-up towards $3,000 and beyond becomes more likely.

Ultimately, while the short-term outlook for ETH seems promising, caution remains key. Investors should carefully consider their own risk tolerance and conduct thorough research before making any investment decisions. As with any market, past performance is not necessarily indicative of future results.

The next few days or weeks will be crucial in determining whether ETH can break through the $2,850 resistance and continue its ascent towards $3,000 and beyond.

Featured image from Adobe Stock, chart from TradingView